Does the timing of interest rate hikes and cuts impact the the stock market? Do cuts in interest rates then lead to a stock market peak and subsequent decline? Or are cuts just a confirmation of the direction the stock market is already in? Lets take a look at the last 25 years.

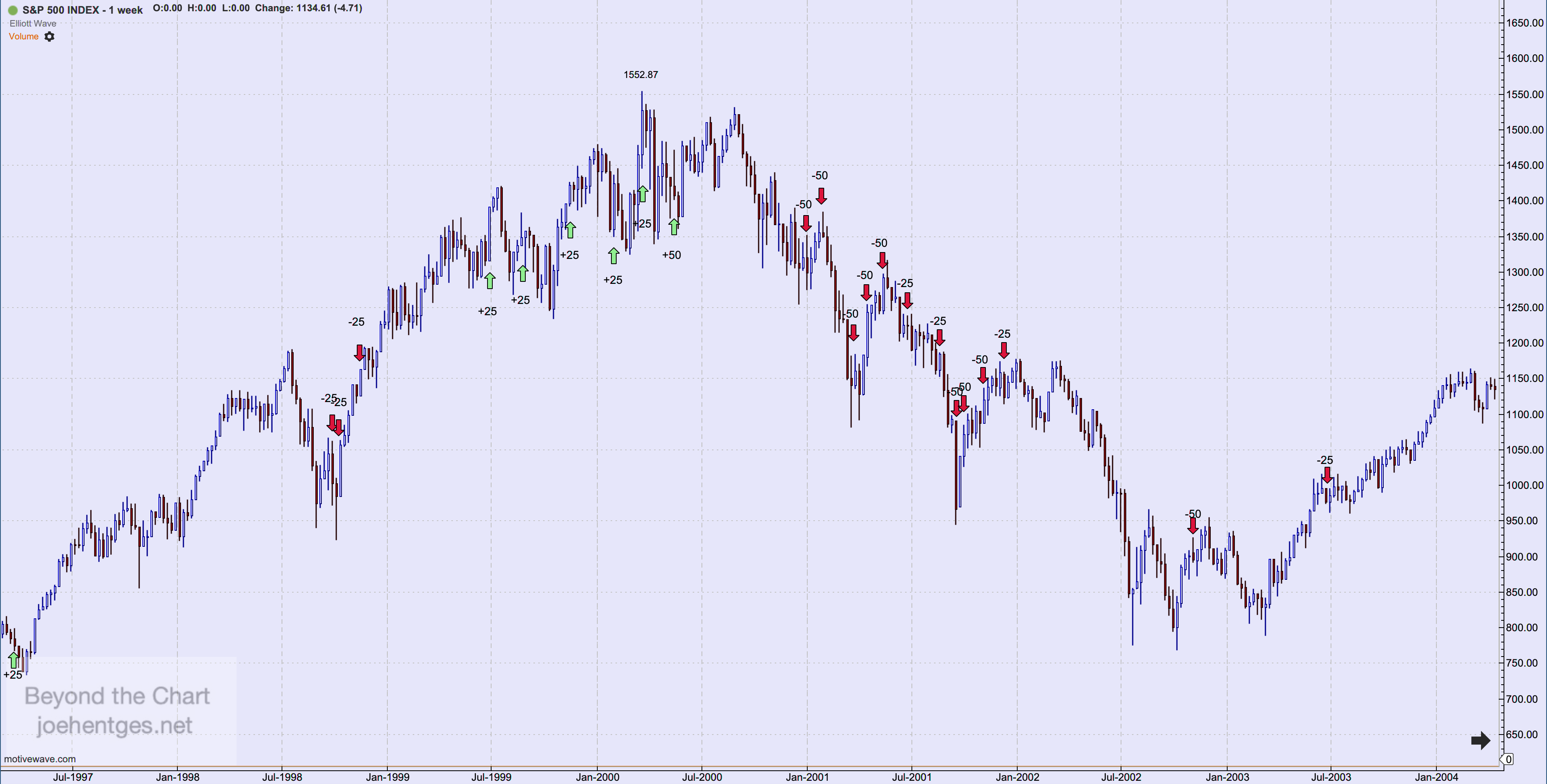

1998 - 2003

In 1998. the Fed cut interest rates in reaction to the Russian currency crisis. They cut three times. The lowest weekly close on the SPX occurred the week of August 30, 1998 before the first cut on September 29, 1998. The third and last cut was on November 17, 1998.

The Fed resumed raising rates in mid-1999 starting with +25 bps on June 30, 1999. The SPX peaked the week of March 19, 2000. The Fed's 5th rate hike of +25 bps occurred on March 21, 2000 to be followed by yet another rate hike on May 16, 2000 of +50 bps.

The Fed did not cut rates until January 3, 2001 where they cut -50 bps. The SPX had been in decline for 9 months. It is also interesting to note that the SPX bottomed the week of October 6, 2002 before the last 2 rates cuts in November 2002 and June 2003 for a total of 13 rate cuts.

