Here are 5 takeaways from the market last week:

Here are 5 takeaways from the market last week:

- Earnings from marque tech players did well overall

- Oil continues slide

- No interest rate hike in sight as Fed sits on its hands

- Consolidation continues as market slides sideways

- Effect on the Election

Earnings

Apple (AAPL), Facebook(FB), Alphabet (GOOGL) and Amazon (AMZN) all did well and all of them had their stocks up for the week. The winner of the four was Apple.

Apple was up 5.6% for the week followed by Alphabet +4.4%, Facebook +2.4% and Amazon +1.9%.

Apple beat expectations and CEO Tim Cook says their services sector “will be the size of a Fortune 100 company next year”.

Oil

West Texas Intermediate (WTI) for September delivery closed at $41.38 on Friday up $0.24. This helped it bounce up from what many folks were calling bear market territory as if it really wasn’t in a big bear market to begin with.

Since June 8 USO the oil ETF is down 21.5% thru its close on Friday. WTI closed June 8 at $52.81, so Friday’s close is down 20.9% from that 2016 closing high.

Is it still the glut because of drilling or is it the global economy? And speaking of the economy…

No interest rate hike

Even with strengthening employment numbers the Federal Reserve refuses to raise interest rates. The uncertainty around Brexit and the overall global economic conditions still have them spooked.

Of course a 1.2% increase in GDP on Friday, less than half of what was expected, didn’t help. Q1 GDP was also decreased.

Now this report came out after the Fed made their announcement on Wednesday, but I have no doubt that they knew what the GDP report was going to be.

It does make me wonder what else they are hearing from around the globe.

Consolidation

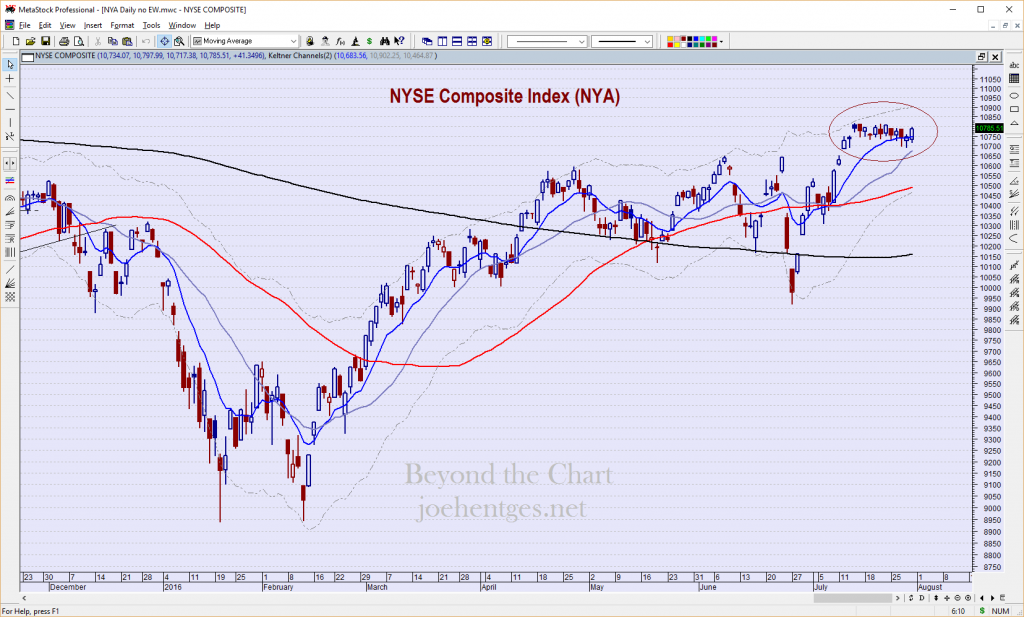

As you can see in the chart below the New York Composite Index has moved sideways since July 14. This consolidation has allowed the market to neutralize a very overbought condition.

Effect on the Election

The Dow Jones Industrial Average, S&P 500 average and the Nasdaq Composite sit at all-time monthly closing highs. The highest in the history of this 240 year old country!

So what does that say about the sentiment and mood of the country?

It seems that when it comes to the election everyone wants to talk about how the outcome of the election might affect stocks or how an election year affects stocks.

What about how the stock market itself affects the election?

I believe that unless we get a very severe market break or crash of some kind before November 8, the current party in the White House will stay in the White House.

Tighten your seatbelt…it will be a very interesting 100 days, starting Monday August 1.

So, these are my 5 takeaways. Did you have any others?

Today’s Video

Today’s video is a very brief version of what I provide my Insider Members. In addition to the market I look at Caterpillar (CAT), US Steel (X) and ExxonMobil (XOM). All had earnings this week.