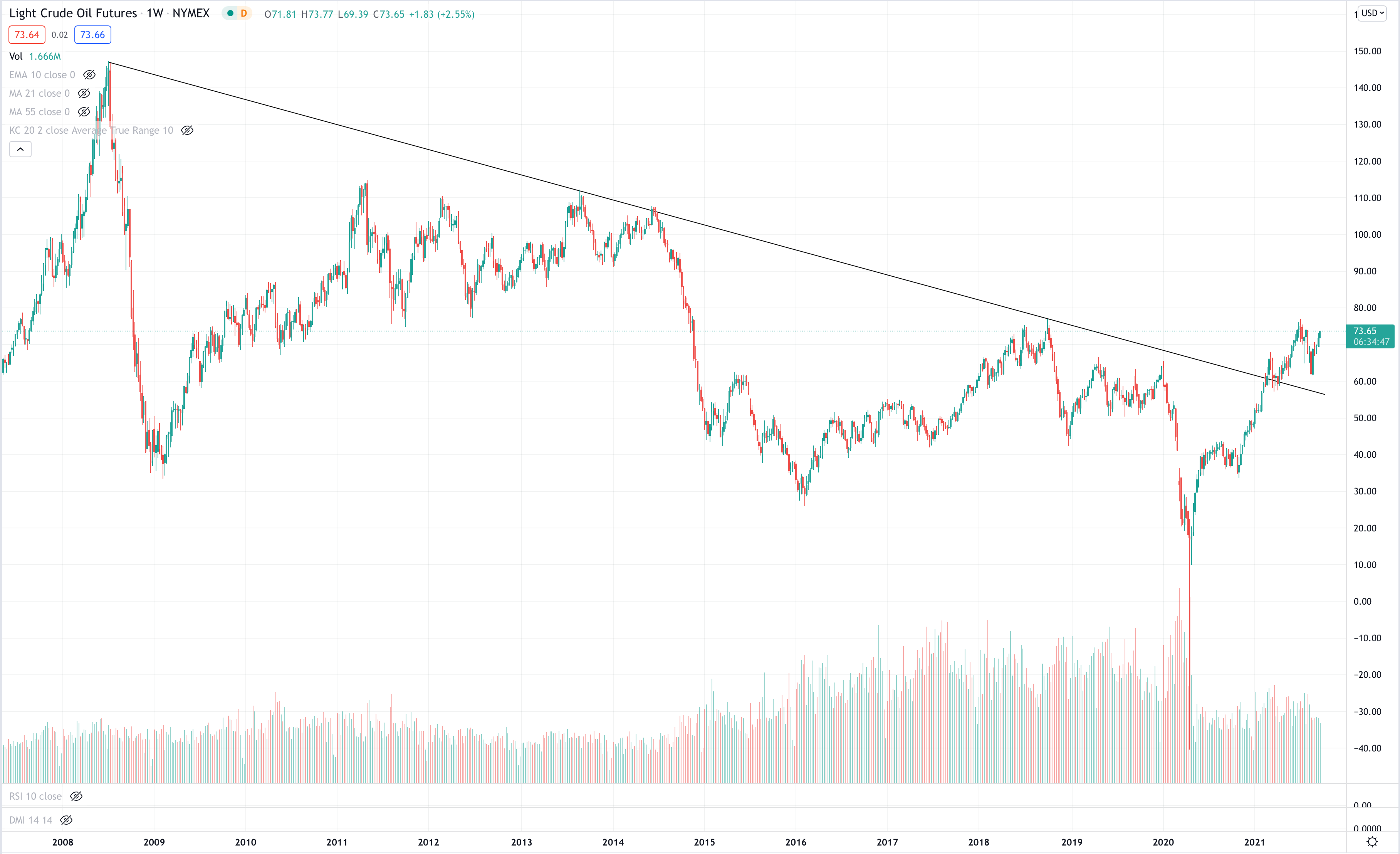

It’s no secret that commodities have been in one heck of a rally over the last year or so. And that includes crude oil. Light Crude Oil futures fell to a never seen before -$40.32 in April 2020. They have since rallied to a high of $76.98 in July of this year. In the process, Light Crude Oil futures broke a 13 year downtrend from the peak in July 2008.

There appears to be overhead resistance at $77 which when broken would enable Light Crude Oil futures to surge possibly into the 90’s. What could possibly cause a crude oil squeeze and drive the price significantly higher? Any number of things but I don’t think it matters. What matters is the price action.

