0

Will This Change Help the Financials?

Today the focus is on State Street Global Advisors (SSGA)’ Financial Select Sector SPDR Fund (XLF). This ETF is usually either the number 2 or number 3 most actively traded non-index ETF. 3 month average daily volume of a little over 40 million shares.

Sector Changes

In June S&P Dow Jones Indices and MSCI, Inc. announced they were modifying the S&P sectors to remove real estate from the financials (except mortgage REITS) and create a new S&P real estate sector.

So in order to continue accurately tracking the sectors, SSGA announced they were removing real estate holdings from the XLF and creating a new ETF called the The Real Estate Select Sector SPDR Fund (XLRE).

Special Dividend

Removing real estate from the Financials will take place after the close on September 16. XLF will issue a special dividend to its shareholders as part of this adjustment. Ex-dividend date is September 19. The dividend will be in the form of shares of the new XLRE fund.

So going forward starting September 17, XLF will include securities of diversified financial services, insurance, banks, capital markets, consumer finance, thrifts and mortgage finance, and mortgage real estate investment trusts (REITs).

The chart of XLF is discussed in the brief market wrap video shown below. The three largest holdings in XLF are Berkshire Hathaway Inc. Class B, at 9.18%, JP Morgan Chase & Co. at 8.01% and Wells Fargo & Company at 7.59%. Continue reading

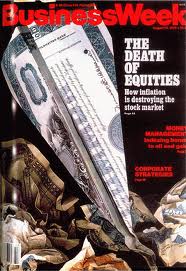

When it comes to the markets, I believe you need to be thinking with a little bit of a contrarian perspective. When a lot of people are doing the same thing or talking about the same thing then “red flags” should go up in your mind. One of the classic signals of the last 50 years was when BusinessWeek had their “The Death of Equities” cover of their magazine on August 13,1979.

When it comes to the markets, I believe you need to be thinking with a little bit of a contrarian perspective. When a lot of people are doing the same thing or talking about the same thing then “red flags” should go up in your mind. One of the classic signals of the last 50 years was when BusinessWeek had their “The Death of Equities” cover of their magazine on August 13,1979.