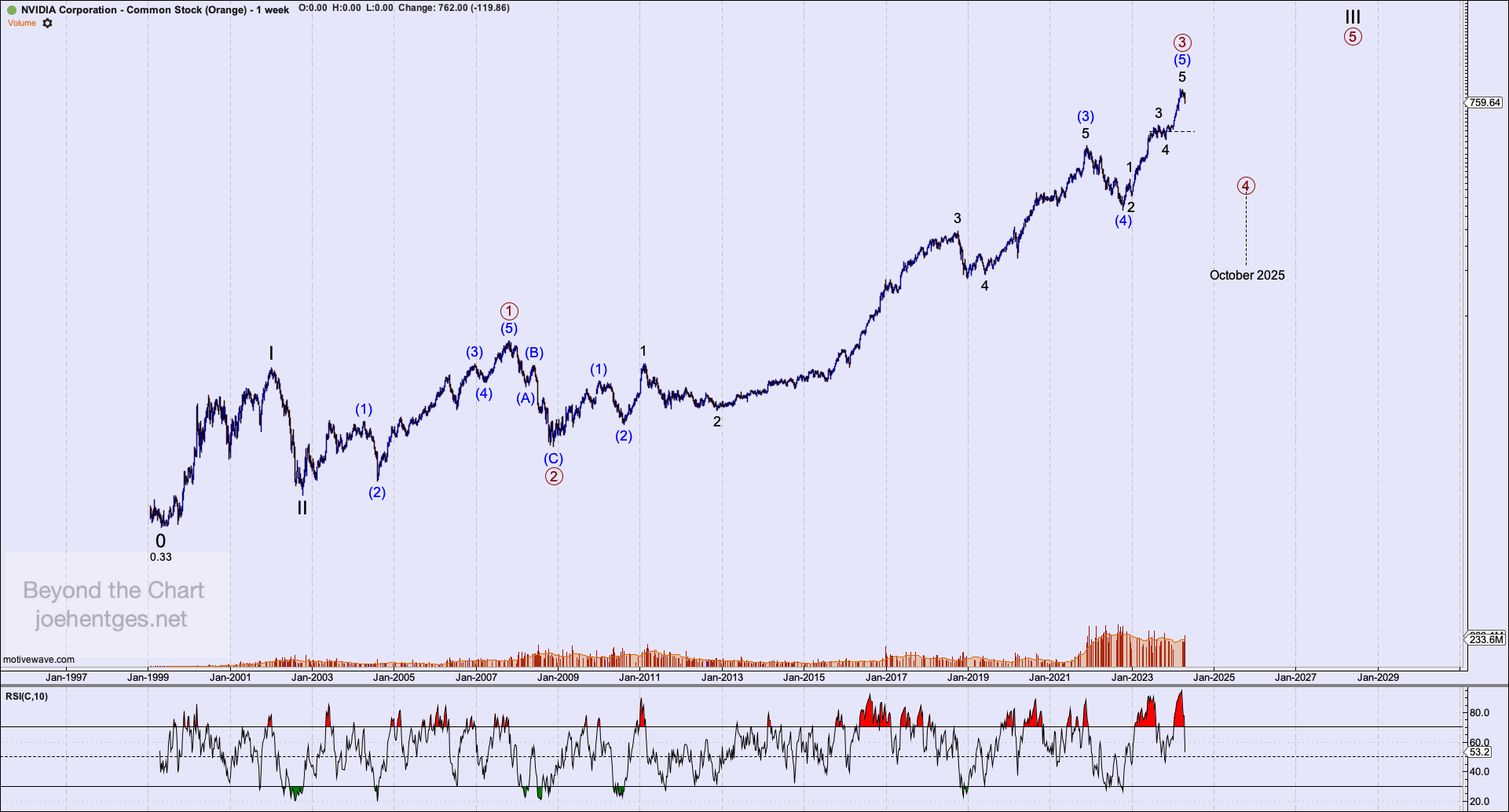

Nvidia has reached that point where it is time for a rest. Last week the stock took a pretty big hit, dropping 13.6%. It was down 10% on Friday alone. (see chart below).

When we view the price action from an Elliott Wave perspective, a 15 year Primary Wave 3 (circled) is complete. Intermediate Wave (5) from October 2022 topped out on March 25, 2024 after a beautiful 5 wave move. (see chart below).

Now I expect NVDA to go thru a corrective phase that will take until about October 2025 to complete. That corrective move should pull the price down into the 108 – 345 zone based on Intermediate Wave (4). What we don’t know is what shape the corrective pattern will take.

Primary Wave 2 (circled) was a sharp pull back so I expect Primary 4 to be a sideways type of move that could have quite a bit of volatility to it. It could take the shape of a Flat, a Triangle or a combination of corrective patterns.

When we drill down to review the daily picture (see below), we see Friday’s close was just above a gap, that when closed, will bring the price to a trend line supporting the entire Intermediate Wave (5). Once this is broken the next level of key support will be around 450. It is going to be an interesting next couple of years.