Collateral Damage in the China Trade War

The trade war with China is on. It started with aluminum and steel. Now it seems to be escalating back and forth. The stock market is concerned because of course everyone knows…or they should, that this is how the Great Depression got fueled. So what starts out as very targeted and seemingly under control, can rapidly spin out of control. And this is where collateral damage occurs.

Bite Out of Apple

The concern with Apple is that it could get caught up in a trade war with China. If China decided to impose tariffs of some kind on iPhones or various components, it would significantly hurt Apple. Or China might organize a boycott of U.S. related products. China is just one concern related to Apple stock. There are other rumors floating about iPhone production and demand.

This week Apple (AAPL) stock got hit hard on Thursday – Friday dropping 6.8% and ended down $9 for the week. Apple’s chart below shows the key support at $165 that the bulls need to hold. If that breaks I believe it will rapidly test the February low.

Collateral Damage

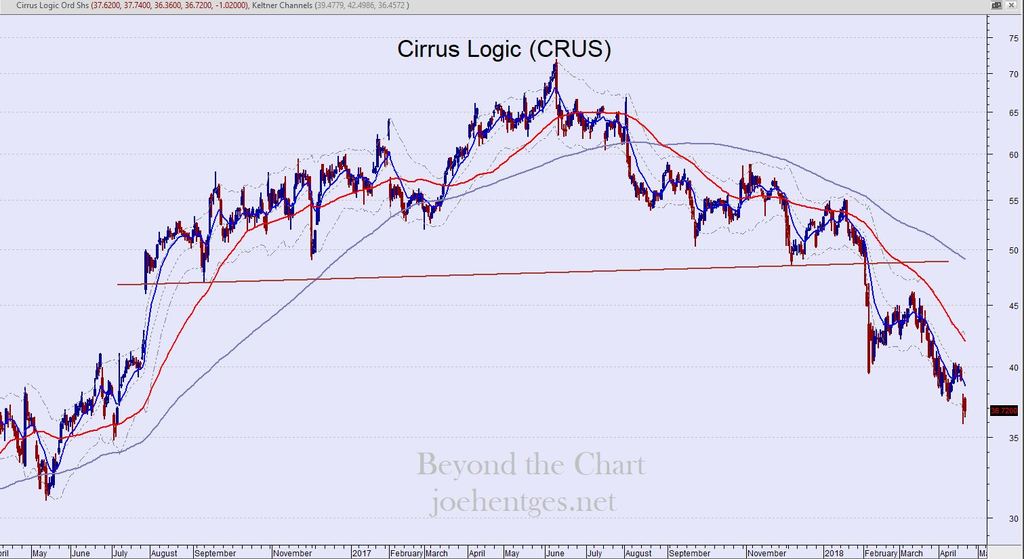

If Apple gets hurt in this trade war with China then it has a rippling effect on several other stocks that supply Apple. Below are 4 stocks that are already showing signs of damage.

The first three stocks are showing signs of a major top. Quorvo is less clear but still at critical short term support.