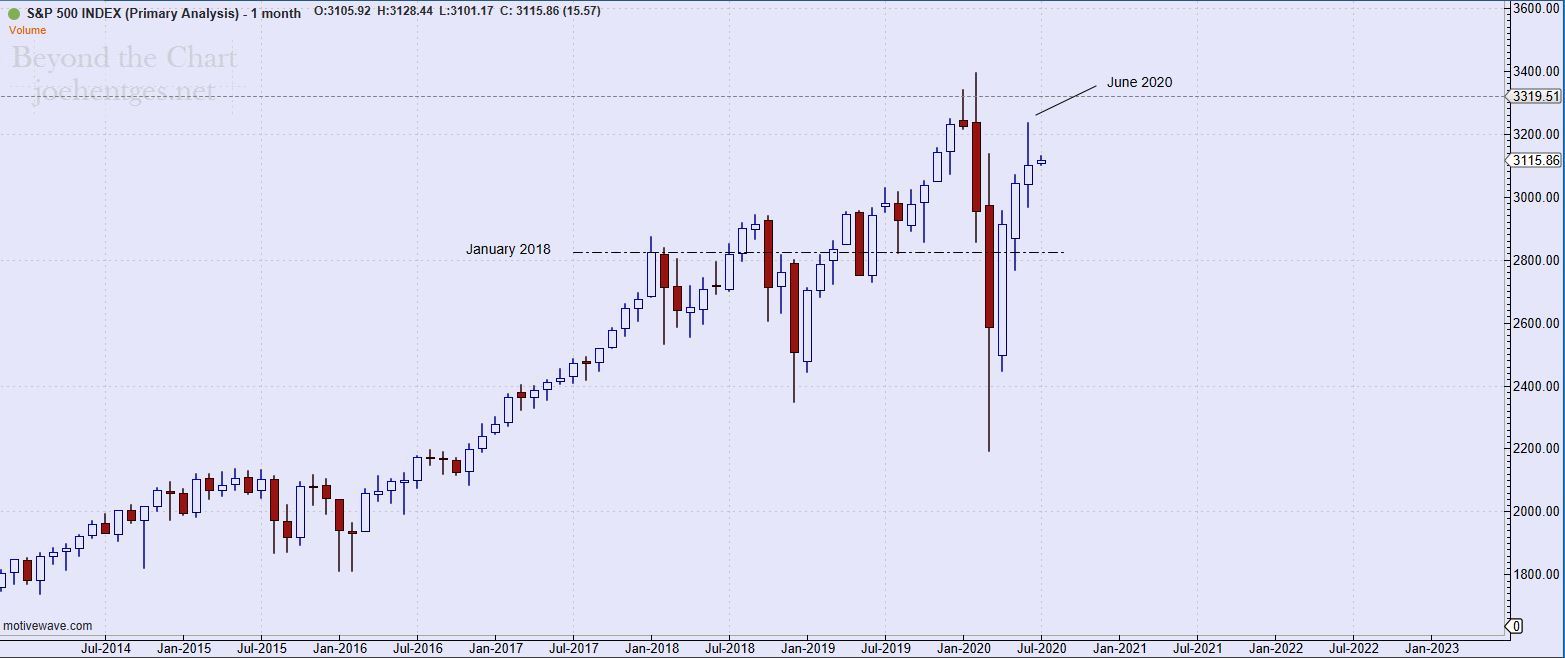

A View From Inside a Stock Market Bubble

So what does a stock market bubble look like? I say just look around. In this post I review many of the signs that have shown up in the first quarter of 2021. There are extremes all around. Some like we have never seen before. It’s a little bit like walking thru a woods and not being able to see the forest because of all the trees. We are right in the middle of it.

When I think of sentiment and extremes, I think of that story of a shoe shine boy in 1929. As the story goes, when Joseph Kennedy heard his shoe shine boy giving him stock tips in the summer of 1929, he decided the market had gone too far and sold everything, thus avoiding the 1929 Crash.

