The Nasdaq Composite Index (Nasdaq) has been getting hit hard lately but hasn’t dropped as much as the Dow Jones Industrial Average (INDU) or the Russell 2000 Index (RUT). One indication of the damage going on is the net 52 week High – Low indicator which on Friday December 3rd hit -713.

It seems the Nasdaq and S&P 500 Index (SPX)are being held up by just a few stocks. And you know which ones these are. They are the FAANG+ stocks of Facebook, Amazon, Apple, Netflix, Alphabet (GOOGL) plus Microsoft, Nvidia and a few others.

This post focuses on the SPDR Technology ETF (XLK) and its top three holdings which make up 51.5% of all the holdings. These are Apple (AAPL), Microsoft (MSFT) and Nvidia (NVDA). When these big tech names roll over and start to break down they will take the XLK, Nasdaq and the SPX a lot lower.

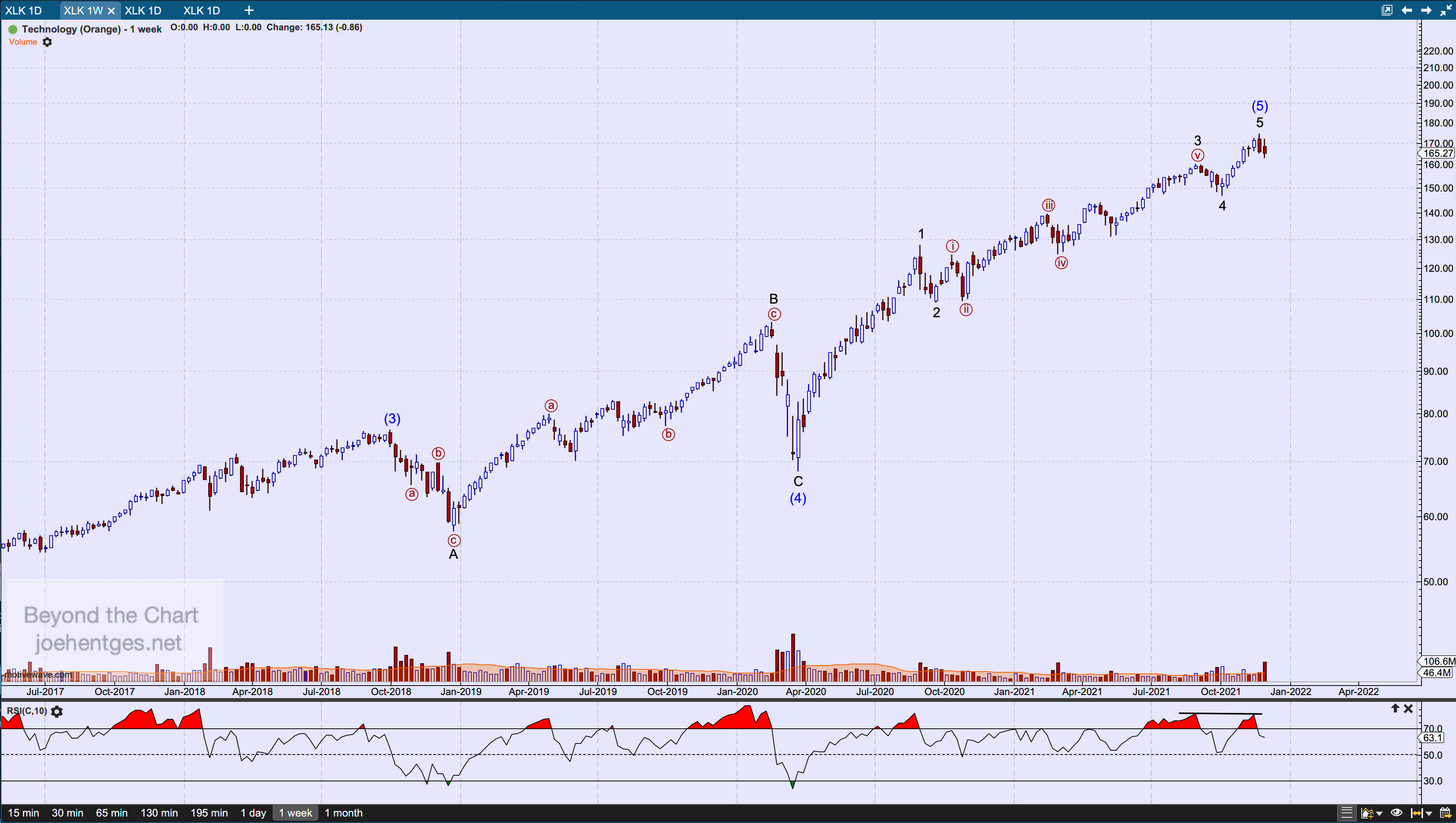

First let’s start with the XLK. Below you see a weekly chart. The Elliott Wave count shows a Running Flat Wave (4) that ended with a low the week of March 22, 2020. From that low there are 5 waves up complete with the high during the week of November 21. That high is 174.25. For this count to hold that high should not be broken. Next up is AAPL.

