Electric Vehicle Stocks, Just Another Craze…or the Future?

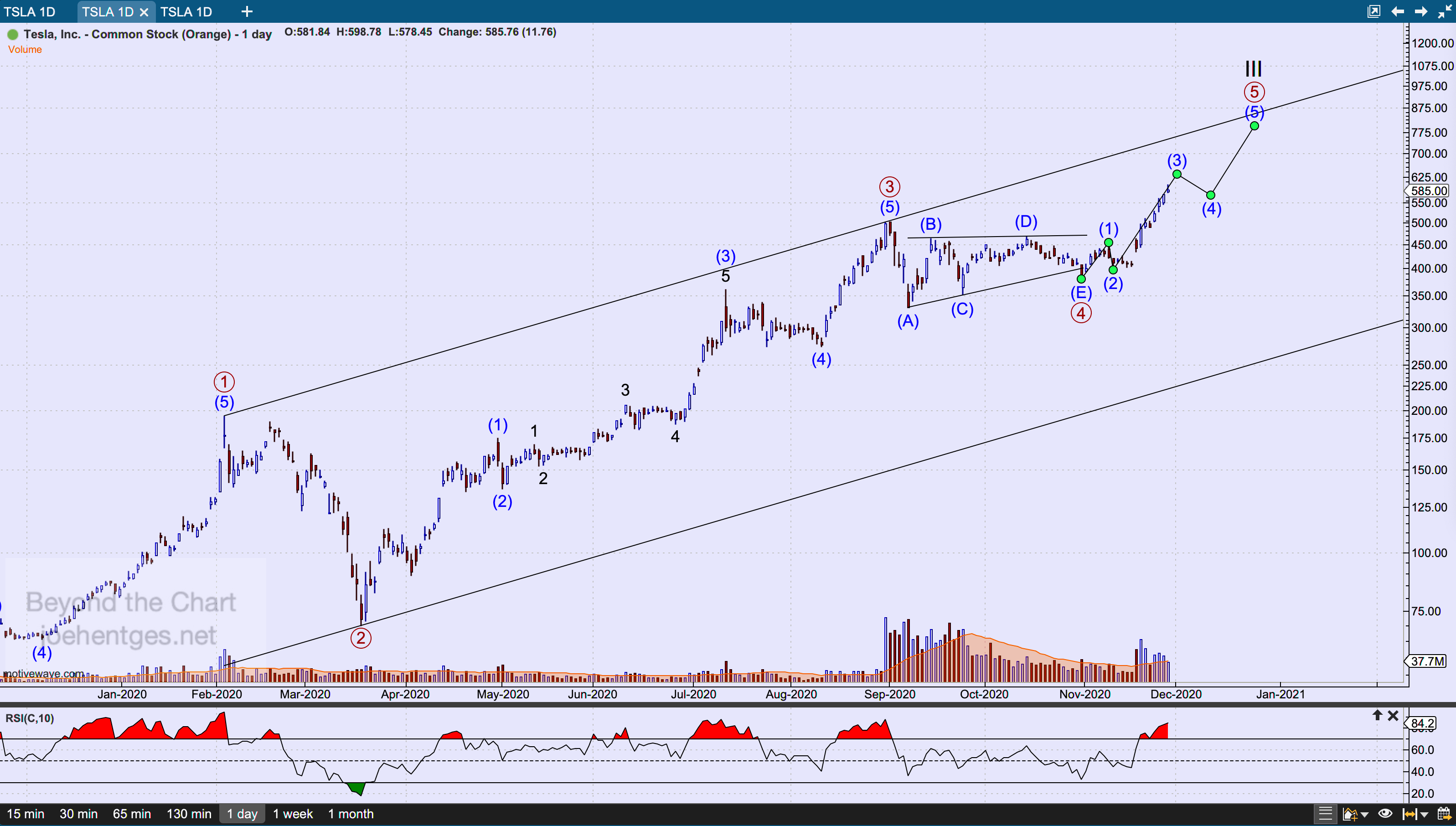

Electric vehicle stocks have been all the rage recently. The largest cap stock and clearly the most widely recognized is Tesla (TSLA). It went public on June 29, 2010 and closed that day at $4.78 (split adjusted). It would take 4 more months before it had a higher close.

By December 31, 2019 TSLA had a full head of steam and closed at $83.67. But it was just getting started. Enter 2020.

As of November 27, 2020 TSLA closed at $585.76. The previous week it was announced that Tesla would be included in the S&P 500 Index. Tesla is up 7X the closing price at the end of 2019 with a market cap of over $540 billion making Elon Musk the 2nd richest man in the world.

