Fasten Your Seatbelts

There's a confluence of cycles occurring in the economy/stock market. The Fourth Turning, Elliott Wave SuperCycle, 18.6-year economic cycle and several others. I've discussed the Fourth Turning before. Neil Howe, the co-author of "The Fourth Turning, An American Prophecy", pub. 1997 and "The Fourth Turning is Here" pub. 2023, believes we are in the midst of the Fourth Turning which began in 2008 and will end in the early 2030's possibly 2033.

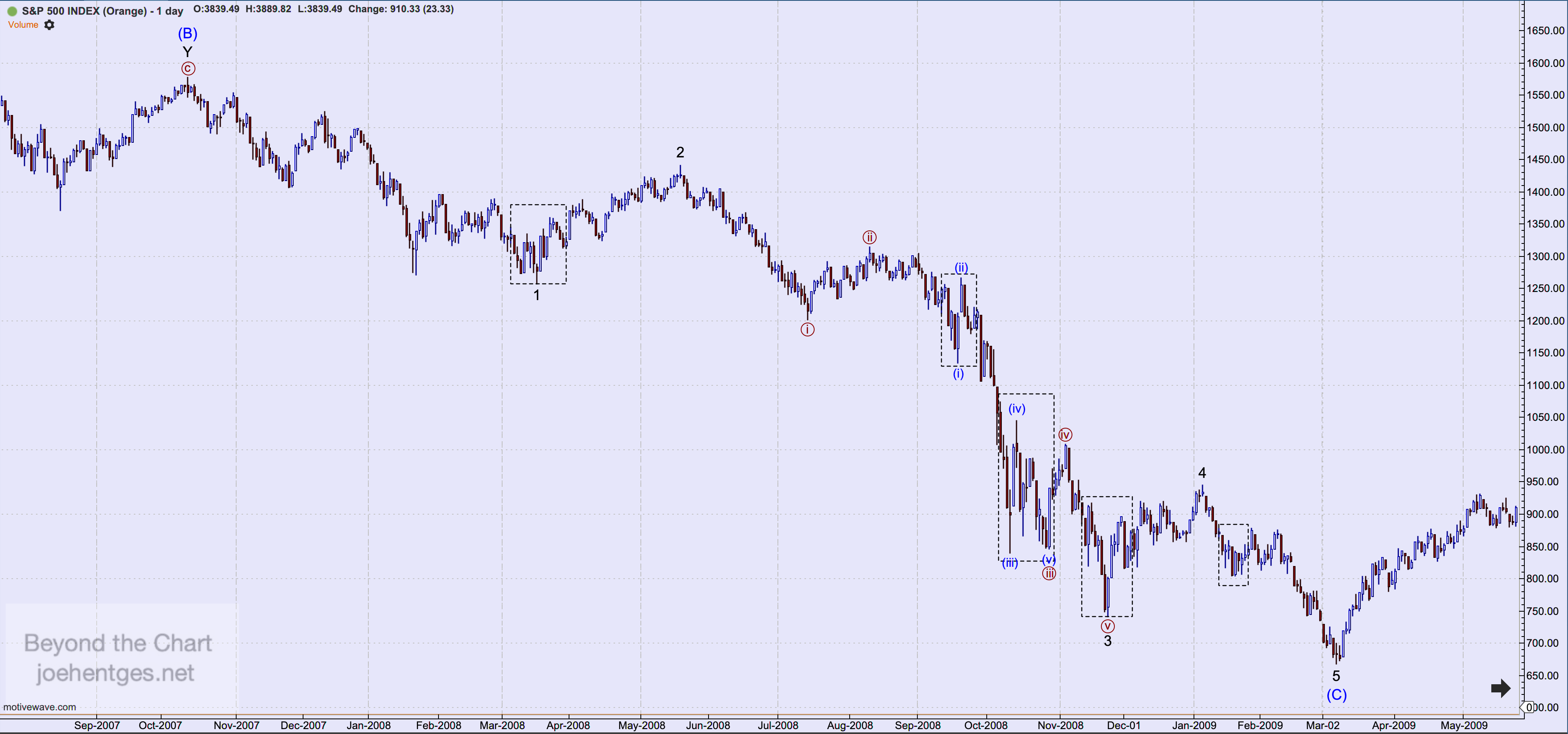

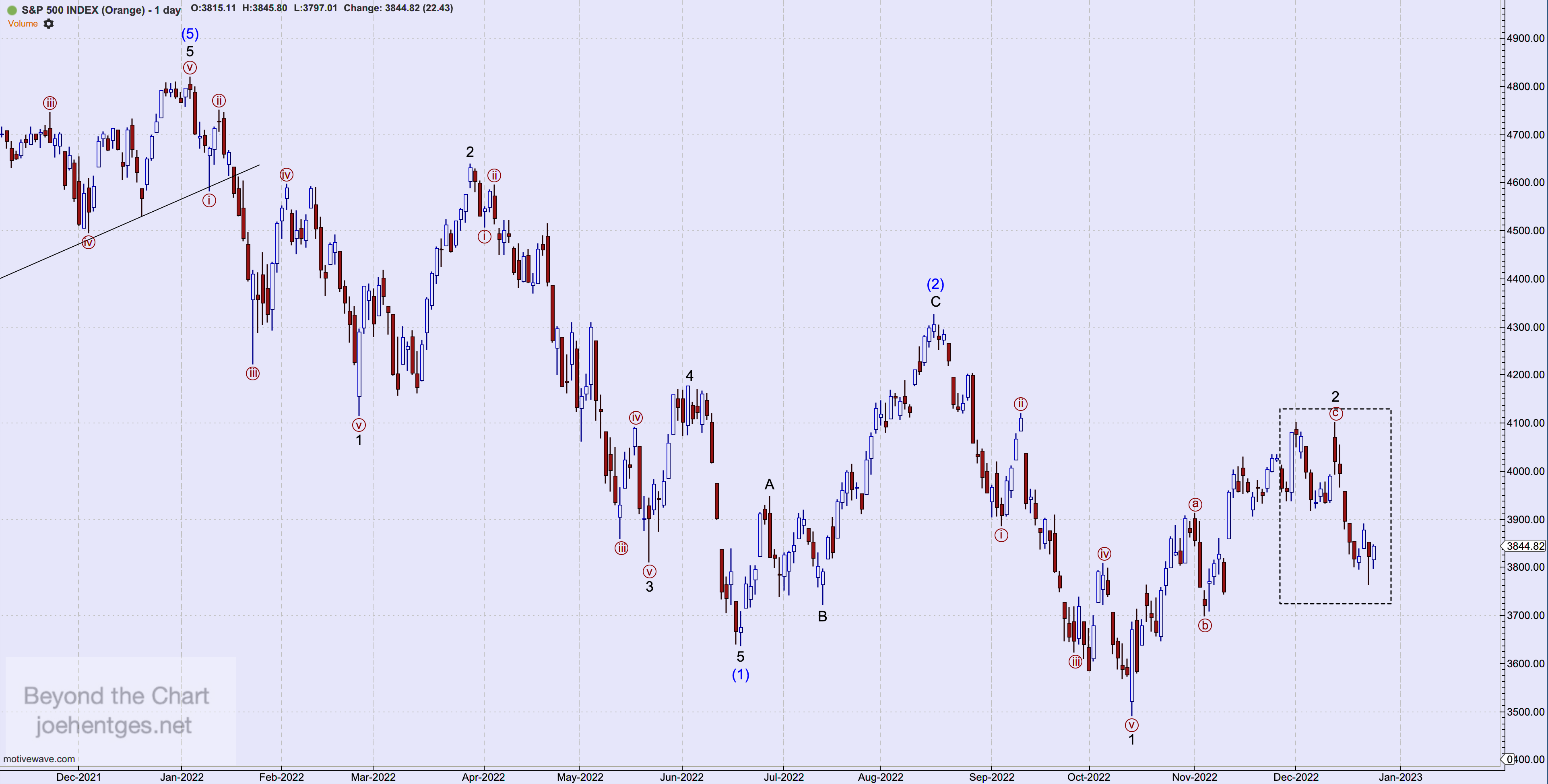

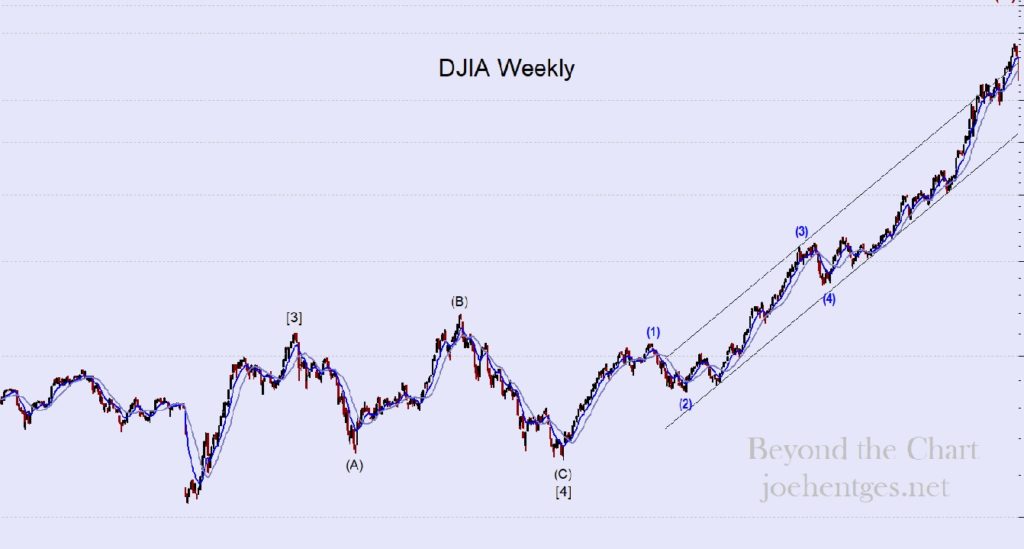

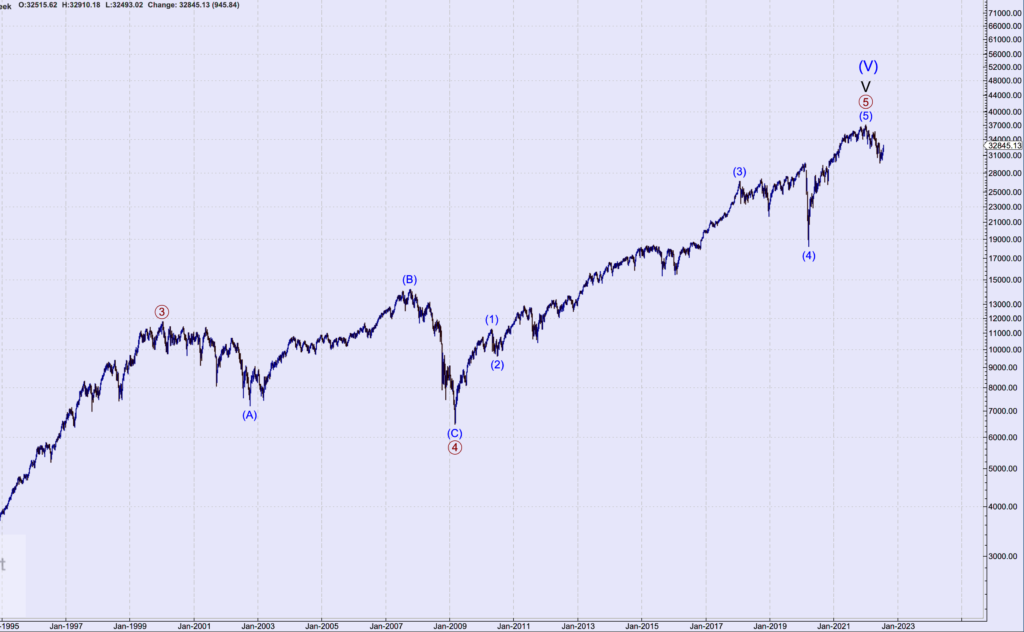

Of course I've also discussed the long-term Elliott Wave cycles. Cycle Wave V of SuperCycle (III) either ended in January 2022 or is in the final stages. The price action will soon confirm the timing. I've recently been introduced to the 18.6-year economic cycle related to real estate and the economy that is impacting the Elliott Waves. It has very significant implications for the stock market and the economy and ties in nicely with everything occurring now.

As a member of the Foundation for the Study of Cycles I became aware of Akhil Patel and also Phil Anderson who has extensively studied the 18.6-year economic cycle. Here is what I've learned:

