Boeing is one of the Dow Jones Industrial Average’s 30 stocks. It has had explosive growth in 2017 and the price appreciation continued into 2018. In 2017 it was up 89% and at one point, on February 27 it was up an additional 23.6% from its 2017 close. Truly amazing growth.

This is not some social media stock. It is not a leading edge semiconductor stock. This company designs and assembles passenger airplanes, a variety of military jets, rockets, satellites and other space related craft and devices. So it was a little surprising to see the stock basically go vertical in price action.

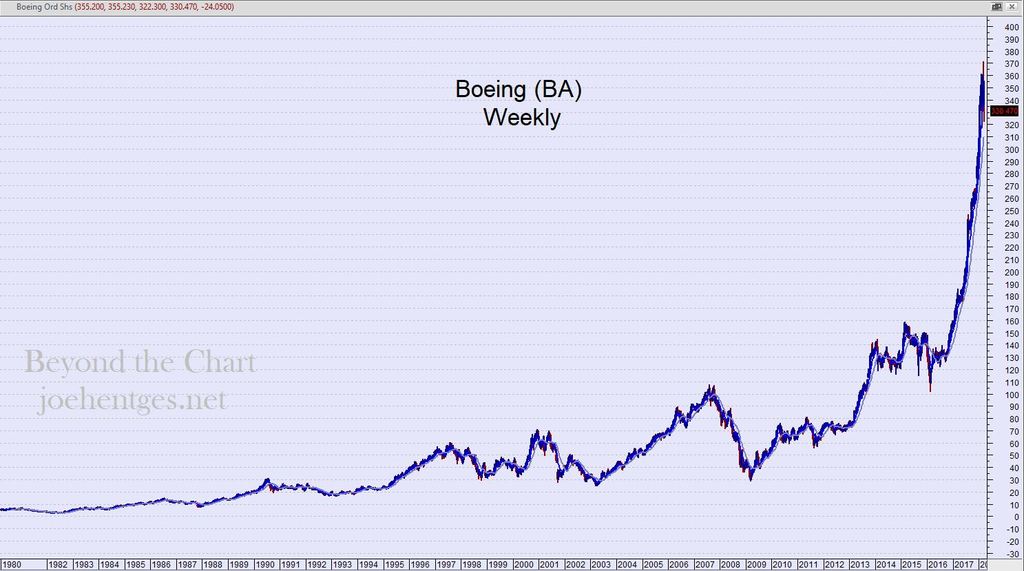

The first chart below shows the weekly view in semi-log scale from 1980 to present. You can see Boeing has traded in a nice upward sloping channel but has overshot the top of the channel during the last 2 years.

The next chart shows the same price data but on an arithmetic scale that dramatizes the type of vertical move the stock has made.

Now in this third chart I show the daily chart for Boeing. On this chart I note the timing of the Bloomberg Businessweek cover story on Boeing that came out in the February 19 issue. Cover story said, “Up. Way Up.” A few days later, on February 27, Boeing posted it’s all-time high closing price of $364.64.

Now not every cover story on a stock spells a turning point, but it is rather interesting to see when some of these stories come out. The classic story that many folks have talked about is the Death of Equities cover story in Businessweek Magazine back in August 1979. It will be very interesting indeed to see how the timing of this cover story works out for Boeing.

Chart

Tweet

The bull market is in volatility. So far this year, the VIX has averaged out to be more than 50% higher than it was for all of 2017. The last and only time this has happened in the past? Try … 2008.

— David Rosenberg (@EconguyRosie) March 15, 2018