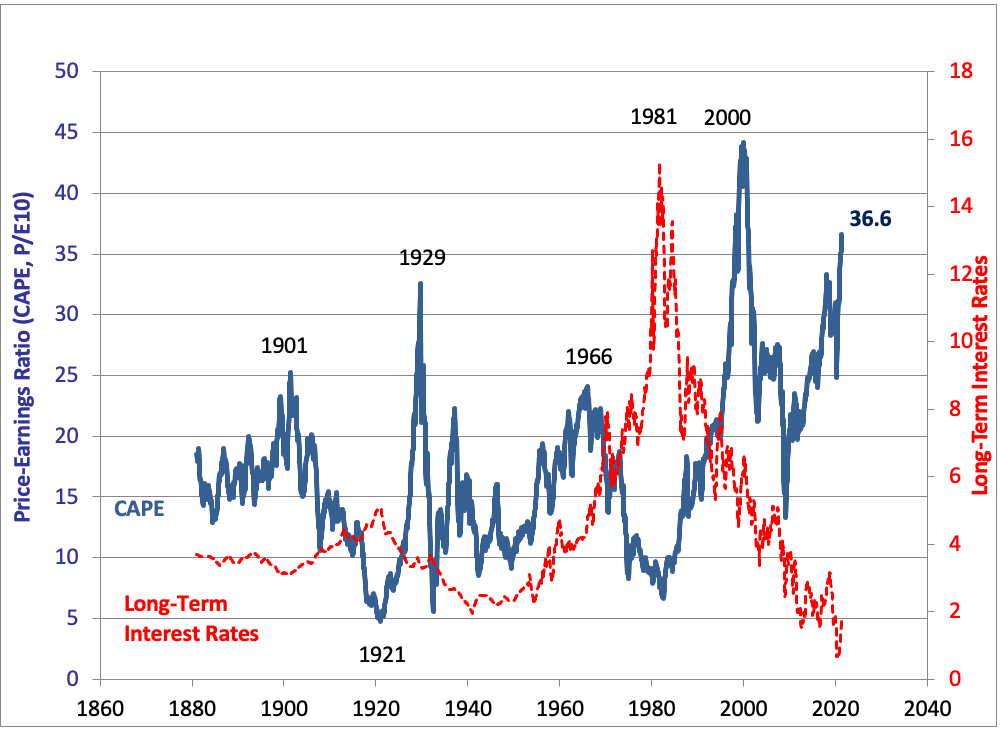

So in order to get a measure of where we are now, let’s look at the latest CAPE data from Professor Robert Shiller. CAPE is his Cyclically Adjusted Price Earnings Ratio created in the late 1990’s and discussed in his famous book Irrational Exuberance published in March 2000, the exact month the Nasdaq and S&P 500 (SPX) peaked and 2 months after the Dow Jones Industrial Average (INDU) peaked.

In the chart below you see the latest reading is 36.6 which is higher than 1929 and 2007. There is only one period of irrational exuberance that is greater than where we are now and that is the period from November 1998 to the peaks in the stock market indexes in January to March 2000. This chart also shows the history for long-term interest rates which tells an interesting story by itself.

Although not labelled on the chart, the two lowest CAPE readings since the 1929 peak came at the Supercycle Wave IV bottom in June 1932 at 5.57 and the end of Cycle Wave IV of Supercycle Wave V in July, August 1982 at 6.64.

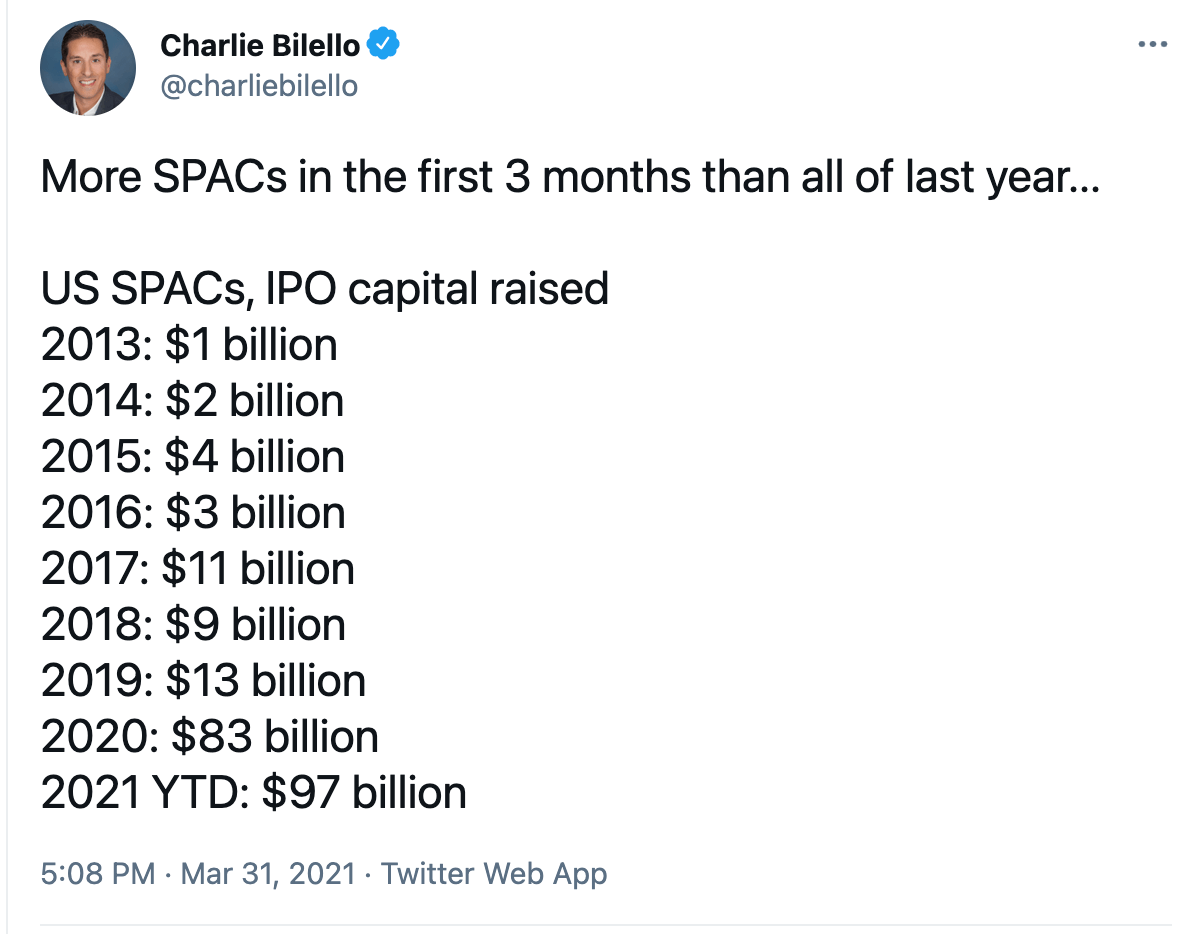

I like to look at a person’s actions versus what they say. Let’s take a look at two groups of investors/traders. The first group is what I call the Wall Street crowd. This group consists both of public corporations and Wall Street firms. These entities show their extreme behavior by taking companies public via the SPAC (Special Purpose Acquisition Companies) route or traditional IPOs (Initial Public Offerings).

