In 2014 Freeport-McMoran Copper & Gold Inc. changed its name to Freeport-McMoran Inc. (FCX). FCX is into copper, gold, molybdenum, cobalt hydroxide, silver as well as and oil and natural gas.

In 2014 Freeport-McMoran Copper & Gold Inc. changed its name to Freeport-McMoran Inc. (FCX). FCX is into copper, gold, molybdenum, cobalt hydroxide, silver as well as and oil and natural gas.

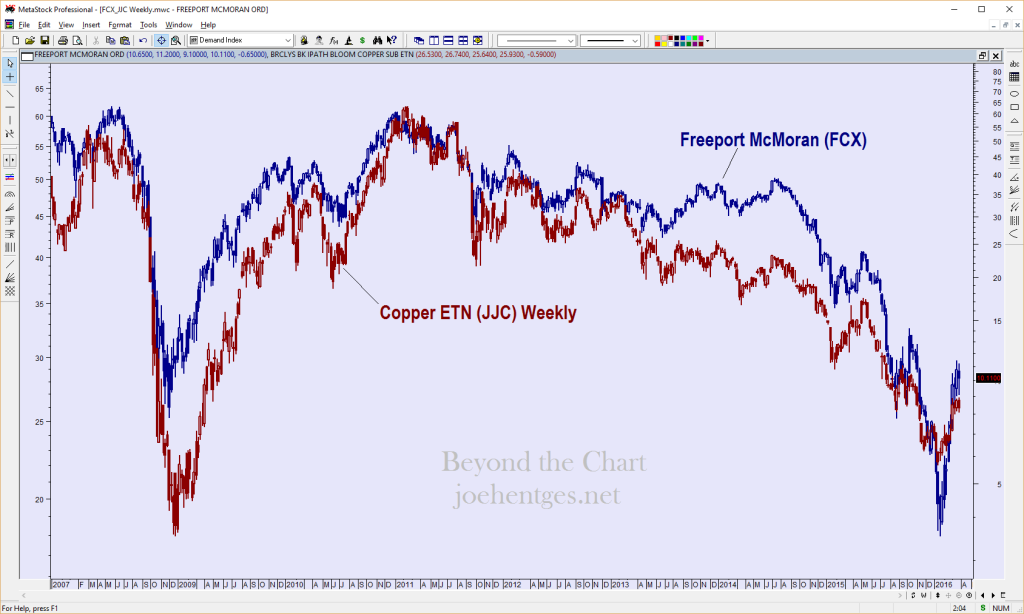

I have seen several articles talking about how FCX has been in sync with oil, but when I look at copper it seems that it is still the best link. The Copper ETN (JJC) started trading in November 2007. Below is a chart showing the weekly data of JJC overlayed with the weekly data of FCX.

The two seem pretty well in sync. Starting in February 2014 JJC led FCX down but did not drop below the 2008 low. FCX then accelerated down and fell well below its 2008 low.

Big Top in Copper

JJC made a huge top from 2010 into 2013 and I first talked about this in a post “What’s Up with Mr. Copper?” on July 25, 2013. (click on the title to view the post). In that post I projected a minimum move to 26 on JJC.

I followed that up with another post on August 27, 2014 “What Story is Copper Telling?”. In that post I showed an updated view of what copper was doing and what the implications might be.

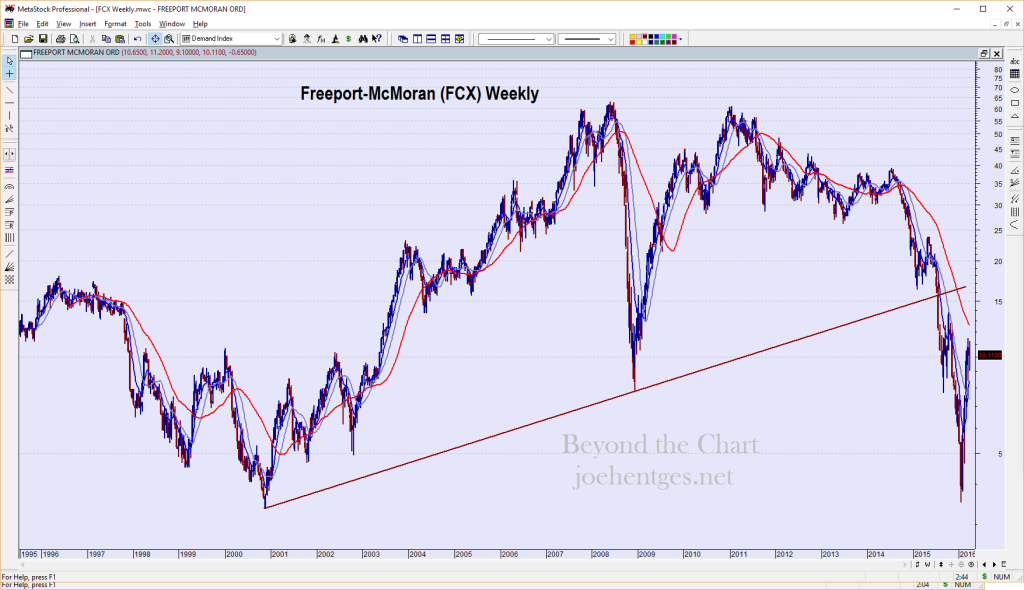

The chart below is another longer term weekly view of FCX. You can see that FCX dropped in January to within a whisker of its 20 year low made in November 2000 of $3.35. Since then it has had a strong bounce in the last two months.

In today’s free video I take a brief look at the market and then look more closely at copper (JJC) and Freeport-McMoran (FCX).

How well do you understand the trading business?