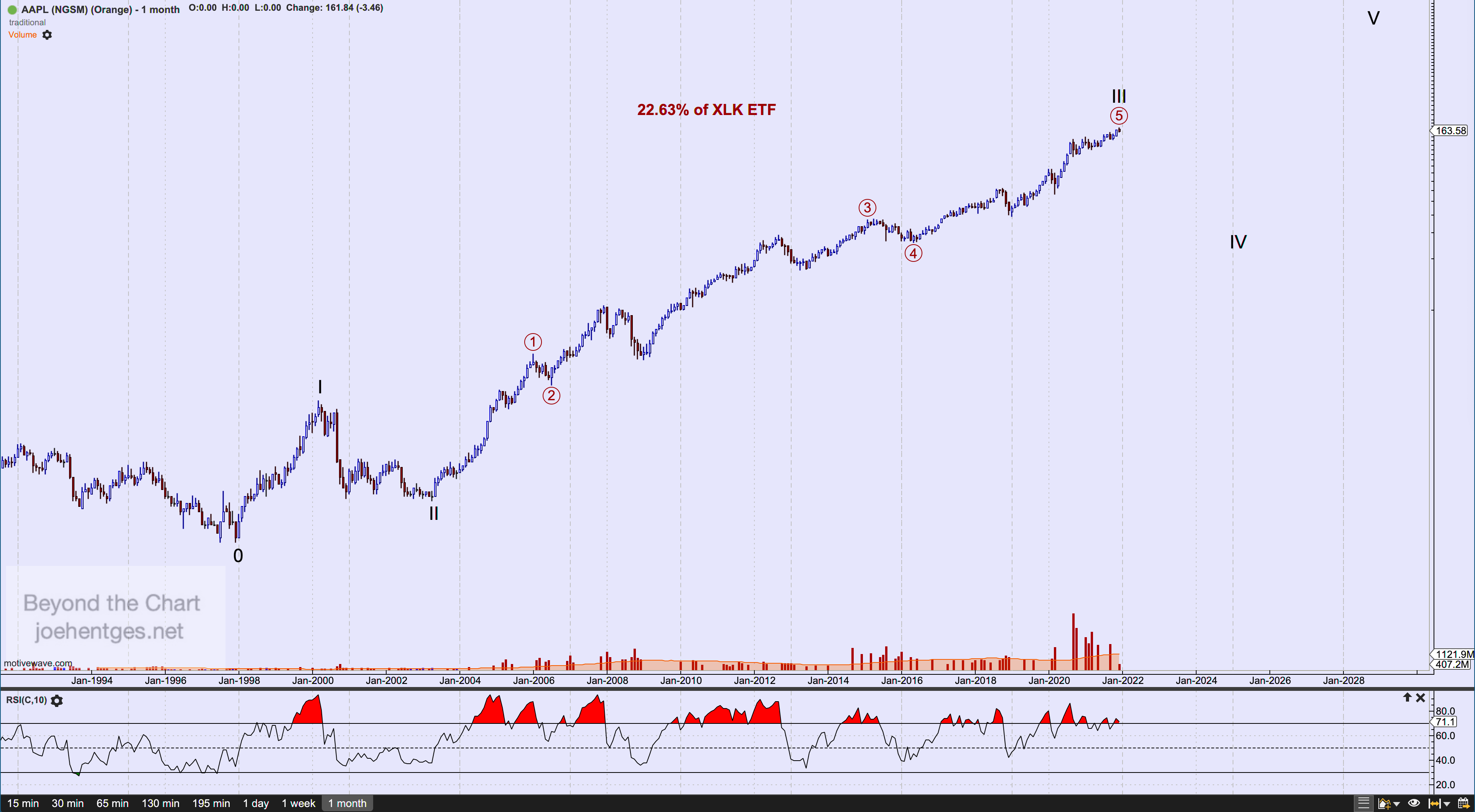

The chart below is the long-term monthly chart of AAPL This is not all the data for AAPL as it first went public on December 12, 1980. The Elliott Wave count I show starts with the 1997 low which occurred in both July and December of that year. 1997 was when Steve Jobs returned to Apple. I show that AAPL just completed a huge Cycle Wave III up from the Wave II low in April 2003.