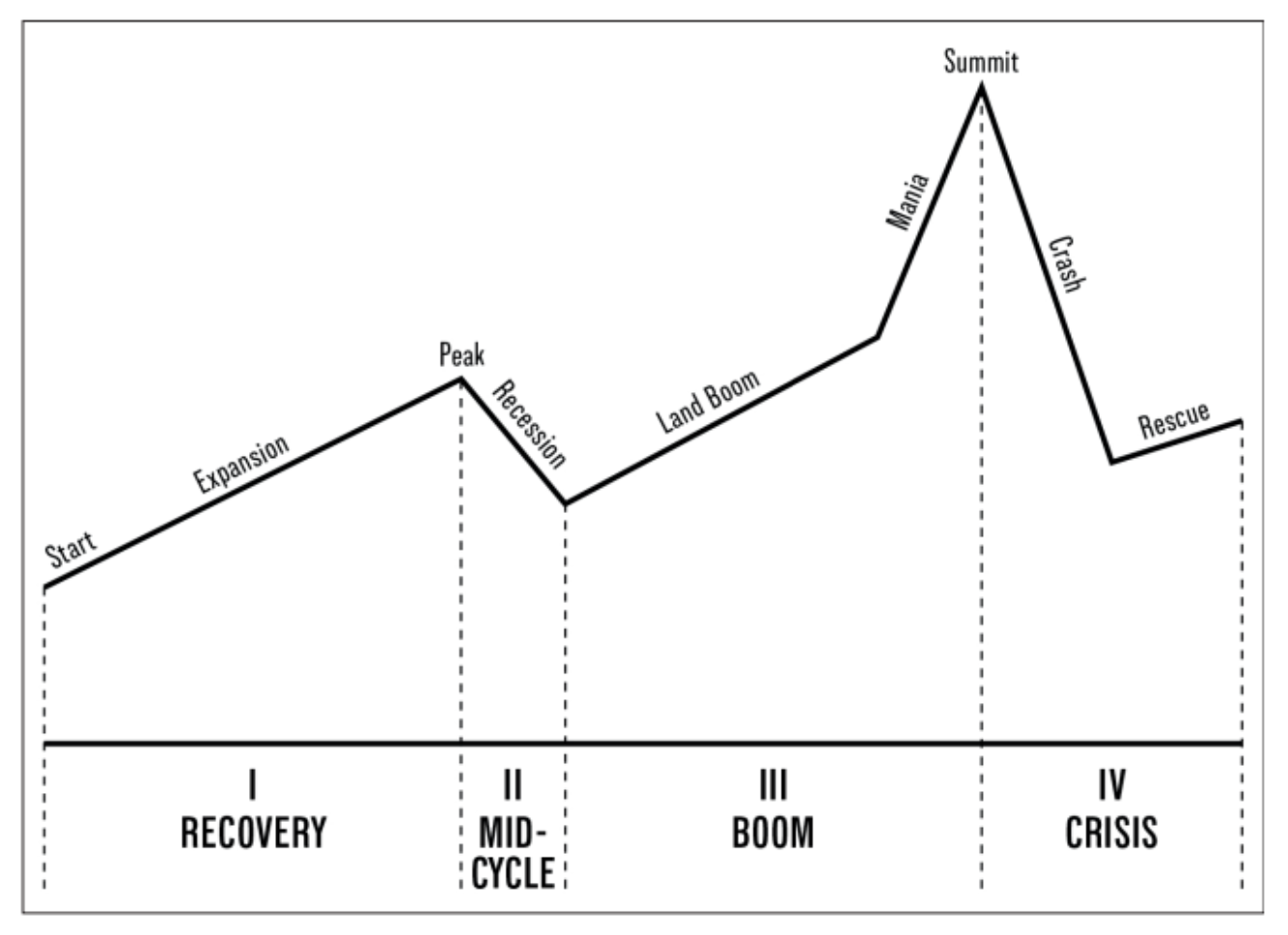

Each cycle has four phases.

Phase I is Recovery. The prior cycle has ended and the economy recovers. Over the next 6-7 years the economy grows and confidence returns.

Phase II is a Mid-Cycle. In this phase a minor recession takes place. This generates some fear but it turns into a relatively short slowdown with no real financial crisis.

Phase III is the Boom. This leads to a much stronger boom over the next six to seven years which generates higher growth, surging stock and property markets. This phase concludes with about 2 years of extreme bullishness and FOMO, before the cycle finally reaches its summit, 14 years after it began.

Final phase is Crisis. As Akhil Patel says: "The cycle ends with a terrific crash and depression. The economy must be rescued from its deep malaise; the ruins are cleared over a period of four years. The 18-year cycle ends, and a new one begins."

This 18.6-year cycle in the economy has been going on for over 200 years now. Sometimes it gets interrupted by major events like World War II. Its length has been has short as 17 years and as long as 21years. The following is a diagram that visually explains the cycle.

Created by Akhil Patel

So the current 18.6-year cycle began in late 2011/early 2012 as the economy started recovering. The unemployment rate in the United States hit a peak of 10.0% in October 2009 and then started to decline. By October 2011 it reached 8.8% and continued slowly dropping. The stock market bottomed in March 2009, ahead of the economy as is usual. The end of the recovery phase occurred in about 2019.

Then the Mid-Cycle period began and included the brief recession at the beginning of the Covid pandemic. So in late 2020 the next phase began. The Boom.

The Boom period began in late 2020/early 2021 and is projected to run into 2025-2026 timeframe, ending about 14 years after it began. At that point everything peaks and the crisis period begins. As mentioned above the crisis period is expected to run about four years.

So an 18.6-year cycle that began in 2012 implies that the end of the Elliott Wave SuperCycle is delayed. And therefore the end of Cycle Wave V has also not occurred and will push higher for 2-3 more years. This drives my alternate count on the indexes. Monitor the price action closely...and fasten your seatbelts.