But there are many other electric vehicle stocks in the market place and it seems like every established auto maker is also getting in the act. Many electric vehicle (EV) companies are headquartered in China but North America has a few also.

These next three electric vehicle stocks are worth a combined approximately $150 billion: Nio Inc. (NIO), Li Auto, inc. (LI) and Xpeng Inc. (XPEV) according to this Bloomberg article. XPEV founded in 2014 is headquartered in Guangzhou, China. NIO founded in 2014 is headquartered Shanghai, China. LI founded in 2015 is headquartered in Beijing, China.

The next chart below shows that NIO is up 1343% in 2020 alone. It has been trading since September 12, 2018.

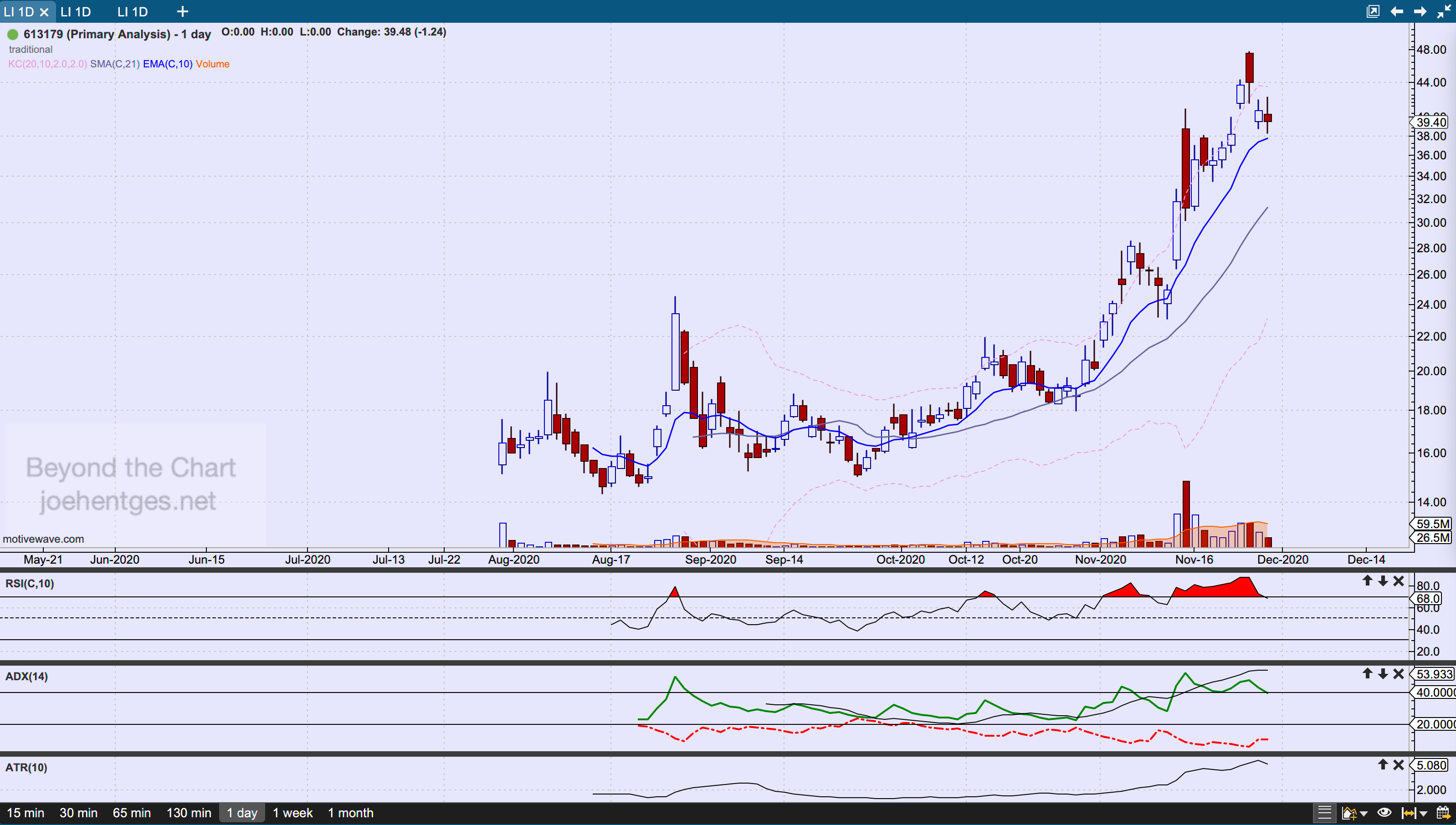

Li Auto came public on July 30, 2020 and closed at $16.46. On Friday, November 27 it closed at $39.48...only up 240%.

