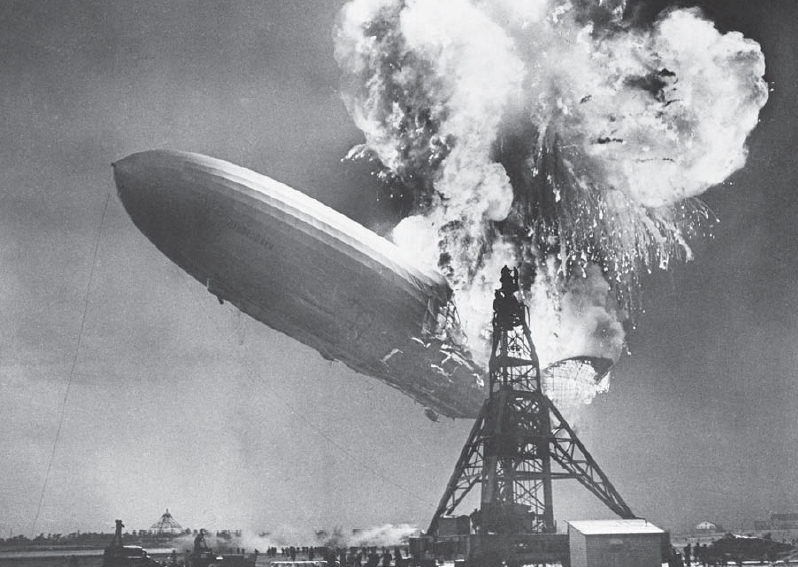

Hindenburg Omen…What is it and what could it mean?

Over the last year or so I’ve come across articles about the Hindenburg Omen. I thought about writing a post about it but it seems that some others have done a pretty good job of that already.

Within the last year this came on my radar from a post that Jesse Felder did in November 2017 called “The Flames Went Higher“. He recently followed that up with two posts. One in August called “The Nasdaq Triggers Another Breadth Warning“. And then one on September 18 called “A Historic Divergence in Stock Market Breadth“. These last two are updates on the 2017 article. All of these talk abut the clusters of Hindenburg Omens and his charts show when they occurred.

Now just yesterday Tom McClellan of the McClellan Financial Publications created a post called “Ten Hindenburgs So Far“. This is a very good article because it gives you the backstory on the Hindenburg Omen and talks about what is happening now.

As Tom points out, we had ten Hindenburg Omen signals appearing in the month of September. Now he also points out: “Not every signal leads to huge calamity of stock prices. But these signals tend to show up before big bear markets. So a Hindenburg Omen is a warning of trouble, but not a guarantee of it.”

And clusters of signals appearing in a short time span seem to be more important than individual signals, as if the market is pounding the table and saying “Listen to me!! – Tom McClellan

So I feel this is rather timely given my view of where we are in Elliott Wave cycles. Check out these posts…the clock is ticking.