0

Goldilocks Market Forgot About the Bears

Over the last week or so I started to hear the word “goldilocks” again as people were talking about the economy. I think it started with the low unemployment rate of 3.9% that was announced on May 4th.

And with inflation at or near the Fed’s target rate combined with surging earnings from the corporate world has many folks talking about a goldilocks market.

But let’s not forget about the three bears.

Papa Bear

Papa Bear points to the earning season and that most companies beat expectations but in many cases the stock prices still got hammered or the response was weak. Spectacular earnings were already priced in.

And who can forget the reverberations that came out of the Caterpillar conference call when their CFO said the first quarter was going to be the high water mark for the year. Basically ‘this is as good as it gets’.

And of course companies are still up to their old marketing tricks as there have been several announcements of huge stock buyback programs. But in many cases that has not boosted the stock much. Why? Investors understand that just because it’s announced… doesn’t mean it will truly be implemented.

Mama Bear

Mama Bear worries about security and the geopolitical scene. Yes there’s talks scheduled between the United States and North Korea, but skepticism still reigns. Hasn’t North Korea had peace discussions several times before?

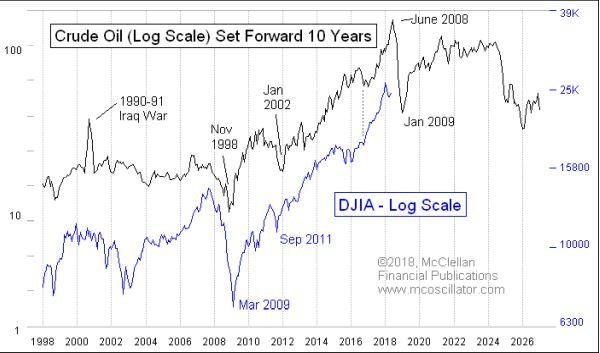

Turmoil is still raging in the Middle East and Trade Wars with China and possibly the European Union, are threatened. Relations with Russia are at multi-decade lows. The United States Navy just announced it is resurrecting the 2nd Fleet to protect the East Coast and North Atlantic due to increased activity by Russia.

Baby Bear

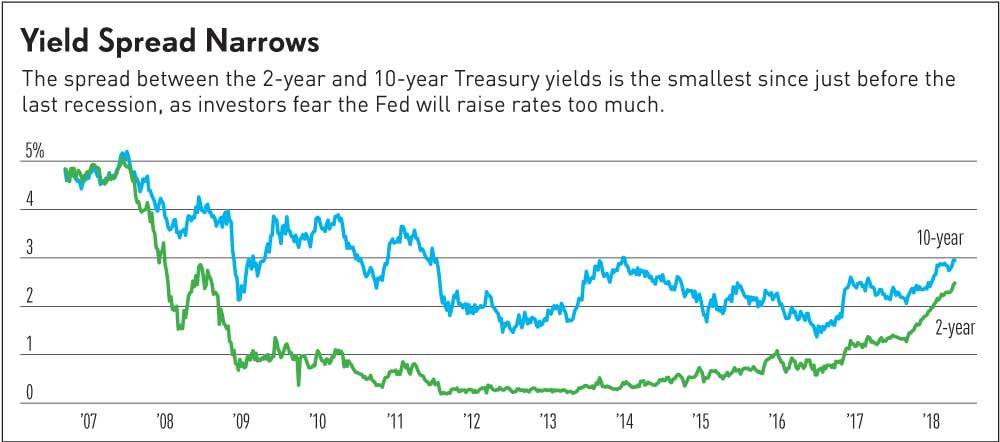

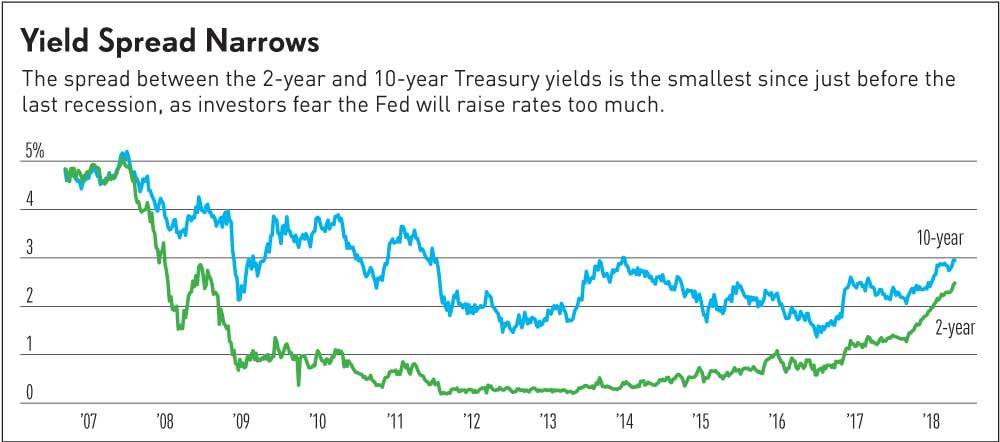

Baby Bear says let’s not forget that interest rates are rising. The 10 year yield minus 2 year yield is back to levels last seen in 2007, just prior to the Great Recession.

But all that is just noise as far as I’m concerned. The real facts are what the stock market is doing on a daily and weekly basis.

The Dow Jones Industrial Average, S&P 500, NYSE Composite Index all peaked on January 26, 2018 with a huge volatility explosion. The Nasdaq Composite and Nasdaq 100 peaked five weeks later on March 13.

The bears are back, out of hibernation…and they’re hungry.