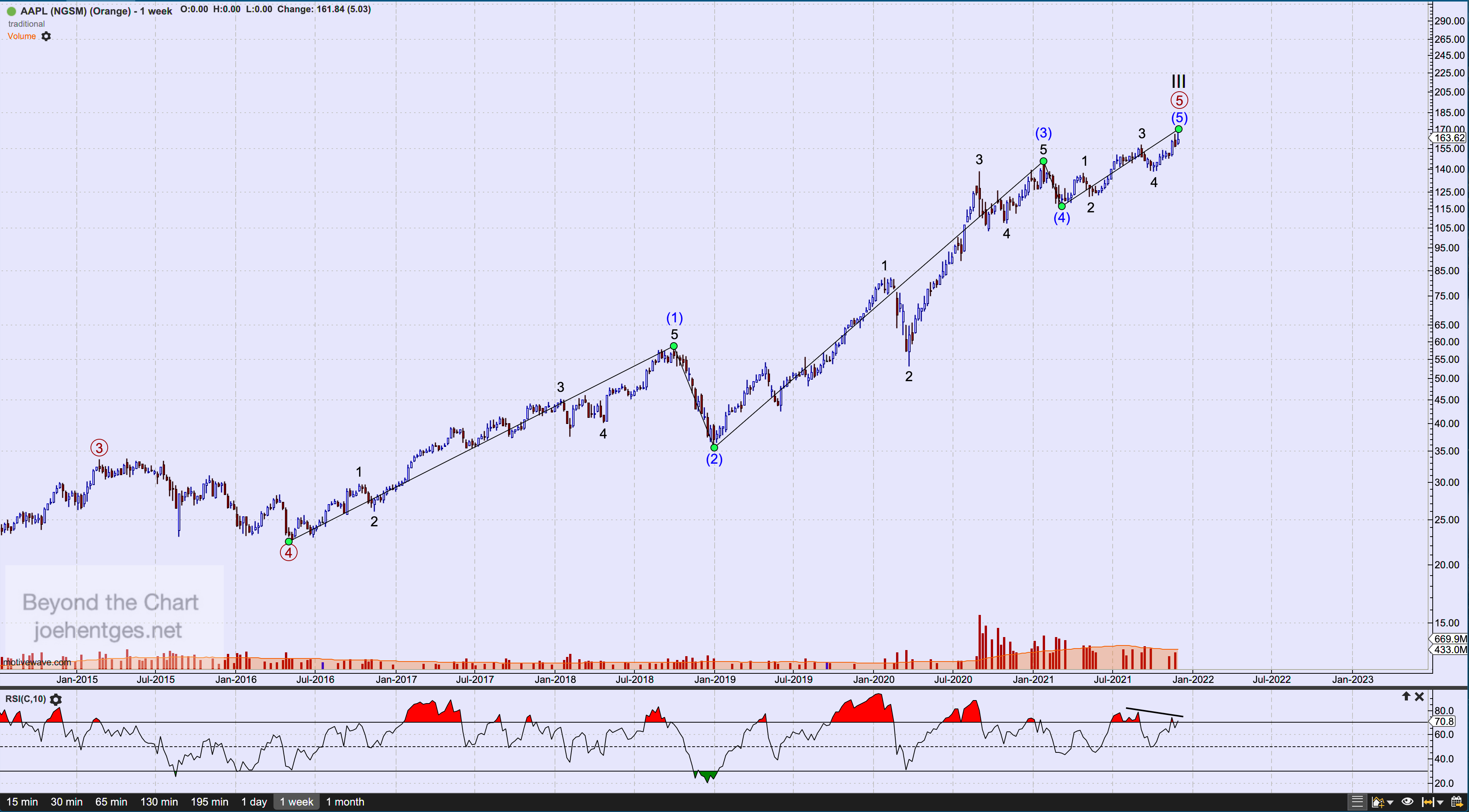

Now let’s look at the weekly chart. In the weekly chart below I show the five intermediate waves up from the 2016 low and the five minor waves that complete Intermediate Wave (5). I expect the $170.30 high to hold or the 5th wave up is not yet complete. At this point watch closely for a continued break down in price. Now let’s move on to MSFT.

