The Federal Reserve (Fed) cut the Federal Funds rate by 50 basis points or 0.50% on September 18. So does this mean that the economy is so weak that the stock market will sell off or is something else going on? Let's review what's happened in the last 30 years, 1994 to 2024.

Mid-90's

The first chart below shows the S&P 500 Index (SPX) from 1993 thru 1996. The Fed raised interest rates 7 times, starting with +.25% in February 1994 and ending with +0.50% February 1995. The SPX chopped sideways during this time and then began a steady rise in 1995.

The Fed then cut interest rates in July 1995 by 0.25% followed by two more cuts in Deember 1995 and in January 1996. The SPX kept rising into May 1996, had a small pullback in July then took off again steadily rising.

2000 to 2003

The next rate cut cycle began in December 2000 with a -0.50% cut. This occurred nine months after the SPX peaked in March 2000. The Fed then cut rates 12 more times, with the last cut occurring in June 2003. At that point they had cut interest rates by -5.50%. Notice that the SPX hit bottom in October 2002, about 9 months before the last rate cut.

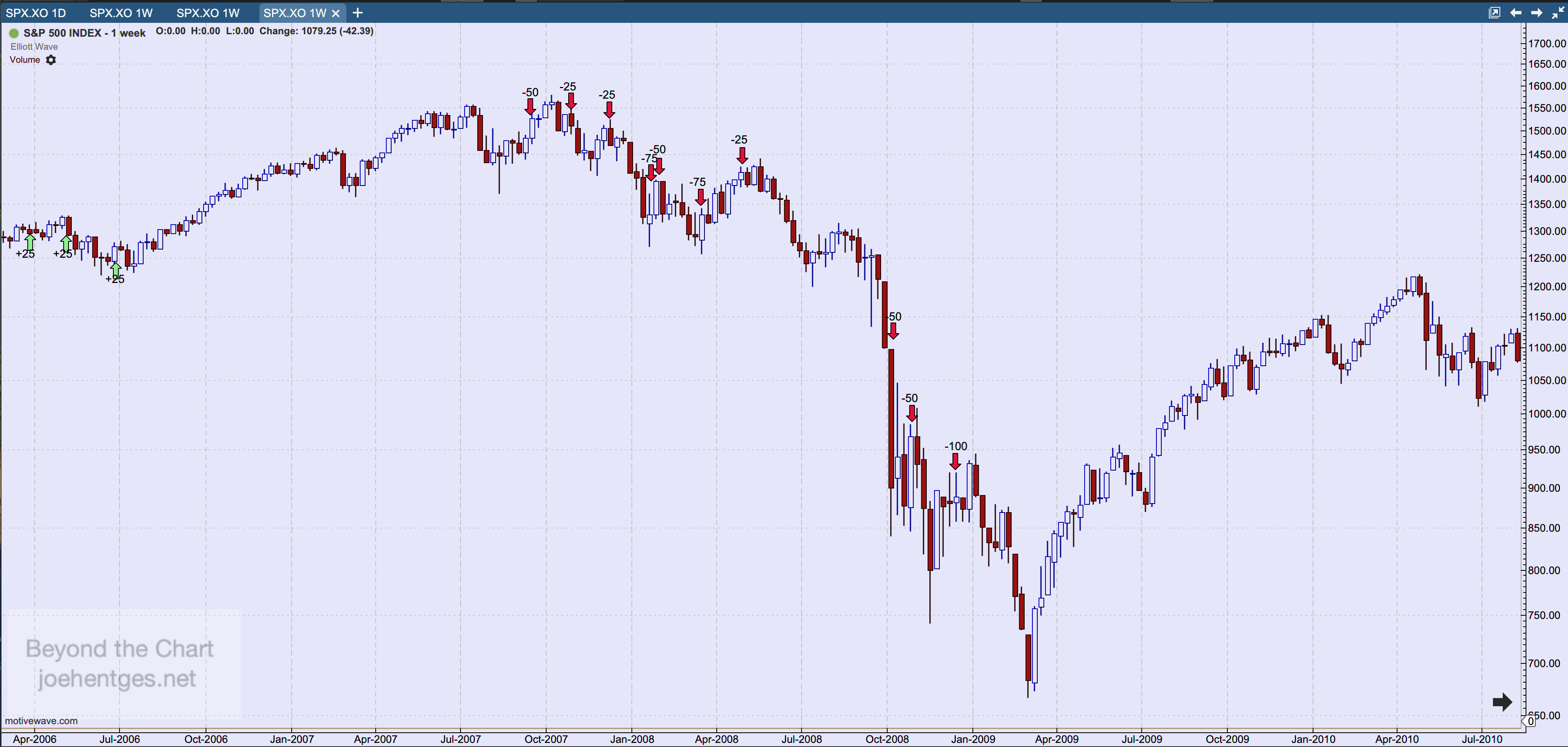

2007 to 2008

The next rate cut cycle began in September 2007 when the Fed cut rates -0.50%. The SPX peaked 3 weeks later. The Fed then cut rates 9 more times for a total of -5.50%. The last cut occurred in December 2008 and the SPX bottomed 3 months later in March 2009.

