or so the stock market might have you believe. All we heard ahead of the election was how a Trump victory would create nothing but uncertainty for the market.

As results poured in Tuesday night and it became more and more clear that Trump was going to win, the markets went into a tailspin. Eventually the futures went limit down and could not trade lower for the rest of the overnight session.

That caused selling to abate and buying to come in and the market began to bounce. And then Trump claimed victory. He gave a very nice acceptance speech. He talked about all the rebuilding that’s going to get done…pulling the country together…and the buying continued.

By the time the market opened at 9:30am ET, the market was back to about even and then rallied all day, with the DJIA up about 257 points. So it took just a few hours and all that uncertainty went out the window. Really?

Infrastructure

Well the market was now certain that infrastructure was going to be a big deal. So stocks like Caterpillar (CAT) went boom! CAT went up as much as $10.27 before closing up $8.33 (9.8%) since Tuesday’s close. It ended up 13% for the week. Never mind that the global economy is still struggling and CAT’s sales figures have been dismal…there’s Trump magic at work here.

Inflation

And of course that Trump magic is going to take a little cash to make it work, so pile on that debt! Mr. Trump did say he liked debt right? So more debt, more spending, more deficits and maybe inflation comes back. So if inflation comes back, then interest rates need to go higher.

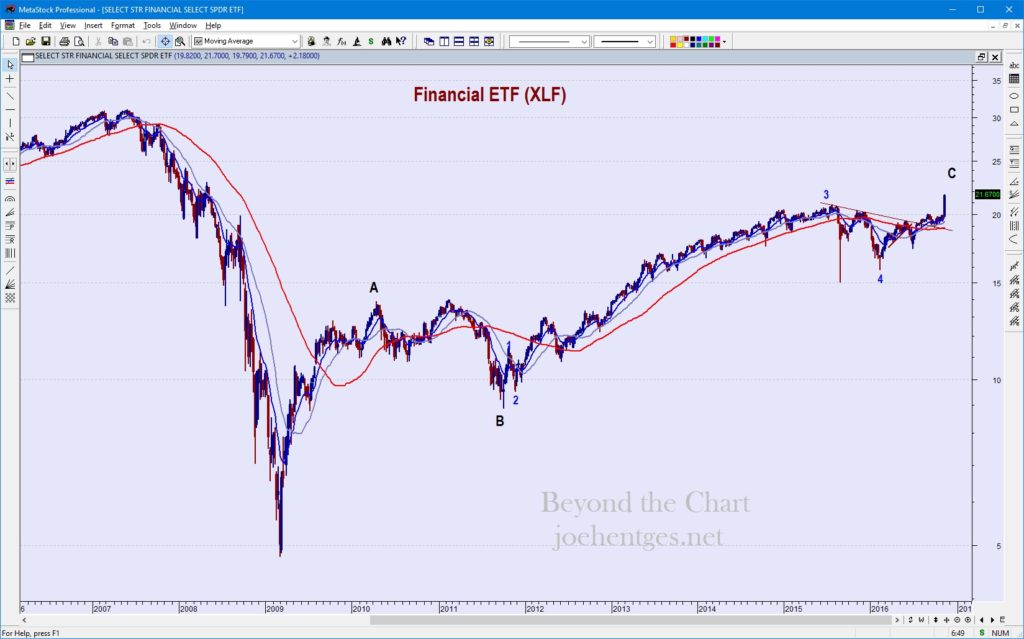

And if interest rates go higher, then the banks and insurance comes start making a lot more money. So boom! Up went the financial stocks. The Financial Select Sector SPDR Fund (XLF) surged to a post-crisis high +11.2% for the week.

And Goldman Sachs (GS) exploded $22 in 3 days (12.1%). It closed up $28.02 (15.9%) for the week!

Clinton Exits Stage Right

And a Trump victory meant that Hillary Clinton would not be in control of the anti-drug company movement and that Obamacare was going to get repealed. So boom, there went the health care and biotech stocks.

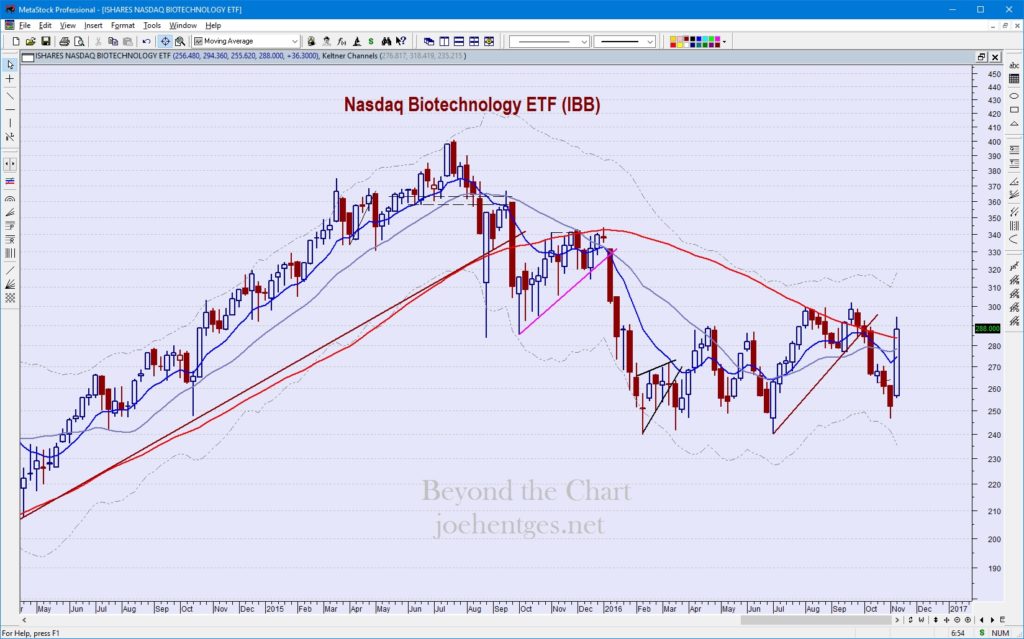

Nasdaq Biotech ETF (IBB) exploded 26.38 points (+10%) in 3 days and was up 36.30 points (14.4%) for the week. I still believe that IBB is in a downtrend. Bear rallies can be swift and powerful as short sellers rush to cover.

Gilead Sciences (GILD) and Celgene are holdings of both IBB and the Health Care ETF (XLV). GILD did nicely last week with all of its move occurring on Wednesday. I did have a very nice trade for my Insider Members, getting in some options on Monday and exiting on Wednesday for a gain of 128% in 2 days.

Unfortunately we were not in Celgene (CELG) which also exploded. It had a 3 day move of $11 (+10.1%) and $16.01 (+15.4%) for the week. It was a buying frenzy on Wednesday that seemed a little out of control.

Uncertainty

So where do we go from here? Is the market really that sure about Trump? Stay tuned. I talk about the DJIA in this week’s video, but a lot more detailed analysis, insight and indicators I share with my Insider Members. Not a member? Click Membership on the menu above.