0

Just Like History the Stock Market Rhymes

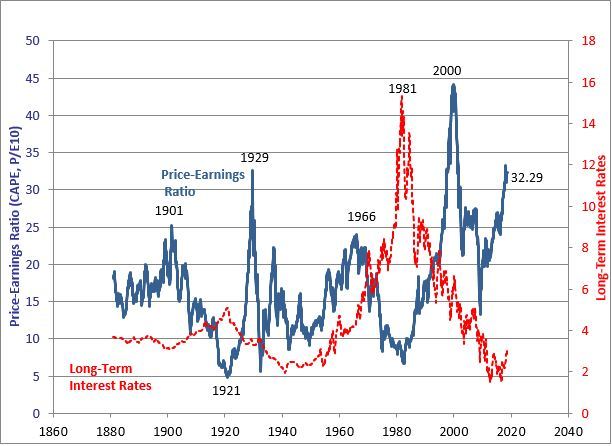

Mark Twain is often associated with the quote, “History doesn’t repeat itself, but it often rhymes.” I think the same could be said for the stock market.

From 1986 into 1987 Paul Tudor Jones and his research director Peter Borish were following an analog model of the late 1920’s. When it came to the fall of 1987, it made them a lot of money. One could say it was a stock market rhyme with 1929.

After the 1987 crash, did we go into a 2nd Great Depression? No. In mid-1988 the stock market starting diverging from the path taken in 1930 and things changed.

Right now the S&P 500 Index (SPX) is looking very much like a stock market rhyme to the way it acted at the top in 2000. In the first chart below you see how it looked starting from the peak on March 24, 2000, followed by a swift violent selloff over the next 15 trading days. Trading over the next 5+ months created an upward trending wedge type pattern that peaked on September 1, 2000.

The SPX retraced 89.2% of the March – April sell-off, when considering the intra-day highs. On September 1, I’m sure many investors believed that new highs were on the way. But the SPX sold off, breaking down out of that pattern and eventually hitting bottom in October 2002.

The SPX lost 51% of its value from the high on March 24, 2000 to the low on October 10, 2002. The March 2000 peak in the market was a Primary Wave 3 high of Cycle Wave V.

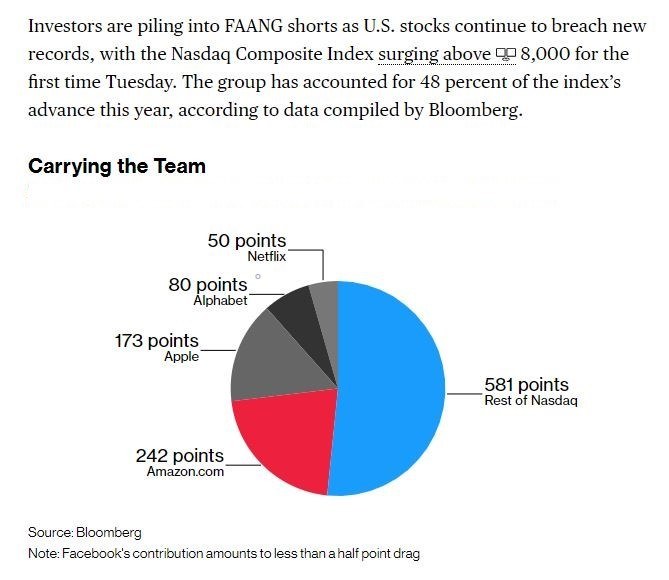

In the 2nd chart below we look at the SPX for 2018. It peaked on January 26th and then sold off violently over 10 trading days. It then oscillated up and down over the next 6 months with a counter-trend Intermediate Wave (2) high of 2863.43 on August 7.

We will now see if this high will hold. Either the market starts down in Intermediate Wave (3) or it pushes above the January all-time high.