In the image below Charlie Bilello shows some recent SPAC data. In 2020 the dollar volume of SPACs was over 6 times that of the previous year. And in the first 3 months of 2021 alone, the SPAC volume exceeds all of 2020.

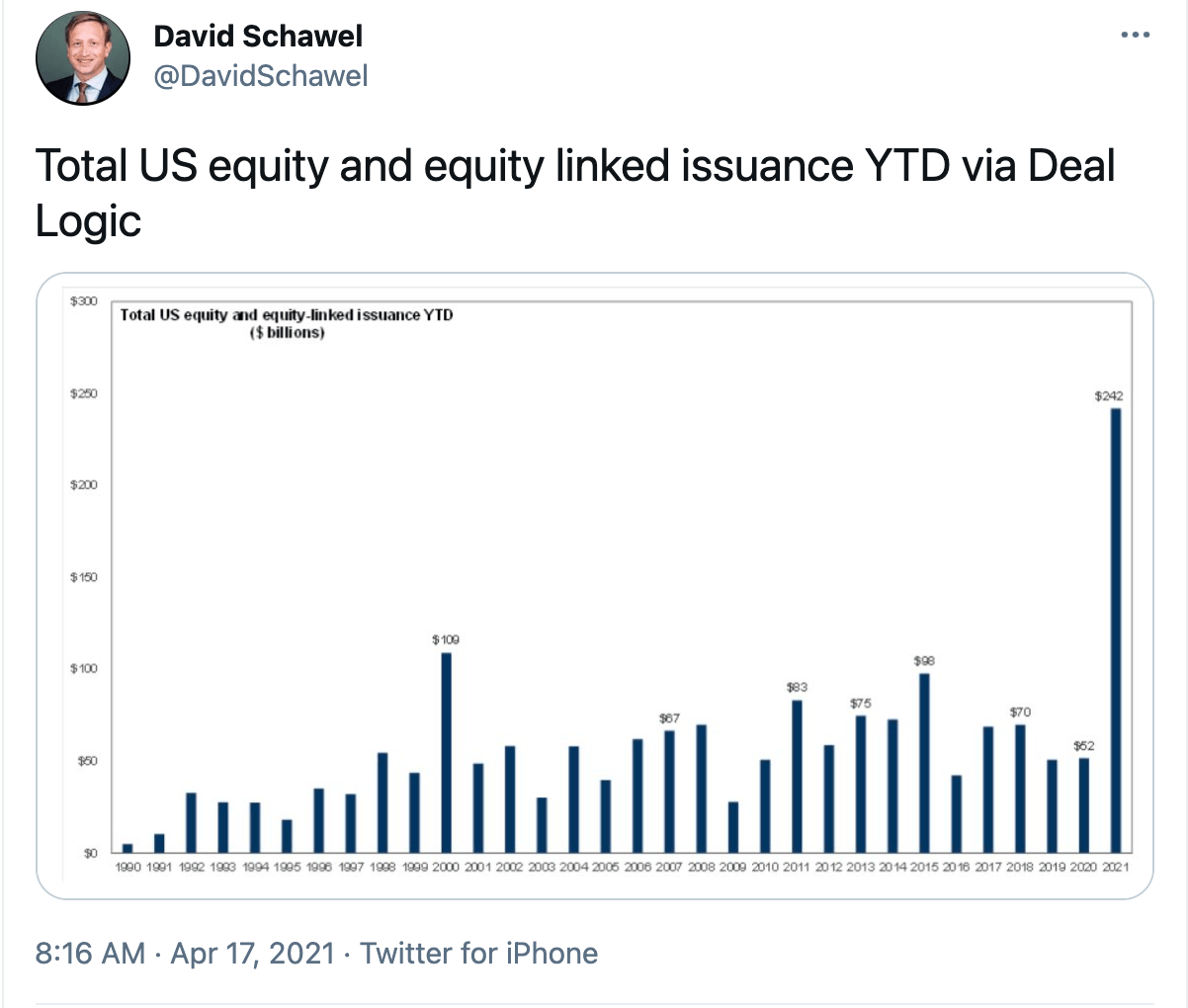

Now for more of a total picture of equity issued in the stock market, here is data from Deal Logic provided by David Schawel. The numbers are astounding. The total dollar volume is over twice as much as in 2000 at the peak of the dotcom craze and yet this number is for just the first 3 months of 2021.