And Xpeng came public on August 27, 2020 and is up 303% from its opening day closing price.

There are many other companies that are focused on EVs also. Some are truck only, some small commercial vehicles only, some are battery related. Here are a few of the names: BYD Co. Ltd.(BYD) - China, Nikola (NKLA) - U.S., Workhorse (WKHS) - U.S., Kandi Technology Group (KNDI) - China, Blink Charging Co. (BLNK) - U.S., ElectraMeccanica (SOLO) - Canada, Ayro Inc. (AYRO) - U.S. and Green Power Motors (GP) - Canada to name a few.

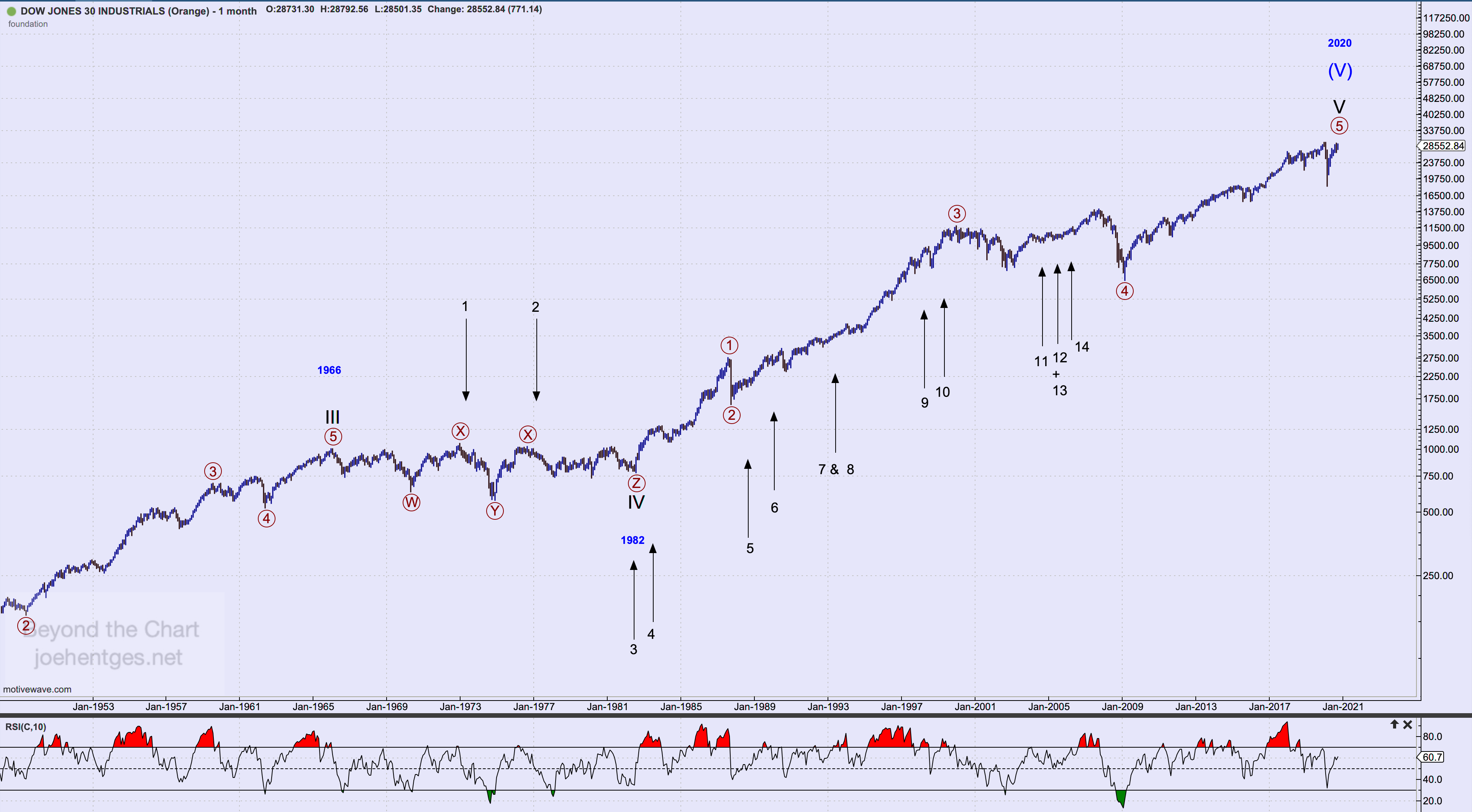

This is a dynamic, quickly evolving market. Given the ever increasing focus on climate change and the future health of the planet, electric vehicle stocks are definitely in the crosshairs of many traders and investors.