The Fear of Missing Out (FOMO) is gripping the stock market big time. I just saw a report that Bank of America Merrill Lynch’s indicator that measures money flow into the stock market, is giving a sell signal. This proprietary indicator measures the cash flowing into the stock market…stocks, ETFs, mutual funds.

It’s a great feeling watching your stock or ETF tick up every day, every week. It’s exciting and makes you feel really good.

Have a plan for managing that trade or investment.

Are you going to take some of the profits? When? When will you get out completely? How will trail a stop that will get you out when the selling kicks in? And oh yes, selling does kick in.

The market is pushing strongly to the upside right now. The S&P 500 is already up 7.4% after just 4 weeks of trading in 2018. That is already more than one third of the total 19.4% gain in 2017.

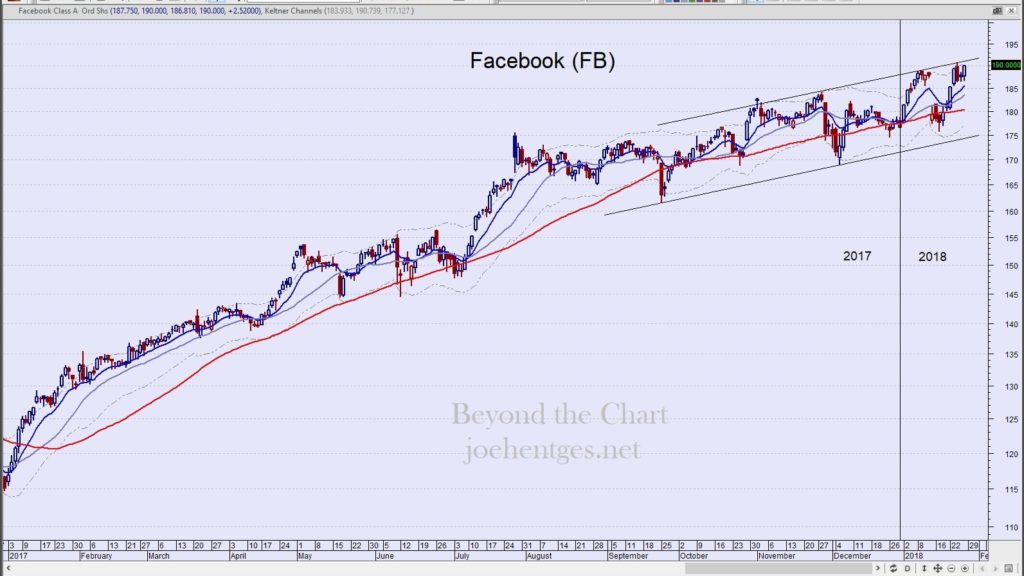

The following 5 tech stocks accounted for 25.5% of the gain in the S&P 500 last year: Facebook (FB), Apple (AAPL), Amazon (AMZN), Microsoft (MSFT) and Alphabet (GOOGL).

I mention it here because when these leaders start to break down, it will not bode well for the overall market. Right now, Apple seems to be struggling. We’ll see what they say this coming Thursday when they release earnings.

Facebook seems to be in a tighter trading range but bounced back quickly from the sell-off on January 12-17. I am watching to see if this can hold. Facebook announces earnings on Wednesday.

So even though the other stocks are still performing well, FOMO can turn to a ‘run for the exits’ fear mentality very quickly. Just look at Celgene (CELG) in October, United Continental (UAL) last summer (also last week) and Wynn Resorts on Friday. Just to name a few.

Can this type of price action happen to the stock market in general? It has and it can.

Think the Opposite

So what do I mean by think the opposite. Where you around trading the market in late 2008 into the first couple of months of 2009? Or did you have money in a 401K that was down significantly? How did it make you feel?

Think about how fear feels…instead of FOMO. Think about looking at your statements and being down 20, 30, 50% or more…and how you will feel. Have a plan for managing your trading account or investments.

Remember if you get out, you can always get back in.

https://jfhentges.wistia.com/medias/gfv3wzu1fa?embedType=async&videoFoam=true&videoWidth=640