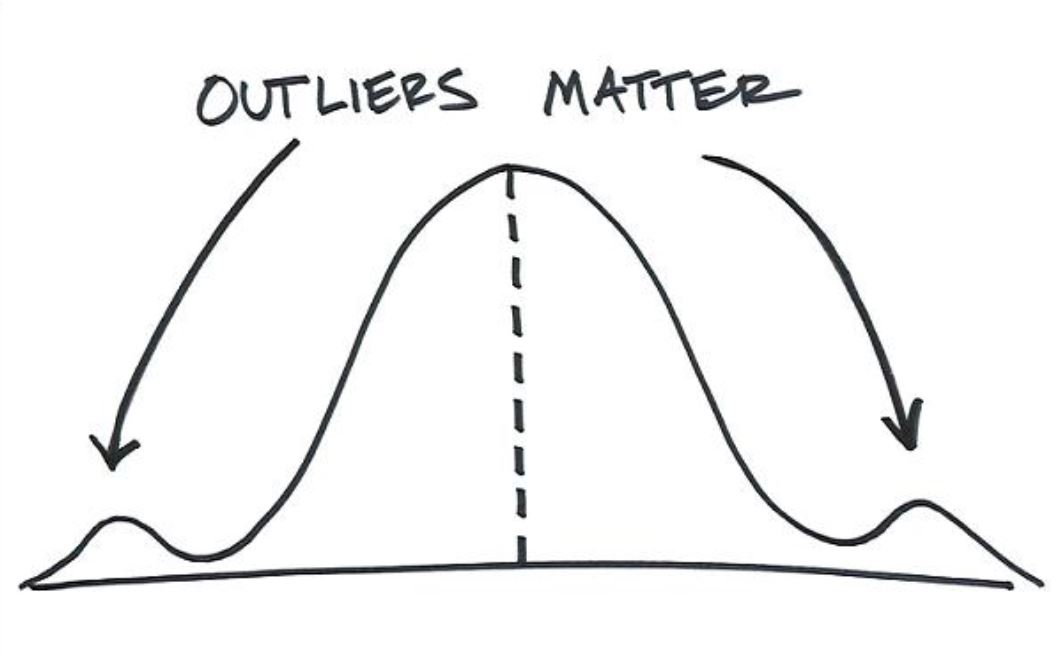

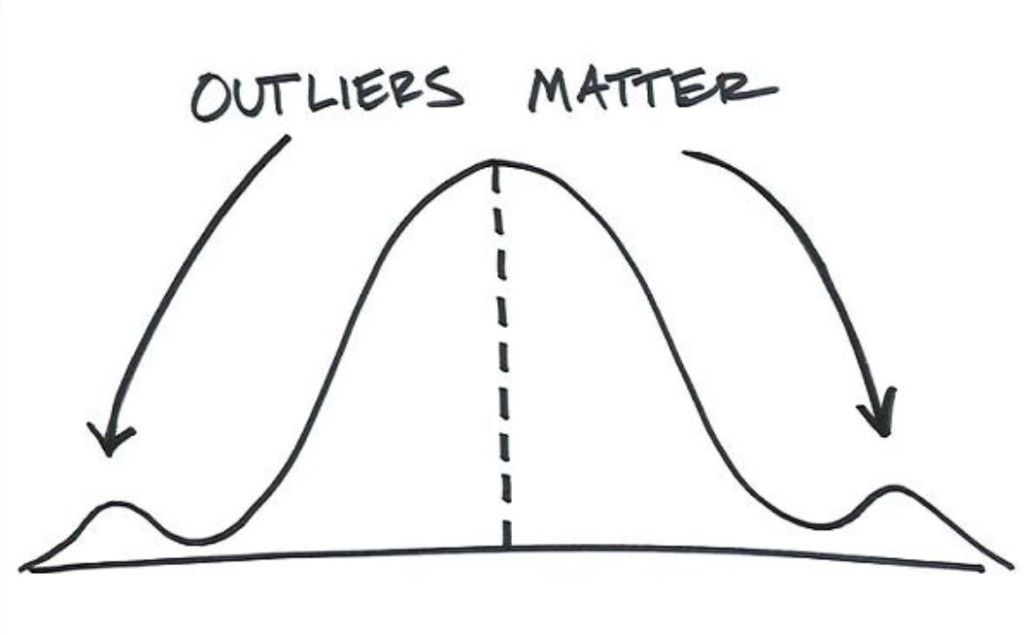

Outliers Make all the Difference

The word outliers became a popular word I believe, after Malcolm Gladwell wrote the NY Times best seller, “Outliers, the story of success” in 2008.

In the book he talks about several successful people and came up with the 10,000 hour rule. His rule said that to achieve world-class success, one needs to practice your craft for 10,000 hours.

The 10,000 hour rule is an interesting idea and one that could apply to trading. But what I want to focus on today is the concept that an outlier is a trade, a trading day, week or month that can make your year.

Outliers and Losses

So what this concept does is support the philosophy of cutting your losses short. In order for outliers to help your trading you will have many smaller trades, days or weeks that offset each other.

And therefore the larger more successful trades will power thru and make your P&L. But that won’t happen if you let losses get out of control and offset the big winning trades.

Marty Schwartz in his book “Pit Bull” talks about this concept. Marty started out trading options but then moved to trading futures.

“For two hundred days a year, I’d end up with reasonably small losses netted out with similar-size gains. Lose $5,000 here, make $6,000 there, round after round, twenty, thirty, forty times a day.But I’d win the other fifty trading days by clear unanimous decisions. Smack the bonds for $75,000, hit a stock for $100,000, nail a couple of options for $125,000, pound the S&P s for $150,000.Over time it made me a big winner, to the tune of $5 million a year.”– Marty Schwartz from “Pit Bull”

Fifty Days

What I want you to focus on is not the 20-40 times a day he traded or that he could make $5 million a year. Focus on the 200 days out of 250 he would basically break even.

That left 50 days that would be his outlier days. The days that made his month and year. So what do outliers have to do with trading? Everything.

The word outliers became a popular word I believe, after Malcolm Gladwell wrote the NY Times best seller, “Outliers, the story of success” in 2008.

The word outliers became a popular word I believe, after Malcolm Gladwell wrote the NY Times best seller, “Outliers, the story of success” in 2008.