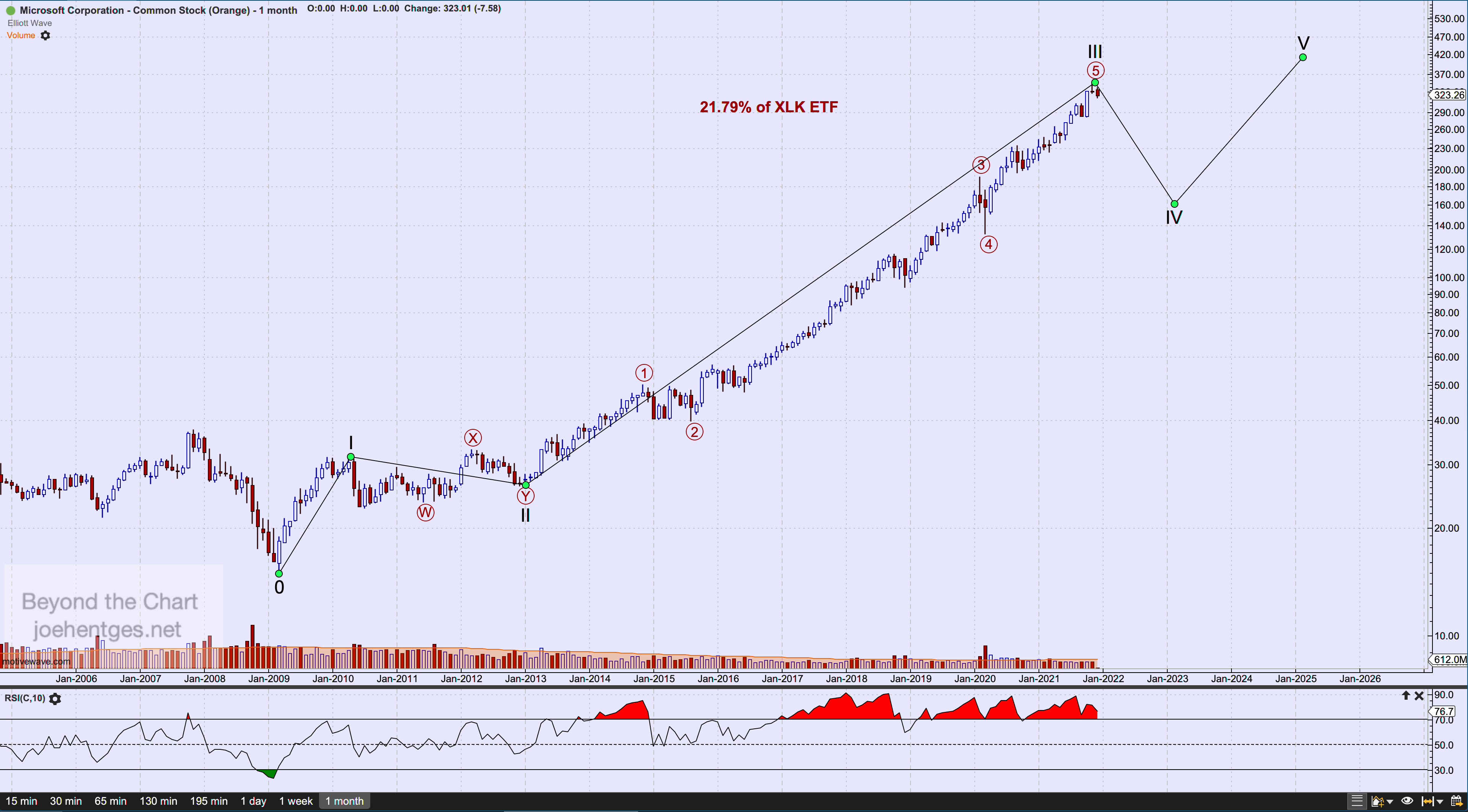

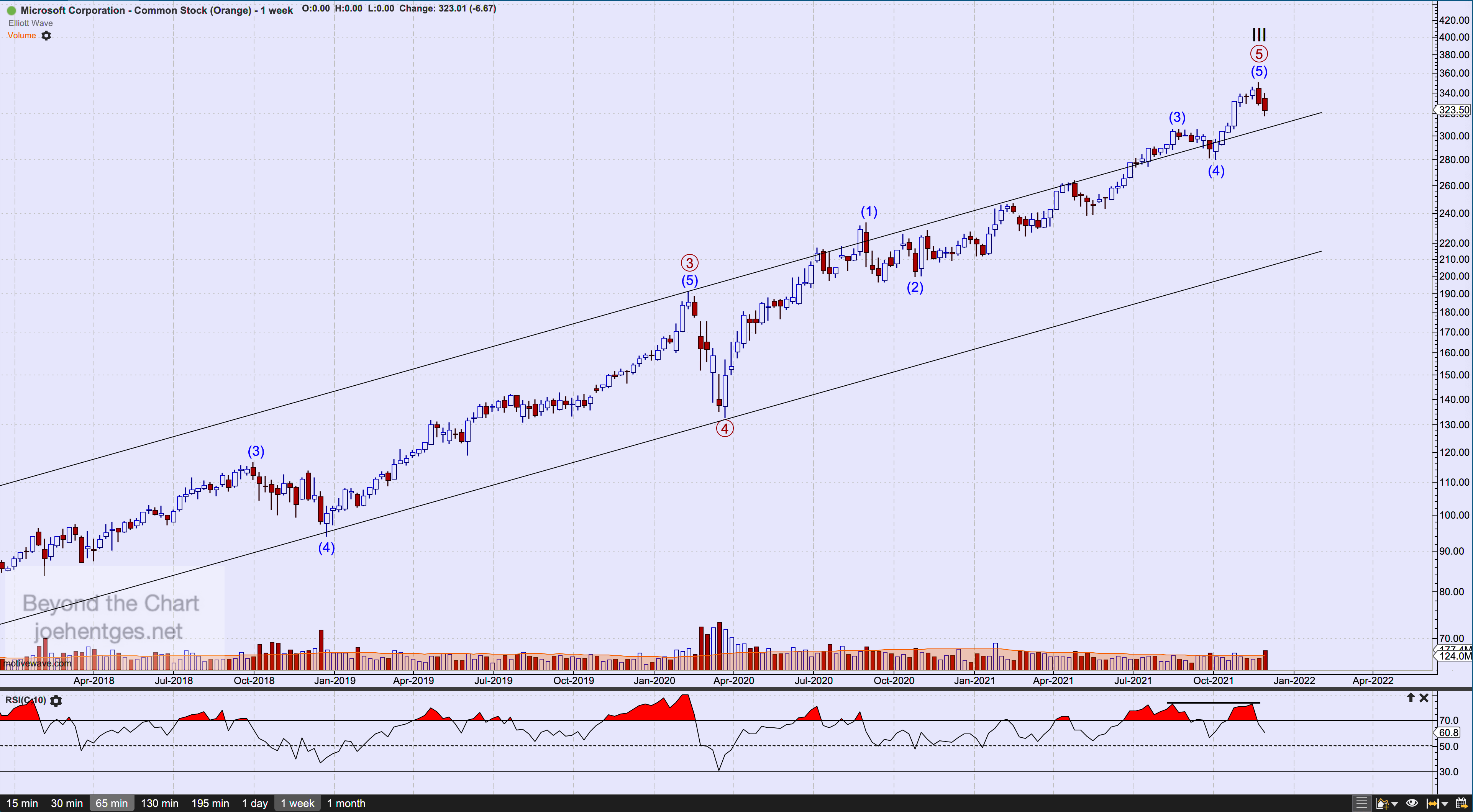

The chart below is the monthly chart of MSFT. I show a wave count from the March 2009 low. Similar to AAPL, MSFT just completed a huge Cycle Wave III ending with the $349.67 high the week of November 21, 2021. It has now begun its Cycle Wave IV which should take many months to complete and may take a variety of shapes. I expect this to pull back into the territory of the previous Primary Wave 4 (circled).

