The S&P 500 (SPX) was up 20 points at its high on Friday then switched into reverse and closed down .90 points in a Friday afternoon selloff. The market had rallied in the morning supposedly because Janet Yellen’s speech late afternoon Thursday, left the door a little more open for a rate hike.

The S&P 500 (SPX) was up 20 points at its high on Friday then switched into reverse and closed down .90 points in a Friday afternoon selloff. The market had rallied in the morning supposedly because Janet Yellen’s speech late afternoon Thursday, left the door a little more open for a rate hike.

But in reality her speech didn’t really offer much different from the rational she gave around not raising the previous week. And talking about her speech. You really need to watch this 3 minute clip of her speech. It is at the very end of her speech.

She cut short her speech after clearly struggling. She did go on to dinner after being checked by the university medical staff that evening. She was back in Washington D.C. on Friday. The Fed would not comment further on Friday.

Also affecting the market on Friday was the High Yield Bond ETF (HYG) and the biotech sector. HYG continued strongly down, closing the week at its lowest close in nearly 4 years. IBB, the Nasdaq Biotech ETF had the biggest weekly drop since August 2011.

The market bounce Friday morning was a continuation of a move that actually started Thursday morning. This was a retracement of the last 5 days down that started late Thursday afternoon on Sept. 17th and ended Thursday morning at 9:30am CT.

In today’s Weekend Market Analysis video I look at yesterday’s price action and for the week. I also look at the last 6-7 days on an hourly basis to see what it is telling us. In addition to our normal ETFs I review the iShares MSCI EAFE ETF (EFA) and the iShares MSCI Emerging Markets ETF (EEM). Stocks in focus are Celgene (CELG) and Gilead Sciences (GILD). Continue reading

The selling on Wall Street resumed today. One word comes to mind to describe it…relentless. Declining stocks outnumbered advancing stocks 8.5 to 1. Declining volume however led advancing volume 18 to 1. Now that ratio is pretty negative but in terms of declining volume, not yet close to the peaks in August selling.

The selling on Wall Street resumed today. One word comes to mind to describe it…relentless. Declining stocks outnumbered advancing stocks 8.5 to 1. Declining volume however led advancing volume 18 to 1. Now that ratio is pretty negative but in terms of declining volume, not yet close to the peaks in August selling.

The market was down again today with the DJIA down 78.6 points and the SPX down 6.5 points. The DJIA was down about 250 points at one point this morning but clawed its way back. One interesting development is the move up in gold.

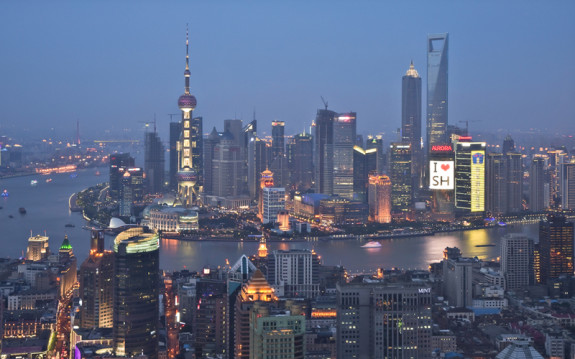

The market was down again today with the DJIA down 78.6 points and the SPX down 6.5 points. The DJIA was down about 250 points at one point this morning but clawed its way back. One interesting development is the move up in gold. China’s PMI Manufacturing reading came out overnight and was the lowest reading since March 2009. So the world’s 2nd largest economy is struggling and that is weighing on the global economy, commodities and markets.

China’s PMI Manufacturing reading came out overnight and was the lowest reading since March 2009. So the world’s 2nd largest economy is struggling and that is weighing on the global economy, commodities and markets.