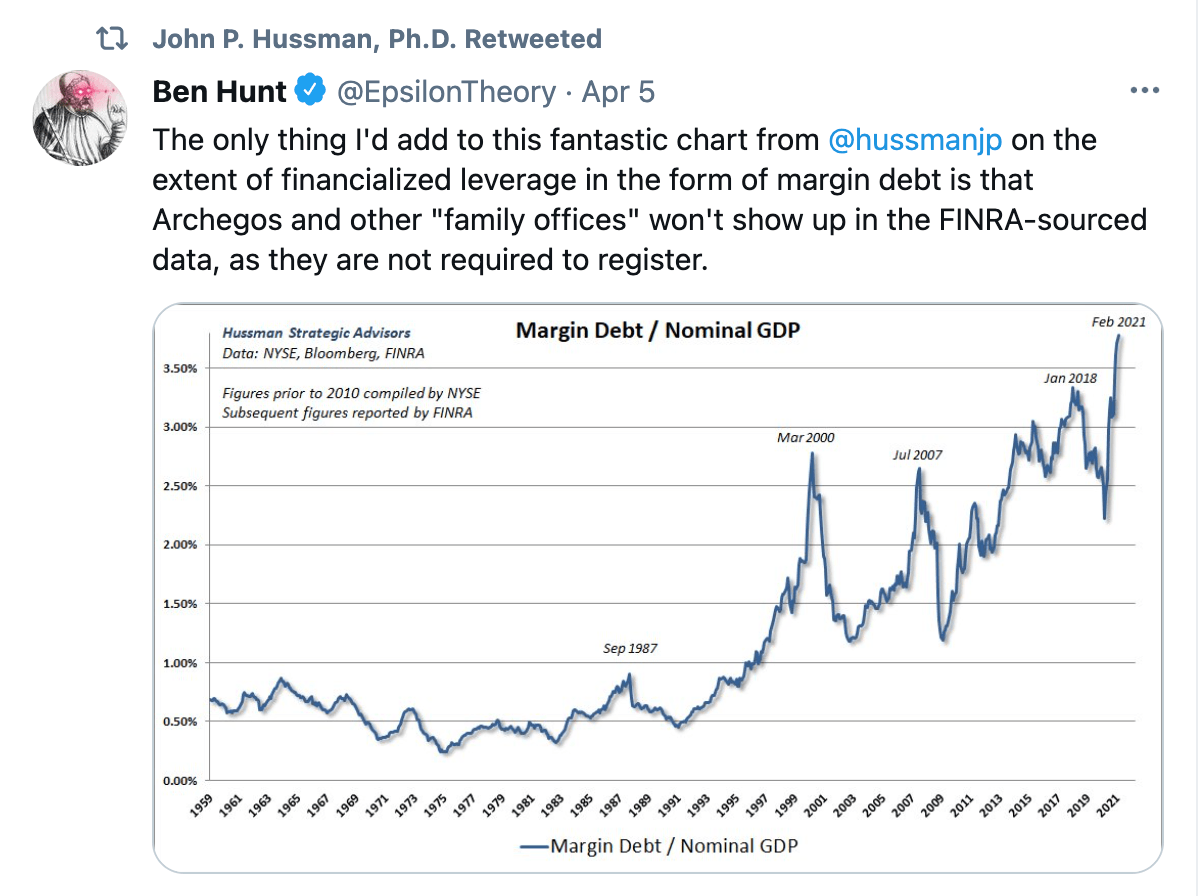

The individual investor/trader is the other group I want to focus on. Let’s take a look at some of the extreme action taking place. So when people get overly confident and greedy, with a dash FOMO thrown in, they take on margin debt to try and maximize the return. Now margin debt has undoubtedly grown with the size of our economy. To adjust for that, John Hussman shows how even when you divide margin debt by GDP, it is at levels never seen before. And Ben Hunt also comments on this chart about debt that is not accounted for in this data.