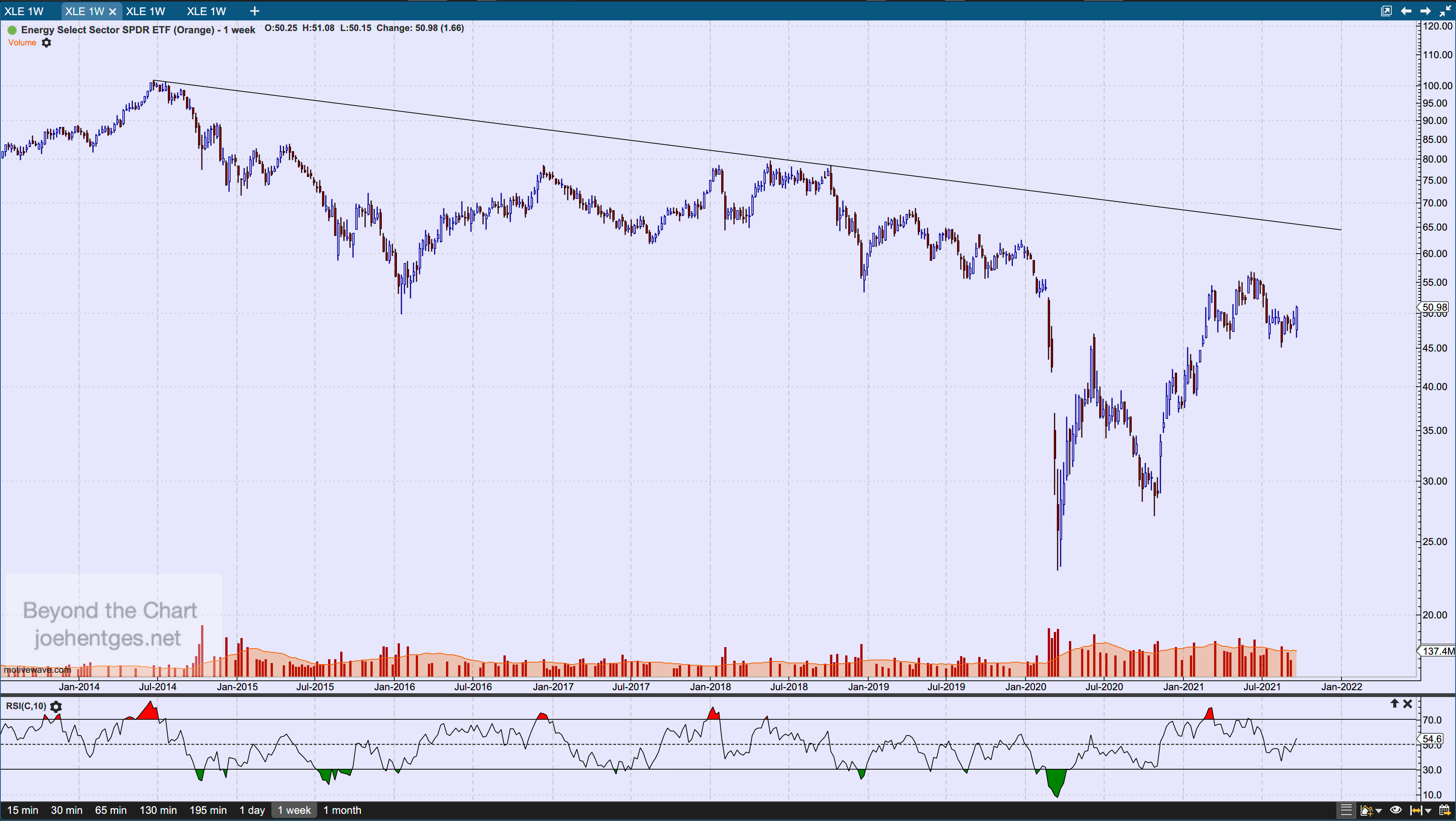

So what about energy stocks? Let’s take a look at the Energy Select Sector SPDR ETF (XLE). From a high of $101.52 in June 2014 they dropped to an intra-week low of $22.88 in March 2020. XLE rallied back to an intra-week high of $56.65 in early June of this year. They have since pulled back some but appear primed to challenge that 2021 high.

In the daily chart below, XLE appears to be breaking out of a small Head & Shoulders Bottom pattern. This projects to the $56 area. Beyond that, there appears to be plenty of overhead challenges. We’ll see how strong this decides to get. And how much of a move occurs in Light Crude Oil futures.