You know those machines. The ones that go beep…beep…beep as they monitor your heart rate. Well one that is monitoring global economic activity is barely beeping. The Baltic Dry Index just hit another new all-time low yesterday.

You know those machines. The ones that go beep…beep…beep as they monitor your heart rate. Well one that is monitoring global economic activity is barely beeping. The Baltic Dry Index just hit another new all-time low yesterday.

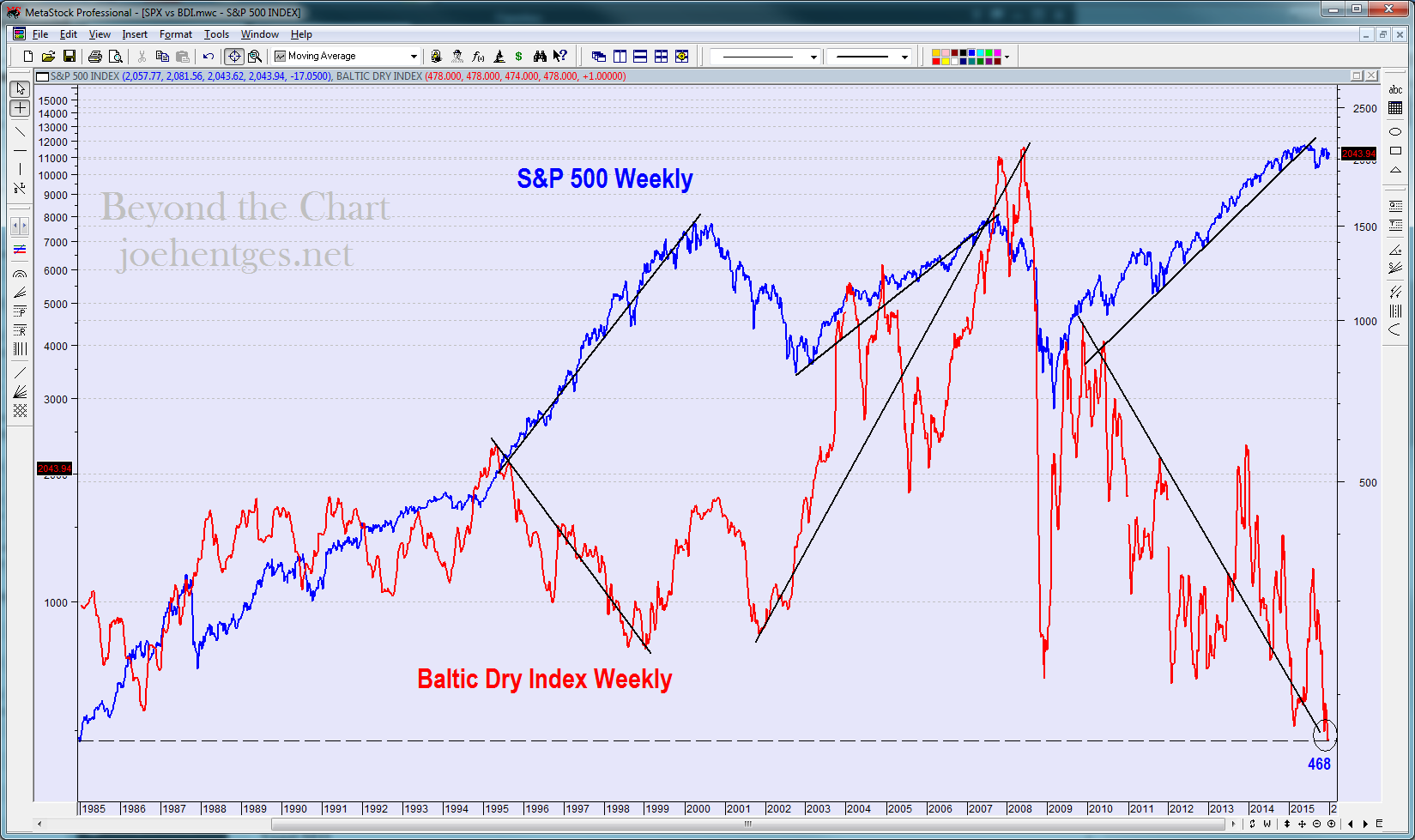

In the chart above you see the dotted line for the December 2009 Financial Crisis low. Right below that is the dotted line for the all-time low from July 1986. That low broke in February 2015, about 7 months before China devalued the Yuan.

The Baltic Dry Index has continued to hit new all-time lows in November 2015 and again in December. And yesterday it did it again, hitting 468. And what is China doing? Devaluing the Yuan…again. It is trying to stimulate its economy.

There hasn’t been much talk about the rippling effect into other currencies yet but there will be. They will try to stimulate their own economies and devalue their currencies.

I think the Baltic Dry Index is like the canary in the coal mine. It is telling us the global economy is on life support and the heart beat is barely beeping.

The history of the Baltic Dry Index goes back to January 1985. The chart below compares the S&P 500 (SPX) with the Baltic Dry Index. I know that the SPX is a United States stock market measurement and the Baltic Dry Index is a global measurement but I wanted to see how it compared.

There are two distinct periods of disconnect. Beginning of 1995 thru 1999 and beginning of 2010 thru 2015. The lines I’ve drawn are meant to show the direction of the trend.

Given the disconnect between the stock market and the Baltic Dry Index, and that the Baltic Dry Index is now at new all-time lows, it is one more piece of information to consider.

To me it re-affirms my belief that we have seen the end of the huge extended Cycle Wave V in the stock market from 1982. And the end of Supercycle Wave (V) from 1932.

I’ve shared my Elliott Wave analysis with my Insider Members. If you are an investor then it is well past the time to be very conservative. If you are a trader, then there is some tremendous movement coming your way. Stay tuned.