The latest economic news out of China is about imports and exports. The February merchandise trade surplus was $32.6 billion versus an estimate of $48.7 billion.

Lots of Red

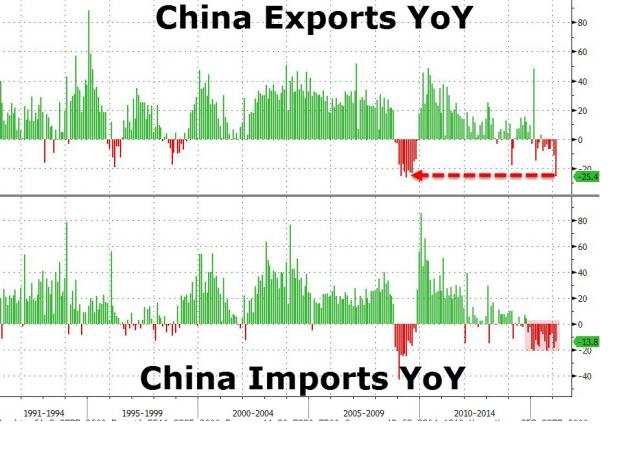

Exports tumbled 25.4% from a year ago while imports shrank 13.8%. On a seasonally adjusted basis, exports shrank 19.9% in February after falling 15.9% in January. The following image comes from an article that further discusses the numbers.

So China anxiety continues as the world continues to try to get a read on what’s really happening in the world’s 2nd largest economy. One of the biggest concerns is the rippling effect it is having with other emerging market countries and China trading partners everywhere.

IMF Warns

The latest warning came from the IMF on Tuesday. IMF First Deputy managing Director David Lipsky said that the “global economy is at serious risk of derailment”.

And as the Wall Street Journal said, “The International Monetary Fund is sounding louder and louder alarms about the state of the global economy. The problem is, few major economies seem to be hearing them.”

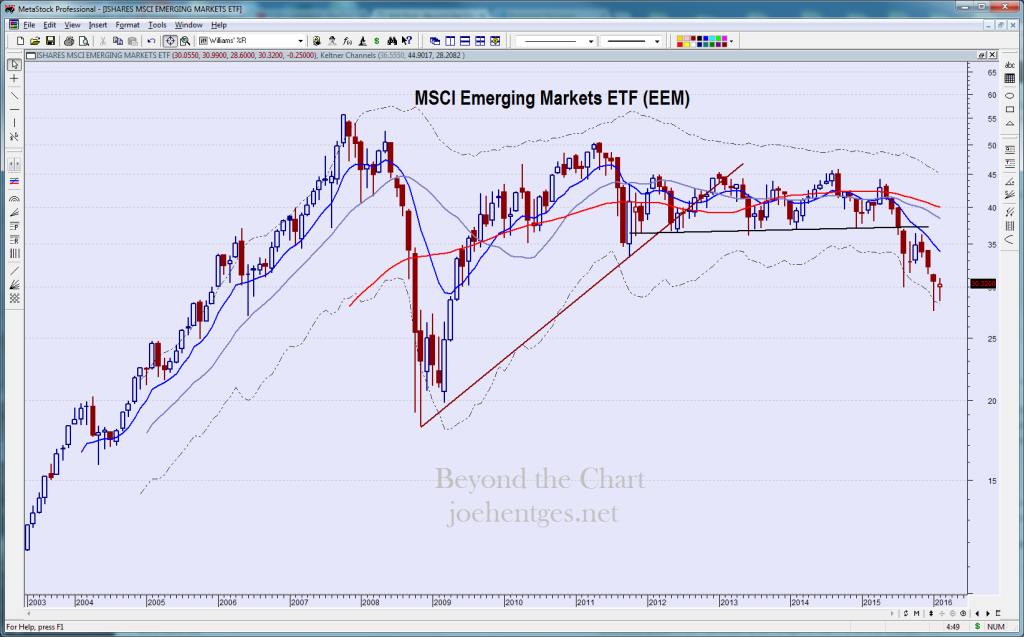

So there is plenty of China anxiety but it seems to come and go in the markets depending on whether a market is collapsing or not. Look how 2016 started out with China collapsing again and taking all other markets with it. Now things have subsided some.

Our market has become very extended. Both short-term and in the bull run that occurred since 2009. The markets are a confidence game. It can unravel very quickly. As we all know, stocks go down much faster than they go up. Just look at 2008. Or August 2015.