China just released two more readings on their economy very early Saturday morning, Dallas time. Both reports showed that the China slowdown continues.

China just released two more readings on their economy very early Saturday morning, Dallas time. Both reports showed that the China slowdown continues.

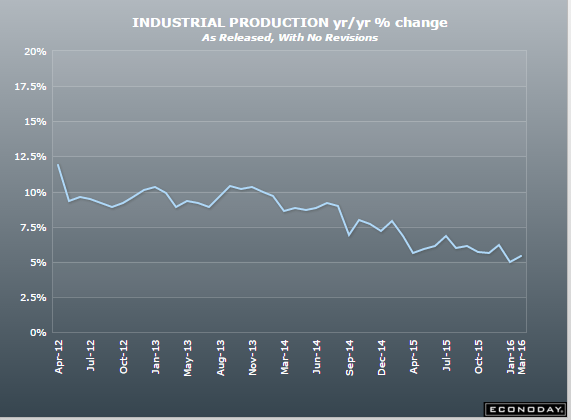

China industrial production was up 5.4% yr/yr less than the 5.7% expected. The chart below shows the trend that is occurring. As the graph below shows, over the last nearly 4 years, industrial production rate of change has dropped by over 50%.

China’s retail sales up 10.2% yr/yr versus a 10.8% expected. The chart below shows that trend. And as you can see in the graph, the rate of change has dropped off by more than 33% from what is was four years ago.

So China continues to try and manage a transition from an export/industrial economy to a consumer/services economy. Speaking today in China, the People’s Bank of China Governor Zhou Xiaochuan said he doesn’t believe major stimulus is needed to support growth.

The Chinese government is now shooting for 6.5% annual growth over the next 5 years. Sunday night and Monday will tell us what the stock market thinks of the ongoing China slowdown and the governor’s comments.

Trading Psychology

One of the more valuable books on trading psychology is The Tao of Poker by Larry W. Phillips. I’m going to focus on some of his poker rules going forward.

Rule 18: Take the long view. This is all about making correct trading decisions. It’s about following your process or methodology. You want to win over the long-term, not just today. And if you win today because you took a risk that went against your methodology, then you are doing yourself more harm than good.

“You are rewarded for correct play in the long run; in the short run, anything can happen.”

– Tom McEvoy, champion poker player

How well do you understand the trading business?

Today’s video is an abbreviated version of what I provide my Insider Members.