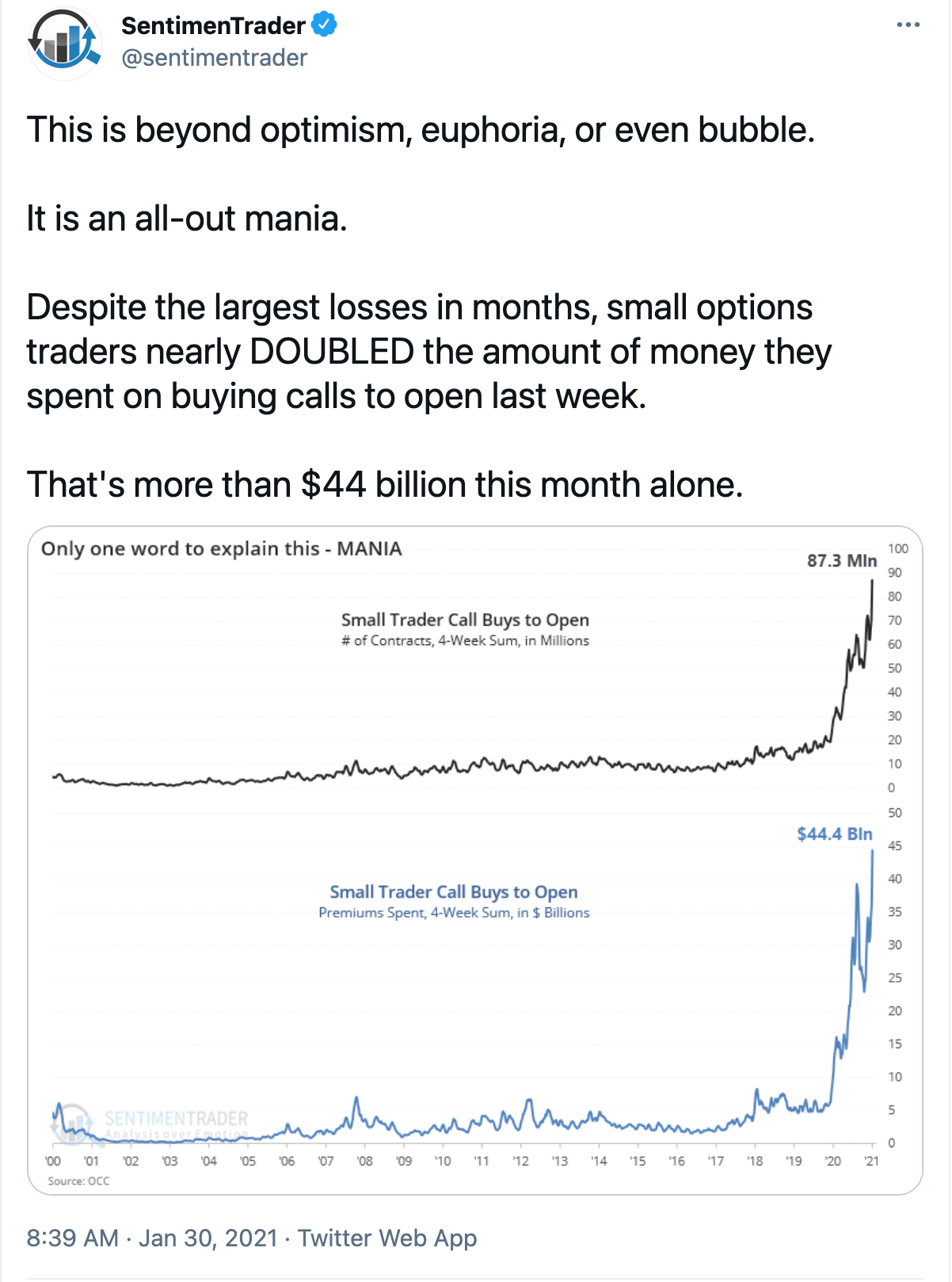

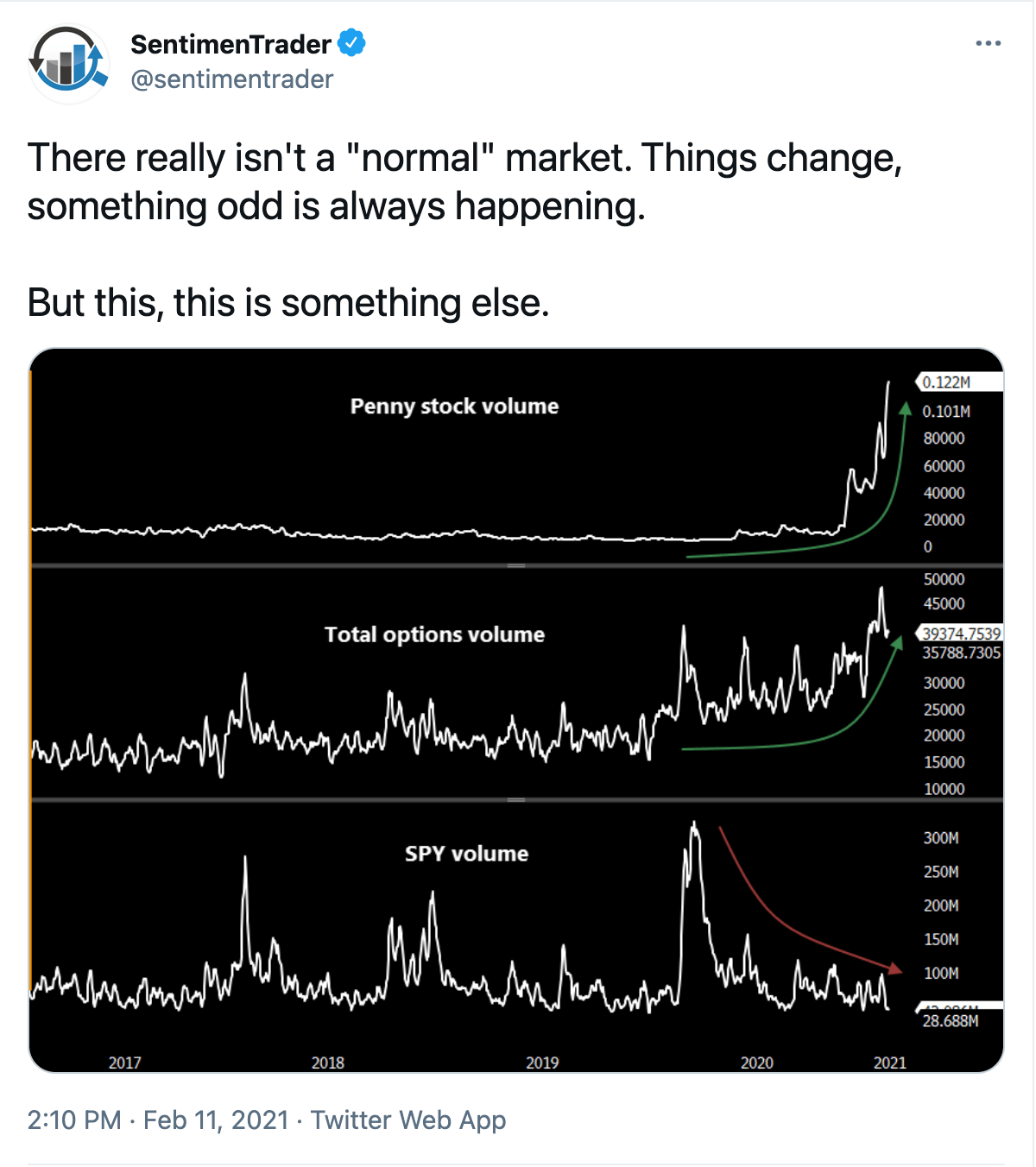

In these next two graphs we’ll focus on options trading and show the extremes exhibited by call option buying which are bets on future bullish movement. Both of these charts are from Sentiment Trader.

