On September 29, 2016 I ordered the book, “The Fourth Turning, An American Prophecy”, What the Cycles of History Tell Us About America’s Next Rendezvous with Destiny. I happened to read an article where a professor from Cornell mentioned the book.

I hadn’t heard of the book before. It turns out that it was published in 1997 and was authored by William Strauss (died 2007) and Neil Howe. It got my attention because it focused on cycles in history. I am fascinated by cycles because I do believe that things move in cycles whether its the stock market, human progress or nature…and I enjoy history.

Winter Comes Again

Now the book is quite the challenge. There is a lot of material and reads a little bit like a text book. There are 335 pages, not counting the 25 pages of notes at the end. The first 142 pages discuss seasons, including Chapter 1 which is an introduction titled “Winter Comes Again”. Note, this was published in 1997, well before Game of Thrones with its “winter is coming”.

The next section of the book explains the four turnings that occur in a four season cycle and when the previous “fourth turns” have occurred in American history. This part two is 160 pages long. The last section, about 30 pages, discuss preparing for the Fourth Turning.

Steve Bannon

Well it turns out that President Trump’s key strategist, Steve Bannon, is a huge fan of The Fourth Turning. He even created a documentary in 2010 called “Generation Zero” that referenced four generation-long cycles.

Because Mr. Bannon has totally bought into “The Fourth Turning” several folks have written about this and were somewhat critical.

As kind of a rebuttal or a set the record straight point of view, Neil Howe wrote an article in the Washington Post called “Where did Steve Bannon get his worldview? From my book.”

In that article Mr Howe writes a very good summary of the turnings and what they mean. A “turning” is about 20 years long, what the authors call the length of a generation.

The Turnings

These four turnings are akin to the four seasons in nature, beginning with spring and ending with winter. These turnings then continue to repeat just like nature.

As Mr. Howe explains in the article…

“The cycle begins with the First Turning, a “High” which comes after a crisis era.

“The Second Turning is an “Awakening,” when institutions are attacked in the name of higher principles and deeper values.”

“The Third Turning is an “Unraveling,” in many ways the opposite of the High.”

“Finally, the Fourth Turning is a “Crisis” period. This is when our institutional life is reconstructed from the ground up, always in response to a perceived threat to the nation’s very survival.”

He also talks a lot more about the fourth turning. In the book, our most recent Third Turning occurred from 1984 to about 2005. 2005 was an estimate, as the book was written in 1997. The Fourth Turning would then begin.

The Fourth Turning

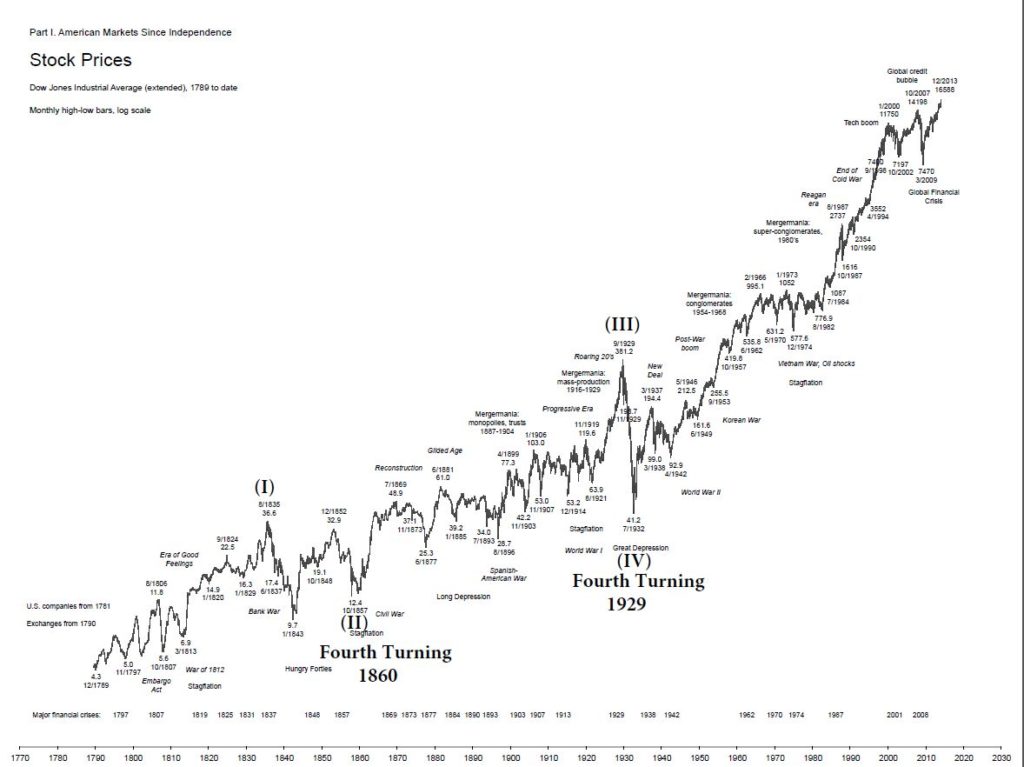

Previous Fourth Turnings occurred at the beginning of the American Revolution (1773-1794), the Civil War (1860-1865) and the Great Depression and World War II (1929-1946). There were actually 3 more Fourth Turnings cited in Anglo-American lineage dating back to the fifteenth century, but my focus is United States history.

Mr. Howe believes, as does Mr. Bannon, that a Fourth Turning began in 2008 with the financial crisis. In the Washington Post article he says:

“America entered a new Fourth Turning in 2008. It is likely to last until around 2030. Our paradigm suggests that current trends will deepen as we move toward the halfway point.”

