The stock market ended the day little changed after pushing higher in the morning. The results were a mixed bag with DJIA and Nasdaq both up just slightly and the other indices down a few points.

The bounce in the market yesterday extended into the morning today but ran out of steam during the 3rd hour of trading. The afternoon had the market digesting news of terror activity in Germany. A stadium was evacuated after an ambulance was found packed with explosives. At least that was the initial report.

There was also news hitting the wire that a passenger tried to get into the cockpit of a British Airways flight from London to Boston. So the market was on edge, digesting these news reports.

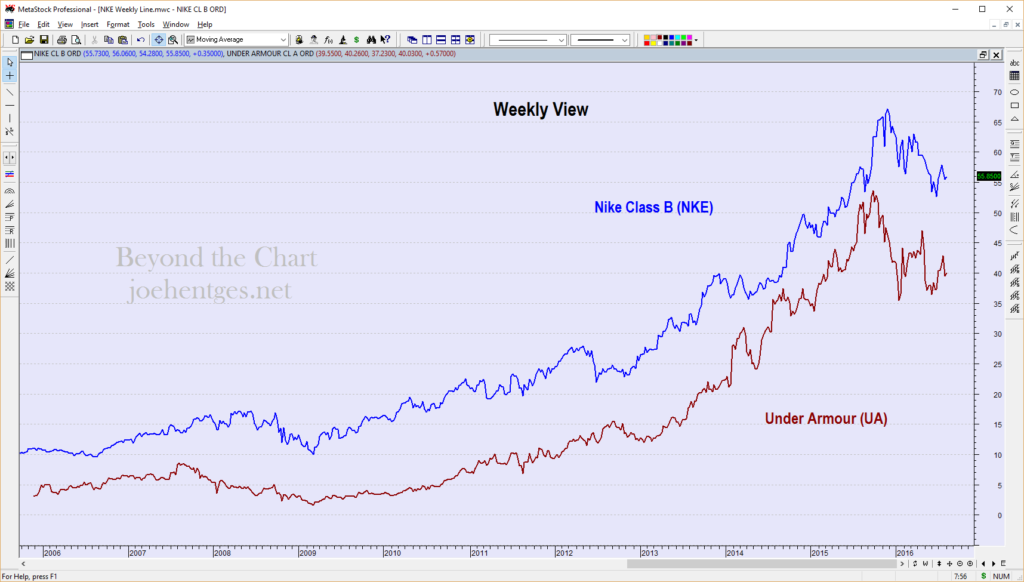

In tonight’s video I look at the market action and check the 3 stocks that had the biggest percentages losses (of my list) today…SolarCity (SCTY), Canadian Solar(CSIQ) and Under Armour (UA). Continue reading

As I look at the stock market action today and recently, it is hard to miss the fact that retail stocks are getting killed. GoPro (GPRO) has been annihilated for a while now but Fitbit (FIT) is joining in as are many others.

As I look at the stock market action today and recently, it is hard to miss the fact that retail stocks are getting killed. GoPro (GPRO) has been annihilated for a while now but Fitbit (FIT) is joining in as are many others.