Global Sell-off in Stocks as Volatility Explodes

This week the Dow Jones Industrial Average (DJIA) and S&P 500 (SPX) experienced their biggest drops in years especially if you look at the lows for the week. But this was not just a sell-off in the United States, there was also a significant global sell-off underway.

In the world’s second largest economy, China, the Shanghai Composite was down big for the second week in a row. It dropped 332.23 points or 9.6% and shattered a 2 year uptrend line.

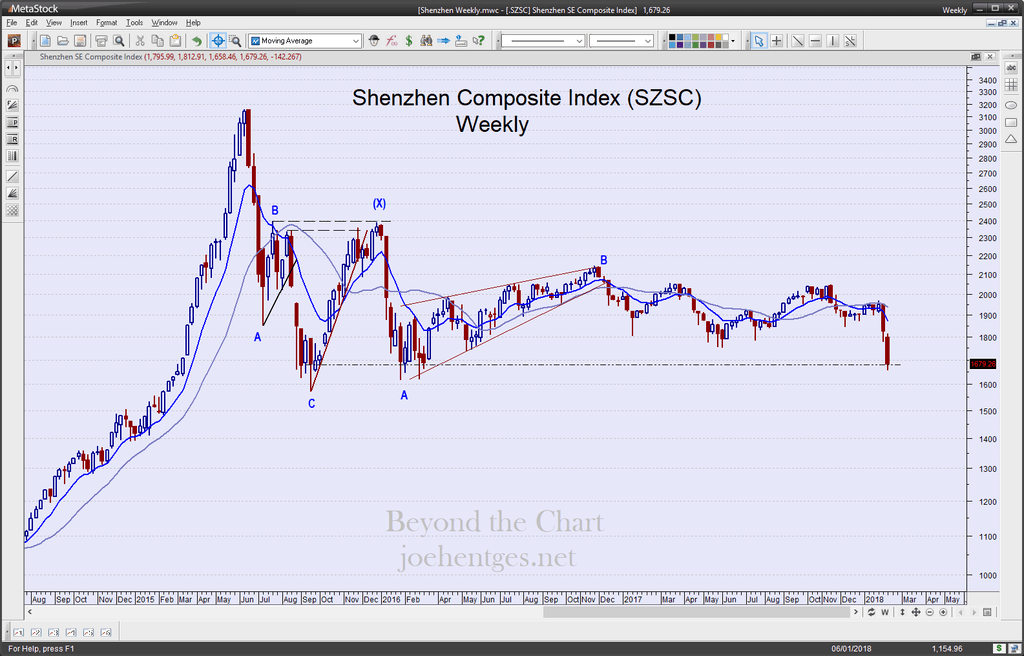

China’s Shenzhen Composite dropped 142.267 or 7.8%. It closed the week at the lowest level since September 18, 2015. Over the last 2 weeks it has dropped 13.9%.