The weekly chart below shows five waves complete from the March 2020 low. Again for this count to hold, the November 22 high needs to hold. Next target will be a break of the Intermediate Wave (4) low at $280.25.

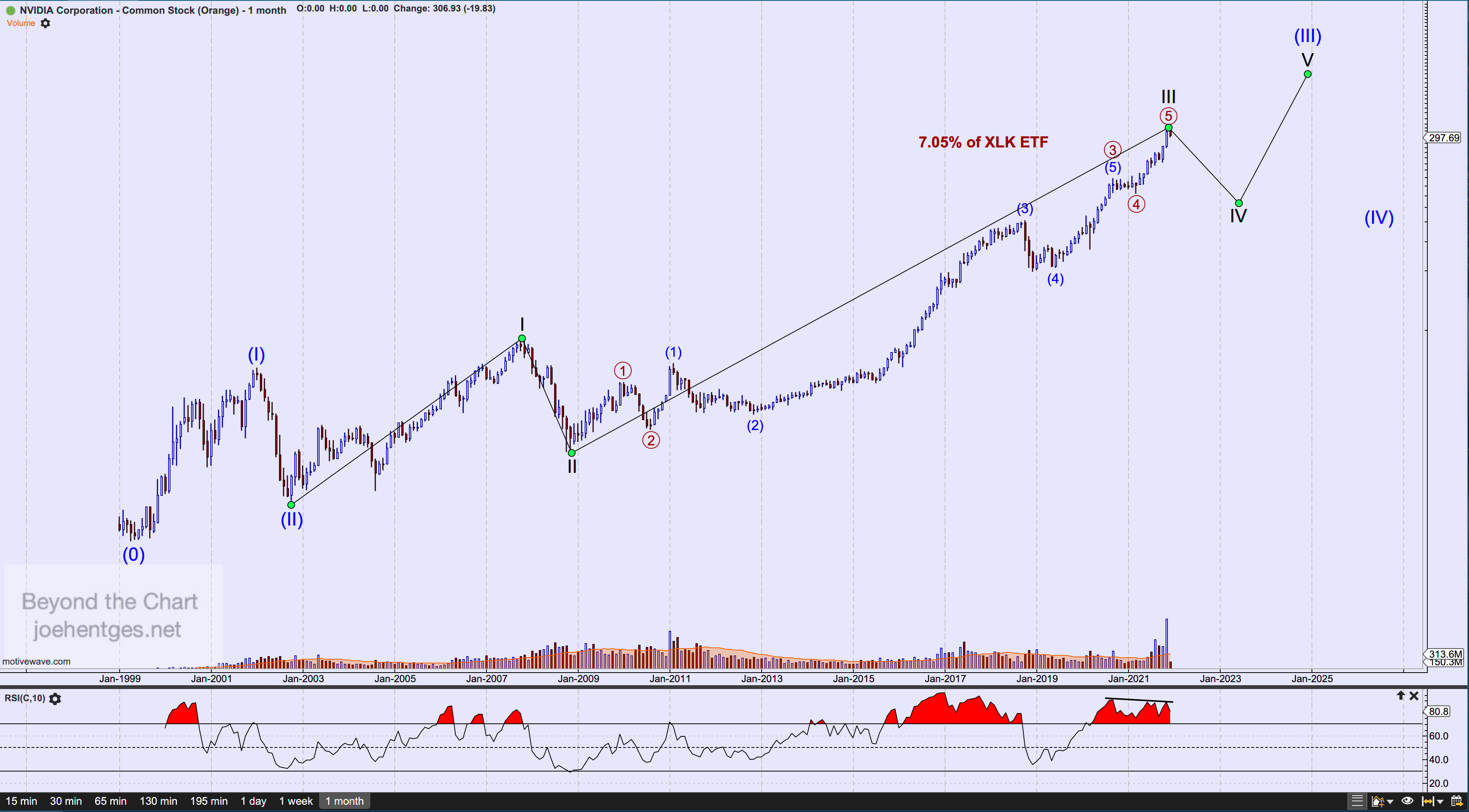

Our last stock is NVDA. The monthly chart below shows all the data since it went public in January 1999. The Elliott Wave count shows a SuperCycle Wave III underway from the October 2002 low. I believe that Cycle Wave III of SuperCycle Wave (III) is complete with the high of $346.47 on November 22. It will now undergo a Wave IV correction that should chop sideways.