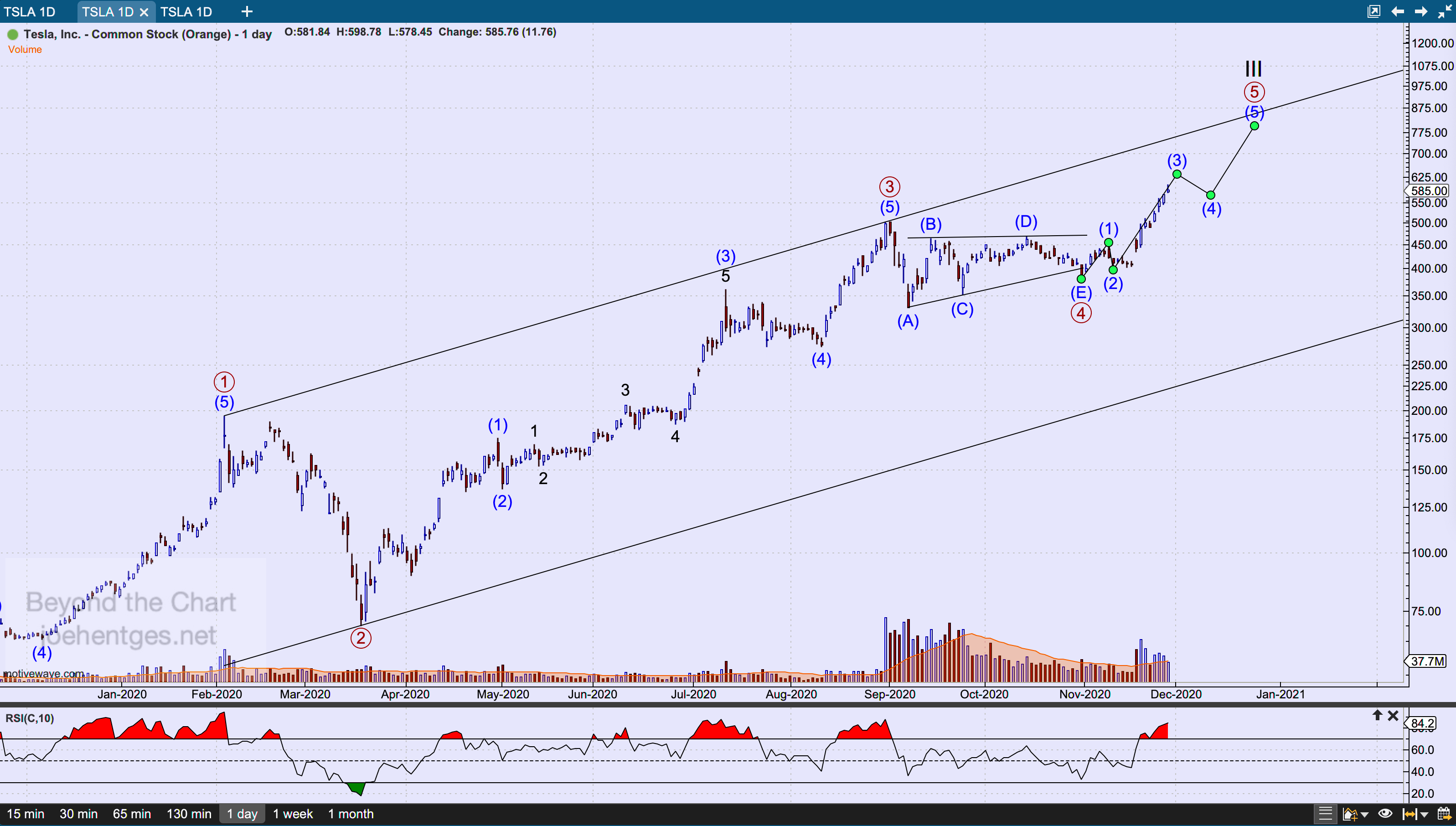

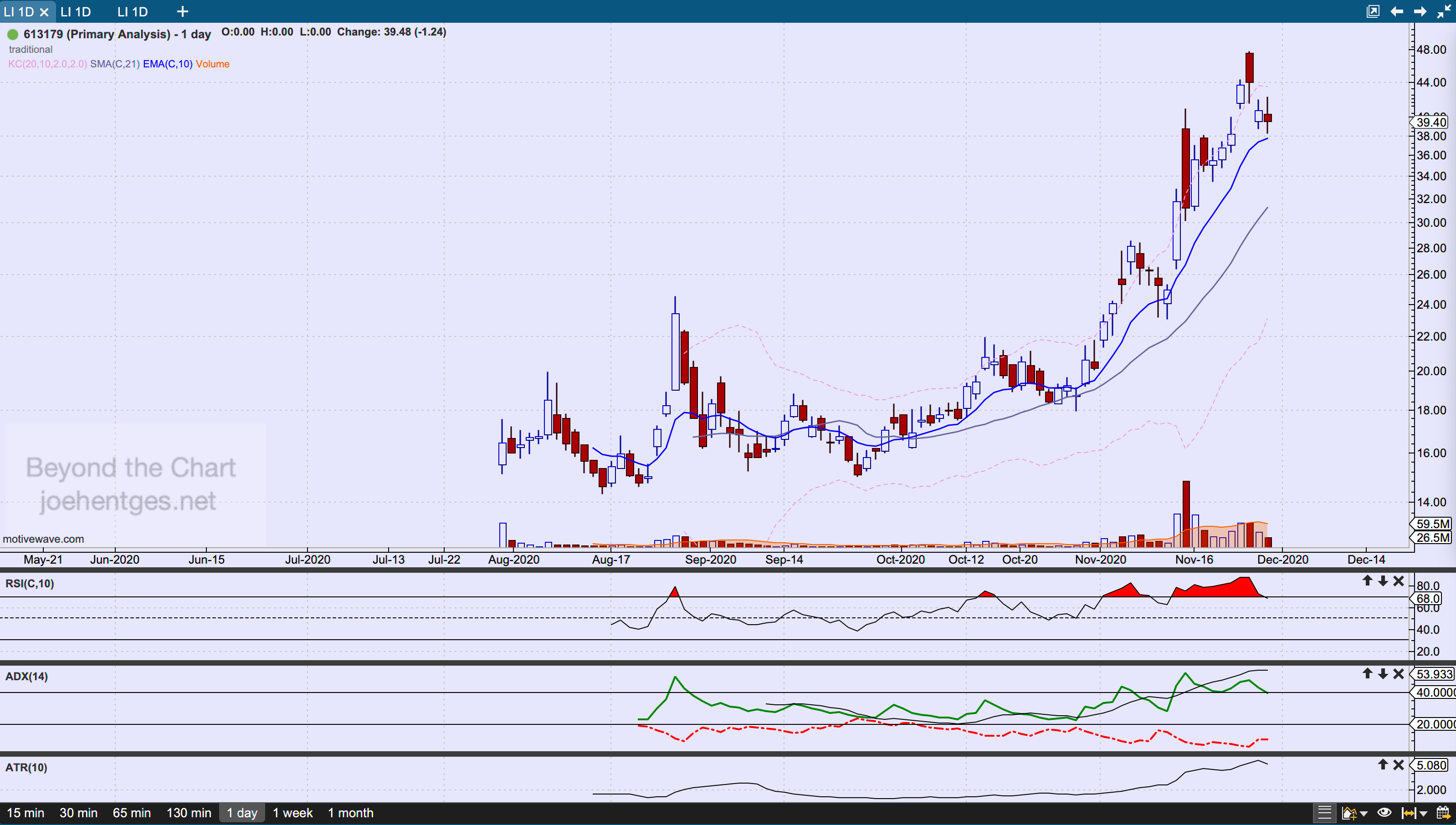

So what we are seeing are extremes in many cases, beyond anything shown at the peak in 2000. You now know what it is like to be on the inside of a stock market bubble. Sentiment figures do not help with timing, but they sure provide the setting and the warning flags. We continue to monitor Elliott Wave structure and price action to stay alert for changes in trend.

