- Home

- Blog

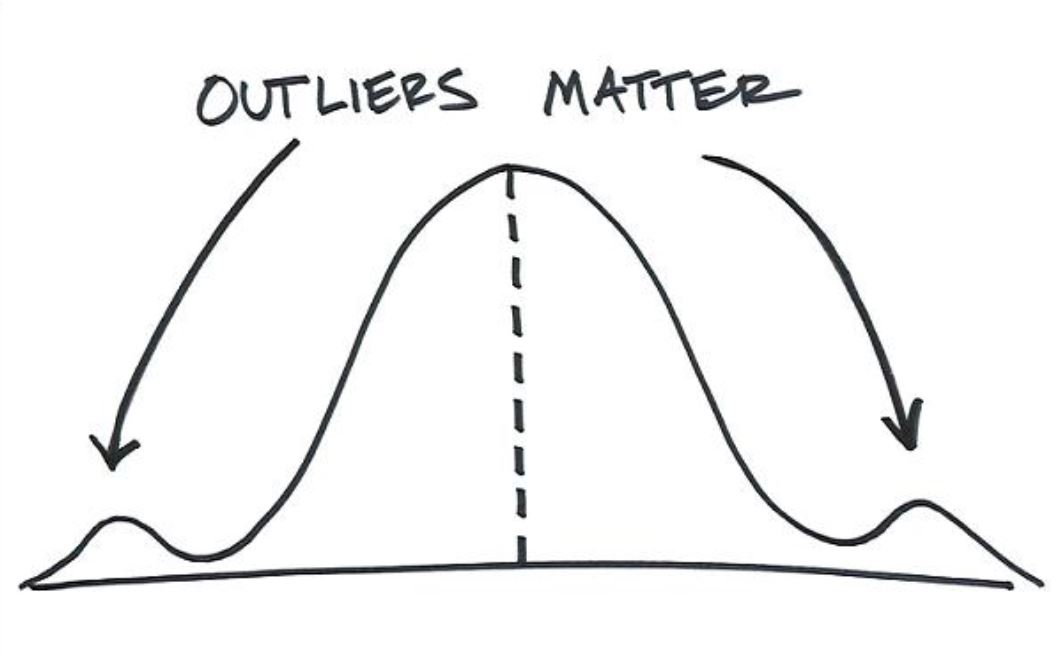

Outliers Make all the Difference

Outliers and Losses

“For two hundred days a year, I’d end up with reasonably small losses netted out with similar-size gains. Lose $5,000 here, make $6,000 there, round after round, twenty, thirty, forty times a day.But I’d win the other fifty trading days by clear unanimous decisions. Smack the bonds for $75,000, hit a stock for $100,000, nail a couple of options for $125,000, pound the S&P s for $150,000.Over time it made me a big winner, to the tune of $5 million a year.”– Marty Schwartz from “Pit Bull”

Fifty Days

What I want you to focus on is not the 20-40 times a day he traded or that he could make $5 million a year. Focus on the 200 days out of 250 he would basically break even.

That left 50 days that would be his outlier days. The days that made his month and year. So what do outliers have to do with trading? Everything.

Memorial Day | Remember Them

This following is a post I wrote last year on Memorial Day weekend. I see no reason to change it as I am proud to remember and honor those who have gone before us. I am living free in this beautiful country because of their sacrifice.

Here in the United States it is officially Memorial Day on Monday. Cookouts, camping, boating, the Indianapolis 500 all part of the official start of the summer season. But on this Memorial Day weekend my thoughts turn to remembering my Uncle Bob.

World War II

Uncle Bob served in the Army in World War II and the Korean War and then at the Pentagon for many years. He was a great guy and my favorite uncle. I was fortunate to have been able to spend some time with him in the late ’80s when we lived in Northern Virginia. Continue reading

Polar Opposites…it’s Sure Not 1982

In August 1982 the stock market exploded higher as the Federal Reserve cut interest rates during the Mexico debt crisis. It was a financial explosion that reminded one of a real life volcanic explosion like Mt. St. Helen’s in 1980.

The week of August 15, 1982 kicked off the 5th cycle wave of a 5 wave Super Cycle move from 1932. The DJIA rose 10.3% that week, closing at 869.30. The CAPE ratio in July and August 1982 was just 6.64.

That was the lowest CAPE reading since 5.57 in June 1932. The all-time low reading since 1881, came in at 4.78 in December 1920. That 1920 reading was during the depression that no one talks about.

Long-term interest rates were 13.06% in August 1982, down from 15.32% in September 1981. Today long-term interest rates are 2.50% up from 1.5% in July 2016. And of course we have several countries with long-term rates less than zero today.

So here we are in April 2019 with the DJIA at 26,477. It has been an amazing bull run. There have been some amazing companies created in this last leg of the Super Cycle.

Apple (AAPL) went public December 12, 1980 ( 1 1/2 years before Wave V kicked off). Microsoft went public on March 13, 1986 and Amazon went public May 15, 1997. All of these companies we talk about now as trillion dollar market cap companies. What will we be saying in 2030? Who knows?

What I do know is that everything runs in cycles. And when it comes to human nature, there is nothing new under the sun. This current extreme valuation environment will not last.

We are near the tail end of this bull run. We may indeed have several more months before the final top is in. But when you step back and look at the forest instead of just the trees, you get a little better picture of where we are in time.

I feel like we are playing one big game of musical chairs. Who will have a seat when the music stops playing? And when the music stops on this bullish extreme…watch out.

MMM just had its worst day since the 1987 crash…yesterday.

Oh, but wait, I forgot, the Federal Reserve will save us. I hear that a lot lately. But the Federal Reserve has been around since December 23, 1913.