Contrarian Perspective

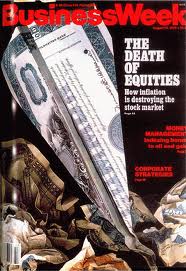

When it comes to the markets, I believe you need to be thinking with a little bit of a contrarian perspective. When a lot of people are doing the same thing or talking about the same thing then “red flags” should go up in your mind. One of the classic signals of the last 50 years was when BusinessWeek had their “The Death of Equities” cover of their magazine on August 13,1979.

When it comes to the markets, I believe you need to be thinking with a little bit of a contrarian perspective. When a lot of people are doing the same thing or talking about the same thing then “red flags” should go up in your mind. One of the classic signals of the last 50 years was when BusinessWeek had their “The Death of Equities” cover of their magazine on August 13,1979.

When the psychology gets to the point where the magazines are putting it on the cover, then many times it means we are probably at or near an extreme. On August 13, 1979, the Dow Jones Industrial Average (DJIA) was 875, 10 years later it was around 2700 and around the beginning of the year 2000 it had closed at 11,722. One of the greatest bull markets of all time. Continue reading

At least for one day, China is back influencing the global markets. China released data last night that showed that

At least for one day, China is back influencing the global markets. China released data last night that showed that