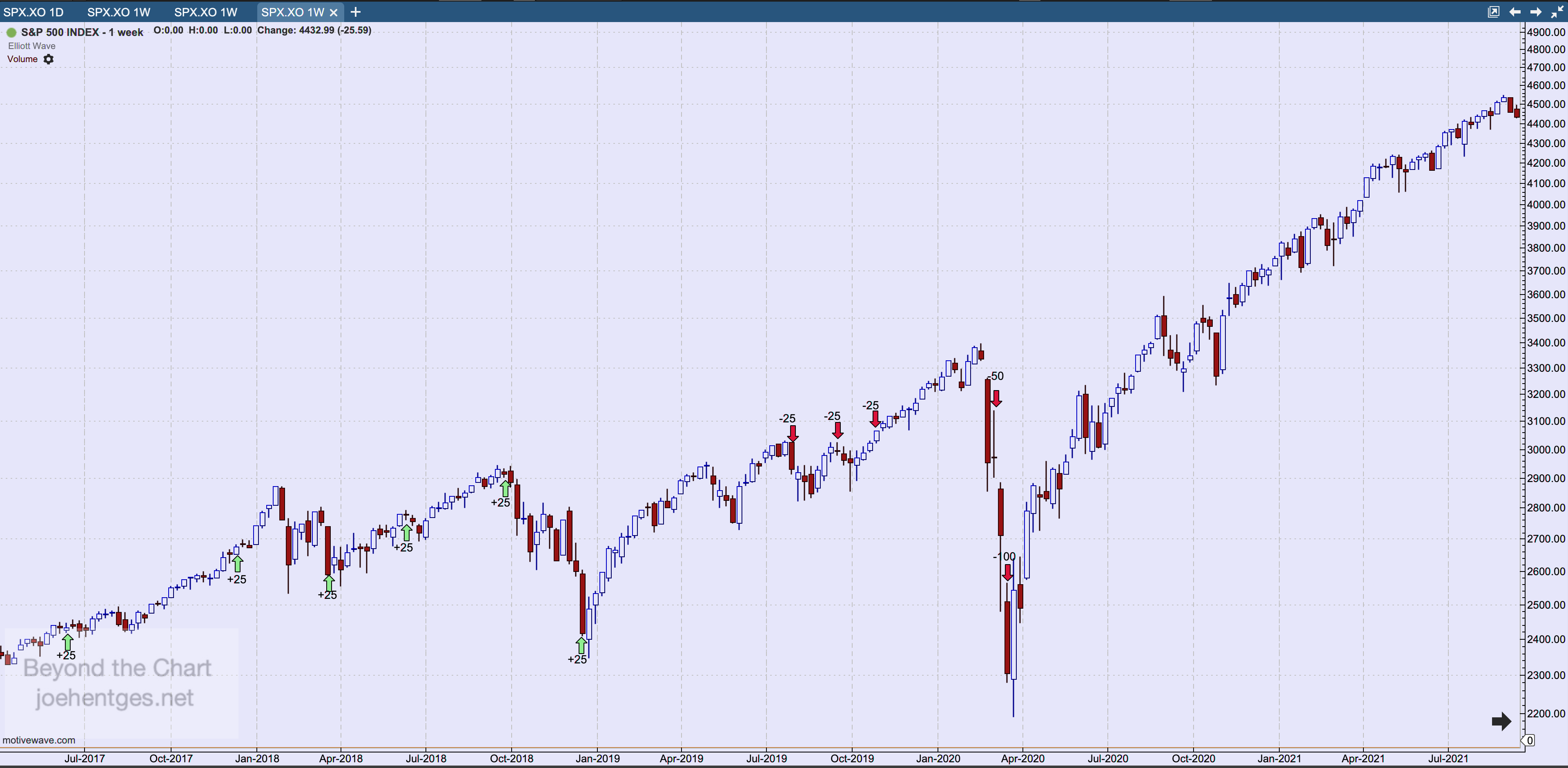

2019 to 2020

The next rate cut cycle began in July 2019 when the Fed cut rates -0.25%. They then cut rates 2 more times before the Covid panic in March 2000. In March 2020 the Fed cut rates -1.50% in a 3 week period. The SPX bottomed during the very next week. This set off a rapid rise in the stock market because not only did the Fed cut rates but they dramatically increased their balance sheet by buying everything in sight and thereby injecting a huge supply of money into the system.

2024 to ......

And now the Fed began another rate cut cycle with the -0.50% cut on September 18, 2024. So is the market about to peak like 2007 or is this more like the mid-90's. Over at Charles Schwab, Liz Ann Sanders and Kevin Gordon published an article back in August that looks back at the 14 Fed rate cycles since 1929. Interesting article that provides additional insight. You can read it here.