Yes I know that I have a technical analysis perspective and focus primarily on Elliott Wave analysis. But that doesn’t mean that I ignore other pieces of financial information. Especially when they sync with my Elliott Wave perspective showing that the stock market is even more overvalued than the Financial Crisis of 2007-2008.

I’ve published several blog posts referencing Yale Professor Robert Shiller’s Cyclically Adjusted Price Earnings Ratio (CAPE). Professor Shiller was awarded the Nobel Prize for Economics in 2013. He authored the widely acclaimed book, Irrational Exuberance, published in March 2000, the very month of the peak in the Nasdaq Composite Index during the dotcom mania.

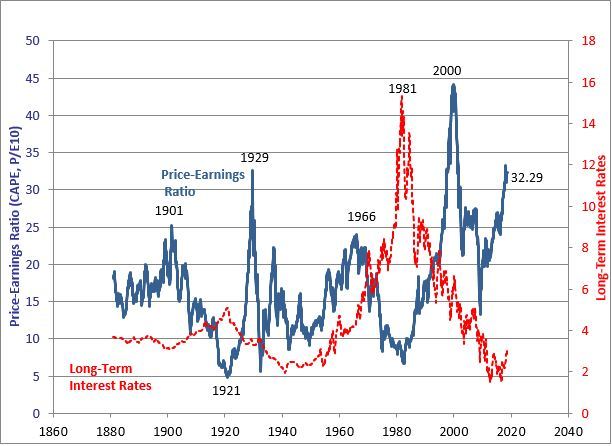

The first chart below shows his data for the CAPE ratio and for long-term interest rates.

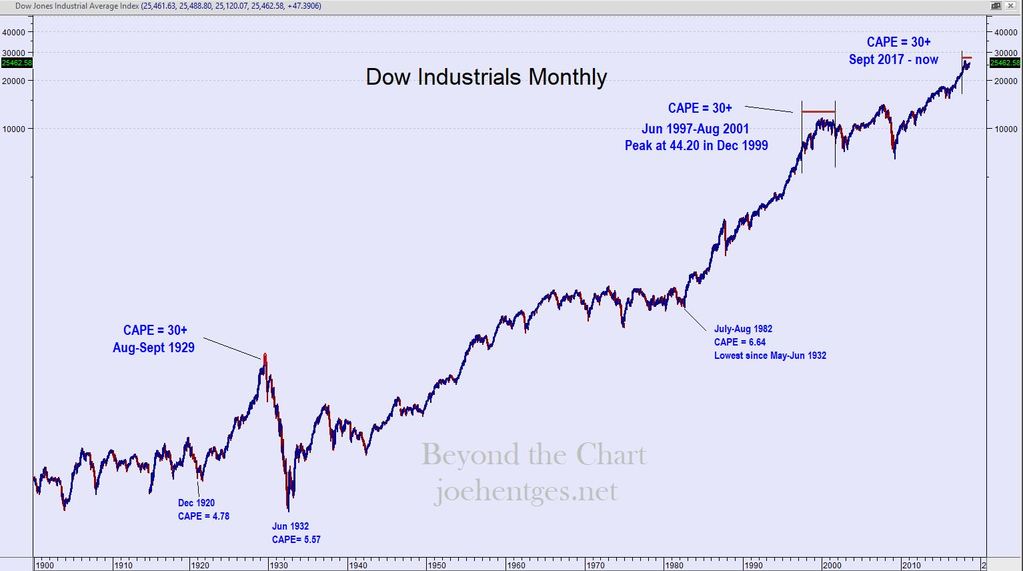

This next chart is the monthly chart of the Dow Jones Industrial Average (DJIA) with notations for the times when the CAPE ratio exceeded 30. Other than where we are today, the only two other times when CAPE was greater than 30 were 2 months in 1929 and the 2000 blow-off period that started in mid-1997.

In January 2018 the stock market was even more overvalued than in 1929, just prior to the 1929 Crash and the Great Depression. Preliminary data for August 2018 shows the CAPE at 32.29. We are still even more overvalued than the 2007 peak prior to the 2008 Financial Crisis. Irrational exuberance indeed. Stay tuned.