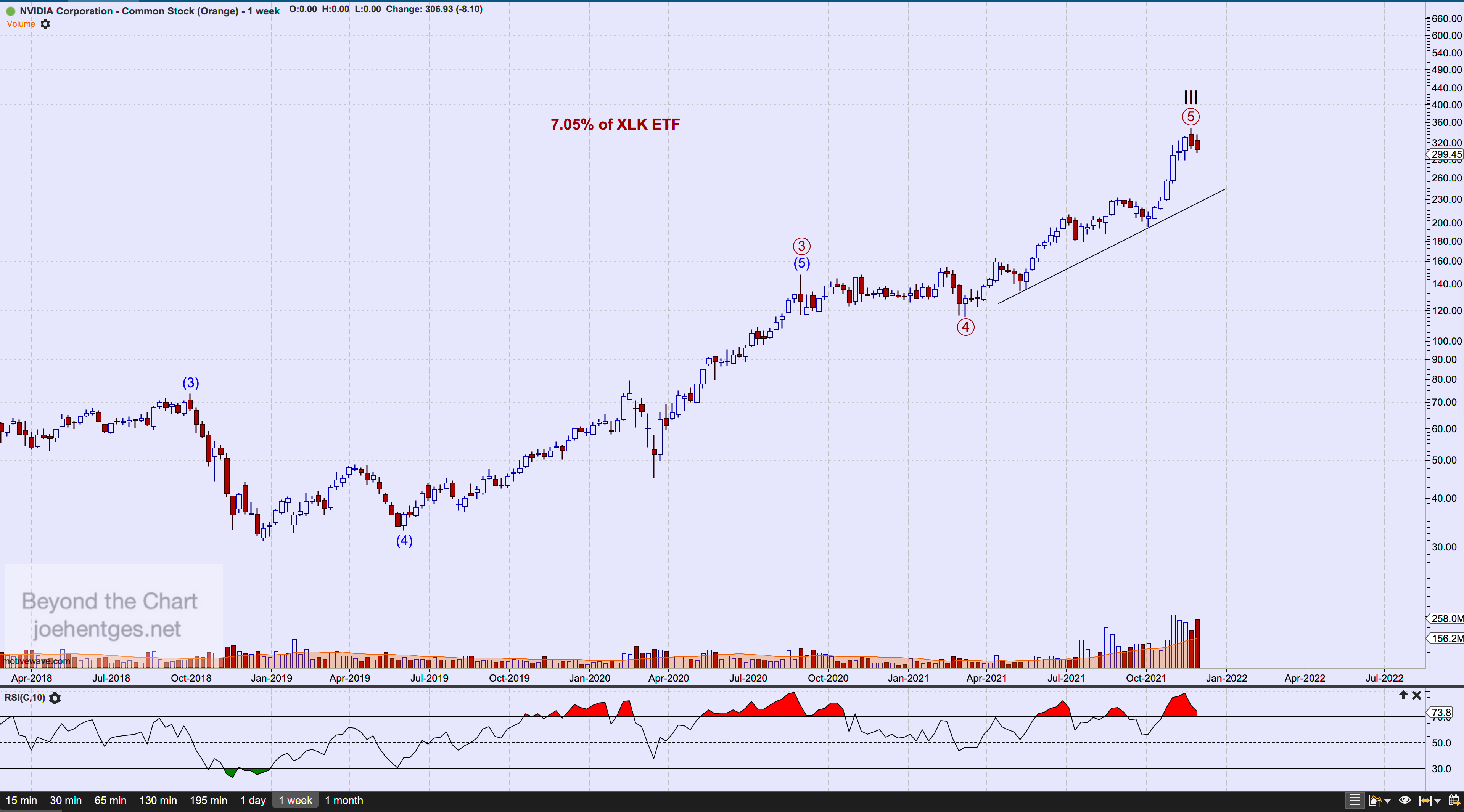

The weekly chart of NVDA shows a relatively short Primary Wave 5 (circled). If the high of $346.47 is indeed in, then price should break down thru the trend line shown on the chart.