How Extreme is this Market?

In this brief video I look at the market both from an earnings and technical view.

Get my free pdf “Warnings at the Top” that explains in greater detail what I’ve been seeing.

In this brief video I look at the market both from an earnings and technical view.

Get my free pdf “Warnings at the Top” that explains in greater detail what I’ve been seeing.

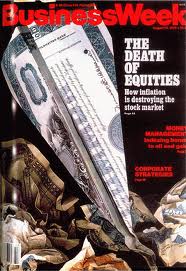

When it comes to the markets, I believe you need to be thinking with a little bit of a contrarian perspective. When a lot of people are doing the same thing or talking about the same thing then “red flags” should go up in your mind. One of the classic signals of the last 50 years was when BusinessWeek had their “The Death of Equities” cover of their magazine on August 13,1979.

When it comes to the markets, I believe you need to be thinking with a little bit of a contrarian perspective. When a lot of people are doing the same thing or talking about the same thing then “red flags” should go up in your mind. One of the classic signals of the last 50 years was when BusinessWeek had their “The Death of Equities” cover of their magazine on August 13,1979.

When the psychology gets to the point where the magazines are putting it on the cover, then many times it means we are probably at or near an extreme. On August 13, 1979, the Dow Jones Industrial Average (DJIA) was 875, 10 years later it was around 2700 and around the beginning of the year 2000 it had closed at 11,722. One of the greatest bull markets of all time. Continue reading

The video attached below is a very condensed version of what I provide to my Insider Members in their Weekend Market Analysis.

The retracement in the stock market continues and we are now rapidly approaching my targets for this 4th wave.

In the Baltic Dry Index chart above you can see that it continues to plummet to new all-time lows. I last talked about this on January 6 in the post “What is the Baltic Dry Index Saying Now?” The situation is now much worse. Continue reading

Do you know where your chair is? Or when to exit? Or what your stop is? The stock market picture continues to worsen and you better have a plan if you are an investor. And if you are a trader then you already know your plan…right? Continue reading

Do you know where your chair is? Or when to exit? Or what your stop is? The stock market picture continues to worsen and you better have a plan if you are an investor. And if you are a trader then you already know your plan…right? Continue reading

The stock market barely moved today. It was extremely compressed. In fact it is the most compressed day for the SPX in months. Many times extremely compressed days like this occur at or near turning points.

In tonight’s Weekday Market Wrap video we look at the market action today and then check in on Apple (AAPL), Adobe (ADBE), Apache (APA), Boeing (BA) and Alibaba (BABA). Continue reading

Powered by WishList Member - Membership Software