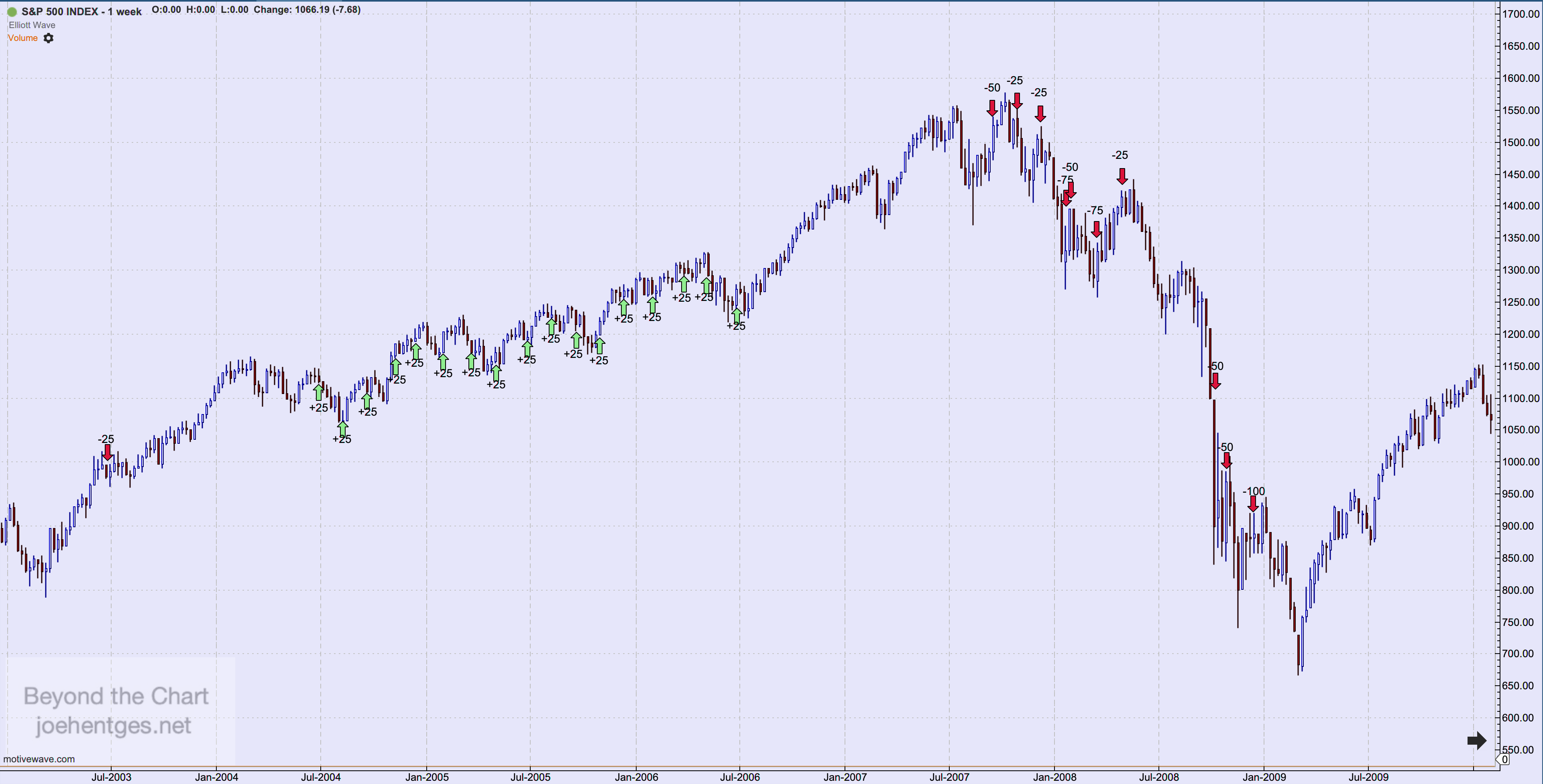

2004 - 2009

The Fed raised interest rates +25 bps 17 times from June 30, 2004 to June 29, 2006. The market kept pusing higher into 2007. The Fed decided to cut rates by -50 bps on September 18, 2007. The SPX peaked the week of October 7, 2007, about 3 weeks later. So as opposed to the peak in 2000, this time the market peaked after the first rate cut.

The intensity of the crisis was evidenced by the 10 rate cuts bringing interest rates to zero with the final cut of one full percentage point occurring on Dec. 16, 2008. The market bottomed the week of March 1, 2009, 11 weeks after the last cut.

2015 - 2020

The Fed kept interest rates at zero for the next 7 years in what became know as the Zero Interest Rate Policy (ZIRP). Beginning on Dec. 17, 2015 they rasied rates by +25bps for the first of 9 straight raises over 3 years.

The first cut of -25bps occurred on Aug. 1, 2019 followed by 2 more cuts of the same size until the COVID panic of 2020 hit. They then cut by -150 bps over a 2 week period in March 2020. Interest rates were now back to zero. 2020 was a minor peak in the SPX, not the end of the primary wave up from March 2009. The peak in the SPX occurred the week of January 2, 2022.

The Fed did not start raising rates until 10 weeks after the peak and have now raised them 11 times. This time does seem to be different though. In prior cycles the Fed was raising while the market was increasing. So will the 2022 peak in the market hold as we expect? When the market turns down it will be because something different is indeed happening and the Fed will follow suit with rate cuts that they justify because the data changed.