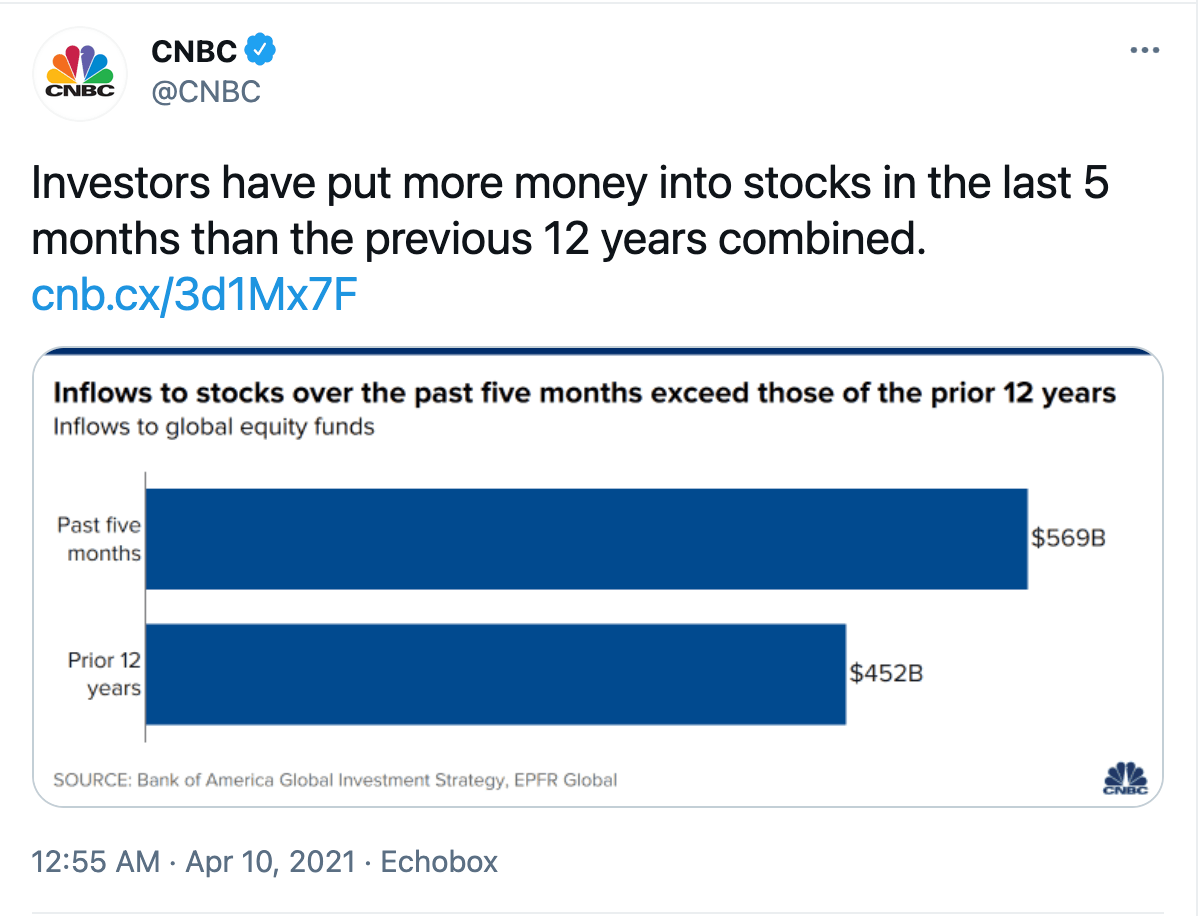

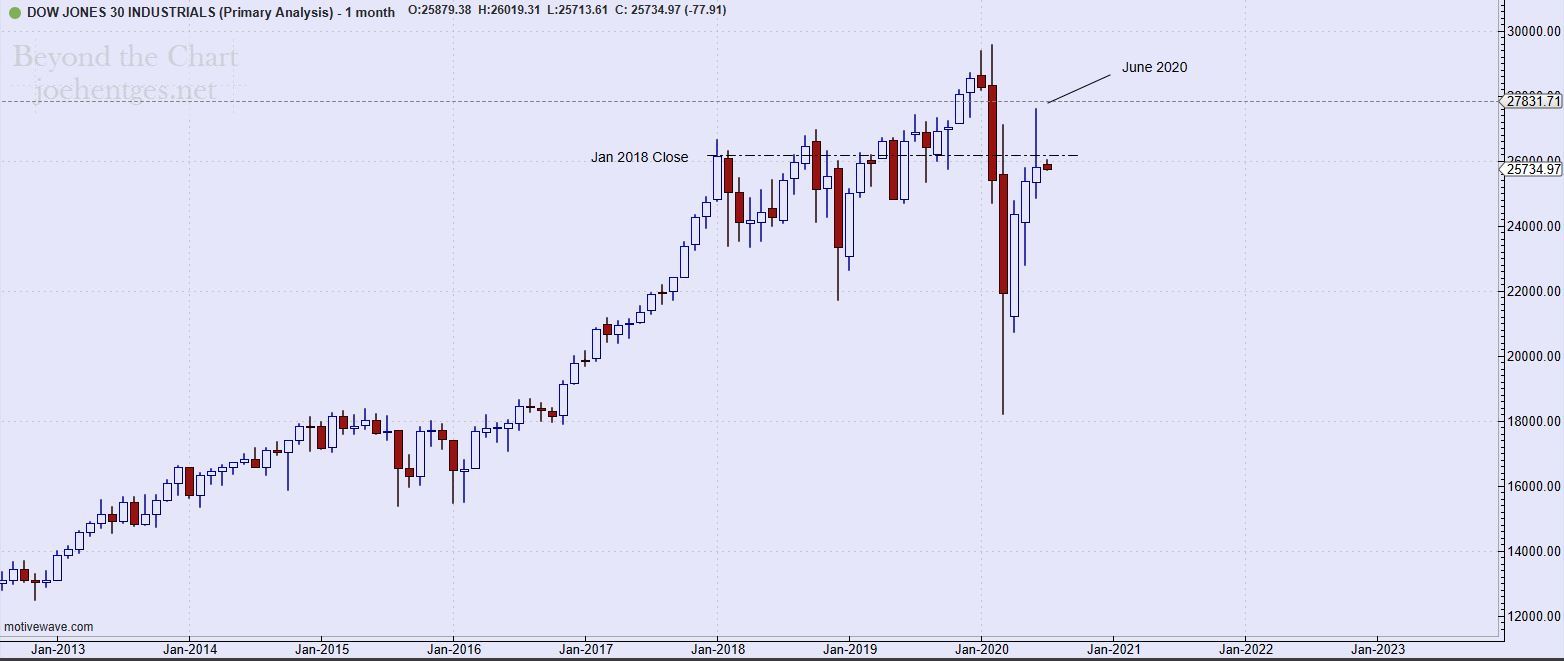

And finally I’ll end with this graph from CNBC. I call this a Supercycle FOMO.