So Snapchat, now known as Snap, Inc. (SNAP) went public last week and it was a feeding frenzy. Shares priced at $17 started trading at $24 and closed that first day at $24.48 with 217 million shares traded. Friday they piled on an additional $2.61 closing at $27.09.

I believe at one point the total estimated value of Snap was well over $40 billion. Incredible for a company that lost $500 million last year. And they don’t have any competition…right? We’ll see.

But their timing is perfect. Coming public at a time when bullish readings on the stock market are at 30 year highs…at least the Investor’s Intelligence Advisors Survey last week was. With the stock market at all-time highs and consumer confidence at the highest since 2000 it’s “party on Wayne”!

Irrational Exuberance

Last week as I was watching bits and pieces of CNBC during the day…constantly having to mute it…I remember one guy saying ‘this feels like 1999’. I thought, there you go…it’s deja vu all over again. Irrational exuberance is back.

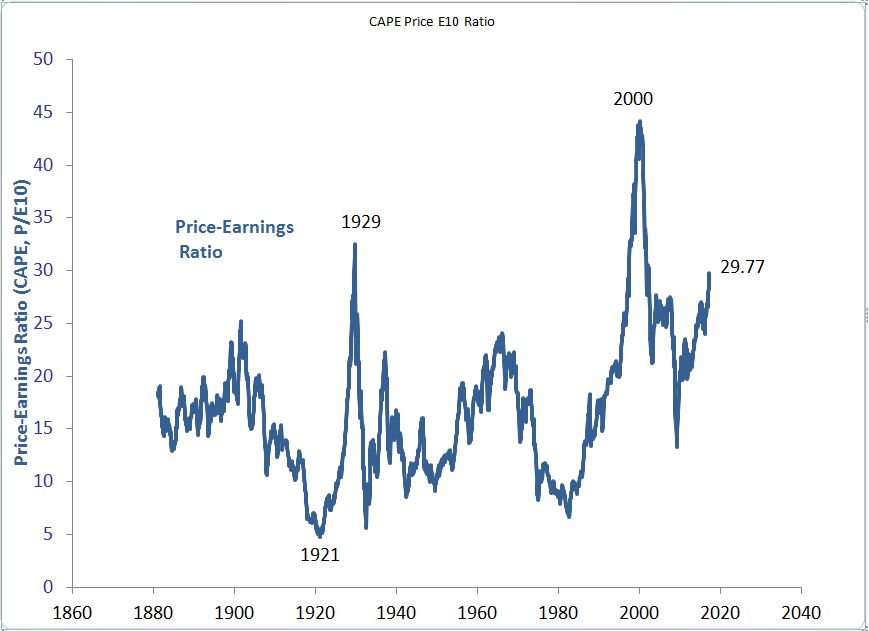

Which brings me to something I’ve talked about several times in the last couple of years. Professor Shiller’s CAPE ratio, which stands for cyclically adjusted price earnings ratio.

The latest reading is now 29.77. Below is the chart of CAPE over the years, since 1871 to be exact.

So that latest reading is higher than anything that occurred during the 2007 peak. And only 3 months in 1929 exceeded the current reading…July, August and September. And we all know what happened after that.

And the 2000 peak was the granddaddy of them all…a once in a century, or maybe several…level of overvaluation. That was actually when professor Robert Shiller’s book named “Irrational Exuberance” was published…March 2000. That was the same month that the Nasdaq peaked.

We are in historic times folks. Don’t let people tell you ‘it’s different this time’. Everyone always finds a way to justify that the party should go on. So we’ll keep monitoring the price structure of this market. I don’t think we are there yet but getting close. Check out this warning from Professor Shiller.

Brief Market Update

In today’s video I look at this week’s market action by reviewing the Dow Jones Industrial Average, one of my indicators, 3 key ETFs and 3 stocks from each of those ETFs: Analog Devices (ADI), Celgene (CELG) and Bank of America (BAC).