2008 was a pivotal time. There is no doubt that the financial crisis shook the world to its core and the whole system came very close to unraveling. Just read “Too Big to Fail” by Andrew Ross Sorkin if you want the gory details.

Grand Supercycle Completes

This is where I want to update you on my view of the Grand Supercycle. The chart below came from an article on ZeroHedge in February 2014, therefore the data only shows thru the end of 2013. (I added the Roman numerals in parentheses and the labels regarding turnings.)

Supercycle (I) peaked in 1835. This was followed by a Flat correction (Elliott Wave terminology) that ended in October, 1857. This was followed 3 years later by the start of the Civil War which Howe and Strauss called the Fourth Turning.

Supercycle (III) peaked in 1929 followed by the Great Depression which ushered in the next Fourth Turning.

Note, in Elliott Wave rules, wave 4 should not overlap wave 1. Supercycle (I) peaked at 36.6 and Supercycle (IV) bottomed at 41.2…no overlap.

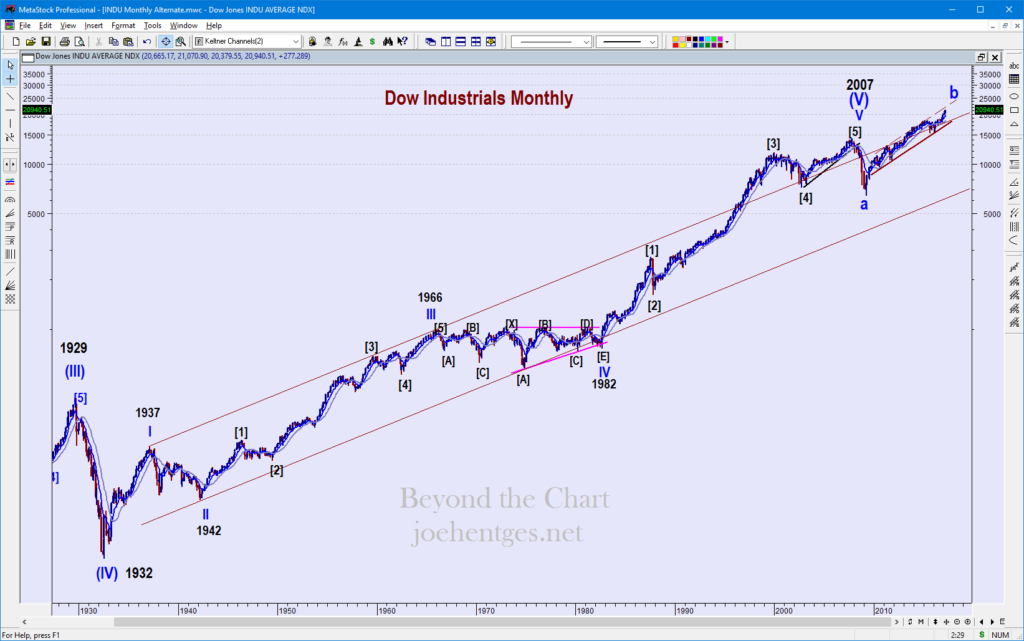

Now let’s take a closer look at Cycle Wave V and Supercycle Wave (V).

This chart shows the wave count that is now my preferred long-term count. This wave count syncs with a Fourth Turning starting in 2008. 2008 was devastating…all markets went down.

Cycle Wave V

I believe Cycle Wave V began August 1982 in a huge upside explosion when Paul Volcker’s Federal Reserve bailed out Mexico.

Primary Wave [2] played out in the 1987 crash.

Primary Wave [3] was a super strong extended wave. It ended in the most extreme overvaluation in stock market history.

As the dot-com bubble burst, Primary Wave [4] moved sideways to down, bottoming in 2002.

Primary Wave [5], Cycle Wave V and Supercycle Wave (V) then ended in October 2007. The housing bubble was already starting to burst.

Where are We Now?

Cycle Wave c was the 2007-2009 move that shocked the globe. The financial system came close to breaking but didn’t. Money pumped into the system and the U.S. government bailed out the banks and others.

The Federal Reserve and other Central Banks pumped money into the system like never before. Over $9 trillion by one estimate. It is unprecedented. This is what drove Cycle Wave b to where it is now. Here we sit 8 years after the stock market bottomed.

Cycle Wave b shown at the far right is almost, but not yet complete. This move extended above the 2007 peak further than I would have thought, but there is no Elliott Wave rule as to the limit on a Wave b in a Flat correction.

If the market is carving out a large Expanded Flat as I think it is, then Cycle Wave “b” needs to be 3 waves. When I look at the weekly chart I can make that case.

No Lack of Bulls

Remember we are at the top of an 85 year bull cycle which is also the 5th Super Cycle Wave up from the beginning of the United States. So yes bullishness runs rampant. Lots of financial instruments to put your money in…stocks, futures, options, options on futures, ETFs, leveraged ETFs and options on ETFs…I’m sure I missed a few.

Now some folks think that the 2007-2009 selloff corrected all of the move up from 1932 to 2007. I don’t see it. Yes the market dropped 50% but when you compare price action historically over long periods of time, you must use logarithmic charts to accurately see how the moves compare.

Stay Alert

So I am watching Cycle Wave “b” closely. We are getting very near the top. The big caution is this. I expect Cycle Wave “c” to be as vicious and strong as Cycle Wave “a” in 2008. Most likely stronger. Third impulse waves and “c” corrective waves can indeed be stunning.

Based on my labeling of the Dow Jones Industrial Average above, Supercycle Wave (V) ended October 2007 and completed a Grand Supercycle wave up from the birth of the United States. And according to Mr. Howe, a Fourth Turning also began at that time.

I continue to keep a close eye on this market. I sincerely doubt that the VIX will be closing under 11.o, 6 months from now. Do not let this market lull you to sleep.